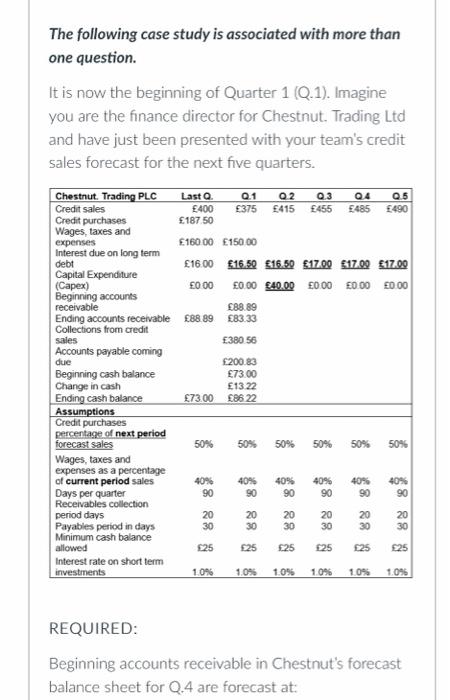

Question: The following case study is associated with more than one question. It is now the beginning of Quarter 1 (Q.1). Imagine you are the finance

The following case study is associated with more than one question. It is now the beginning of Quarter 1 (Q.1). Imagine you are the finance director for Chestnut Trading Ltd and have just been presented with your team's credit sales forecast for the next five quarters. Chestnut Trading PLC Last Q Q.1 02 0.3 Q4 0.5 Credit sales 400 375 415 455 F485 490 Credit purchases 187 50 Wages, taxes and expenses 160.00 15000 Interest due on long term debt 16.00 $16.50 16.50 17.00 $17.09 17.00 Capital Expenditure (Capex) 0.00 0.00 40.00 50.00 50.00 50.00 Beginning accounts receivable 88.89 Ending accounts receivable 88 89 83 33 Collections from credit sales 380 56 Accounts payable coming due 200.83 Beginning cash balance 73.00 Change in cash 1322 Ending cash balance 73.00 86 22 Assumptions Credit purchases percentage of next period forecast sales 50% 50% 50% 50% 50% Wages, taxes and expenses as a percentage of current period sales 40% 40% 40% 40% 40% 40% Days per quarter 90 90 90 90 90 90 Receivables collection period days 20 20 20 20 20 20 Payables period in days 30 30 30 30 30 Minimum cash balance allowed 525 525 25 25 225 525 Interest rate on short term investments 10% 10% 1.0% 10% 1.096 50% 88 109 REQUIRED: Beginning accounts receivable in Chestnut's forecast balance sheet for Q.4 are forecast at: The following case study is associated with more than one question. It is now the beginning of Quarter 1 (Q.1). Imagine you are the finance director for Chestnut Trading Ltd and have just been presented with your team's credit sales forecast for the next five quarters. Chestnut Trading PLC Last Q Q.1 02 0.3 Q4 0.5 Credit sales 400 375 415 455 F485 490 Credit purchases 187 50 Wages, taxes and expenses 160.00 15000 Interest due on long term debt 16.00 $16.50 16.50 17.00 $17.09 17.00 Capital Expenditure (Capex) 0.00 0.00 40.00 50.00 50.00 50.00 Beginning accounts receivable 88.89 Ending accounts receivable 88 89 83 33 Collections from credit sales 380 56 Accounts payable coming due 200.83 Beginning cash balance 73.00 Change in cash 1322 Ending cash balance 73.00 86 22 Assumptions Credit purchases percentage of next period forecast sales 50% 50% 50% 50% 50% Wages, taxes and expenses as a percentage of current period sales 40% 40% 40% 40% 40% 40% Days per quarter 90 90 90 90 90 90 Receivables collection period days 20 20 20 20 20 20 Payables period in days 30 30 30 30 30 Minimum cash balance allowed 525 525 25 25 225 525 Interest rate on short term investments 10% 10% 1.0% 10% 1.096 50% 88 109 REQUIRED: Beginning accounts receivable in Chestnut's forecast balance sheet for Q.4 are forecast at

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts