Question: The following are some examples if it would help: Thank you so much Instructions Solve the given problem on a clean sheet of paper. Upload

The following are some examples if it would help:

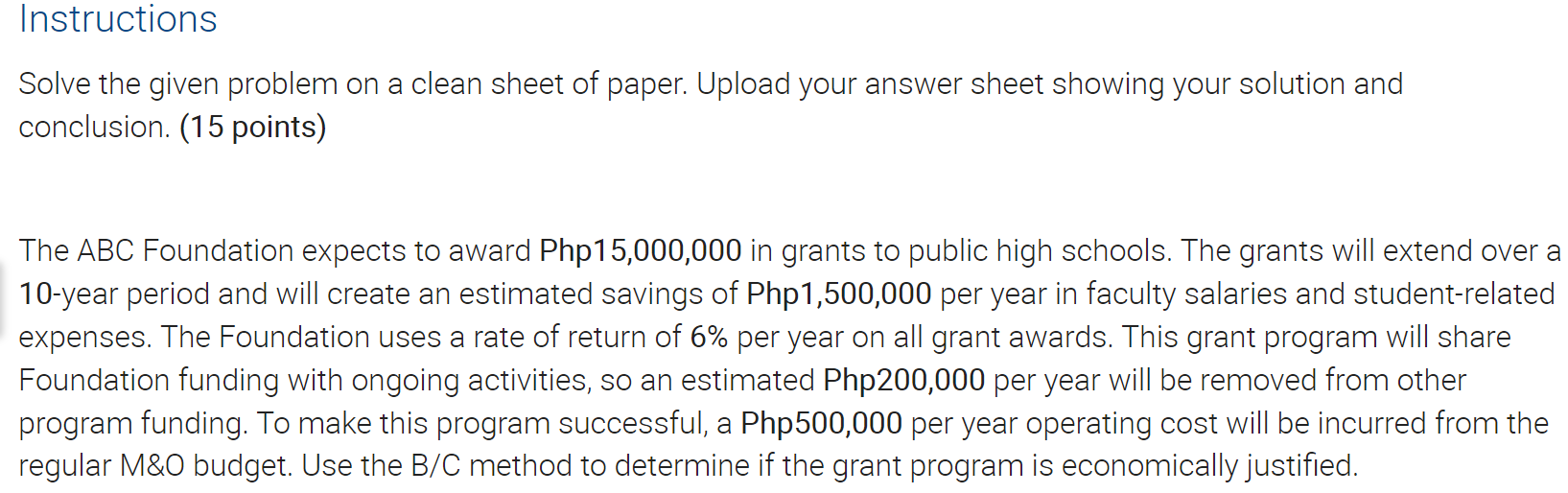

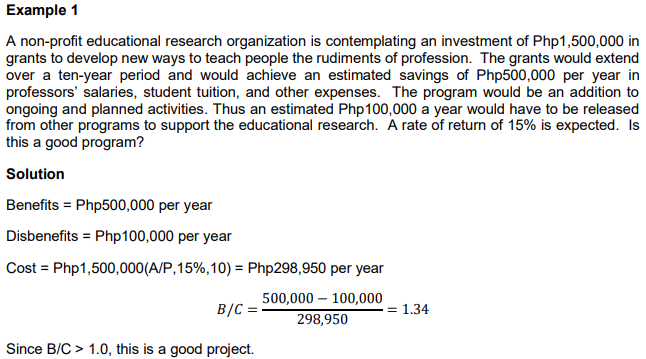

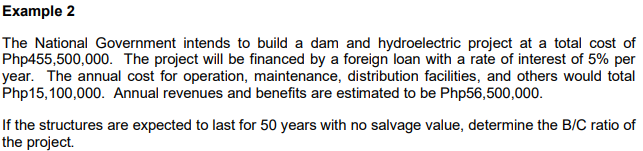

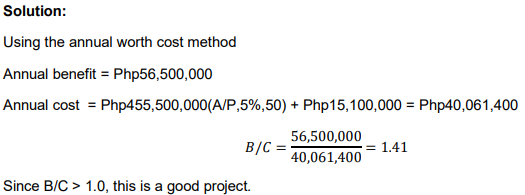

Thank you so much Instructions Solve the given problem on a clean sheet of paper. Upload your answer sheet showing your solution and conclusion. (15 points) The ABC Foundation expects to award Php15,000,000 in grants to public high schools. The grants will extend over a 10-year period and will create an estimated savings of Php1,500,000 per year in faculty salaries and student-related expenses. The Foundation uses a rate of return of 6% per year on all grant awards. This grant program will share Foundation funding with ongoing activities, so an estimated Php200,000 per year will be removed from other program funding. To make this program successful, a Php500,000 per year operating cost will be incurred from the regular M&O budget. Use the B/C method to determine if the grant program is economically justified. Example 1 A non-profit educational research organization is contemplating an investment of Php1,500,000 in grants to develop new ways to teach people the rudiments of profession. The grants would extend over a ten-year period and would achieve an estimated savings of Php500,000 per year in professors' salaries, student tuition, and other expenses. The program would be an addition to ongoing and planned activities. Thus an estimated Php 100,000 a year would have to be released from other programs to support the educational research. A rate of return of 15% is expected. Is this a good program? Solution Benefits = Php500,000 per year Disbenefits = Php 100,000 per year Cost = Php1,500,000(A/P, 15%, 10) = Php298,950 per year 500,000 - 100,000 B/C = 1.34 298,950 Since B/C > 1.0, this is a good project. Example 2 The National Government intends to build a dam and hydroelectric project at a total cost of Php455,500,000. The project will be financed by a foreign loan with a rate of interest of 5% per year. The annual cost for operation, maintenance, distribution facilities, and others would total Php15,100,000. Annual revenues and benefits are estimated to be Php56,500,000 If the structures are expected to last for 50 years with no salvage value, determine the B/C ratio of the project Solution: Using the annual worth cost method Annual benefit = Php56,500,000 Annual cost = Php455,500,000(A/P,5%,50) + Php15,100,000 = Php40,061,400 56,500,000 B/C= = 1.41 40,061,400 Since B/C > 1.0, this is a good project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts