Question: The following current year information is provided for Sciarra Corp., which owns a football stadium In Italy. It is commencing a long-term construction project,

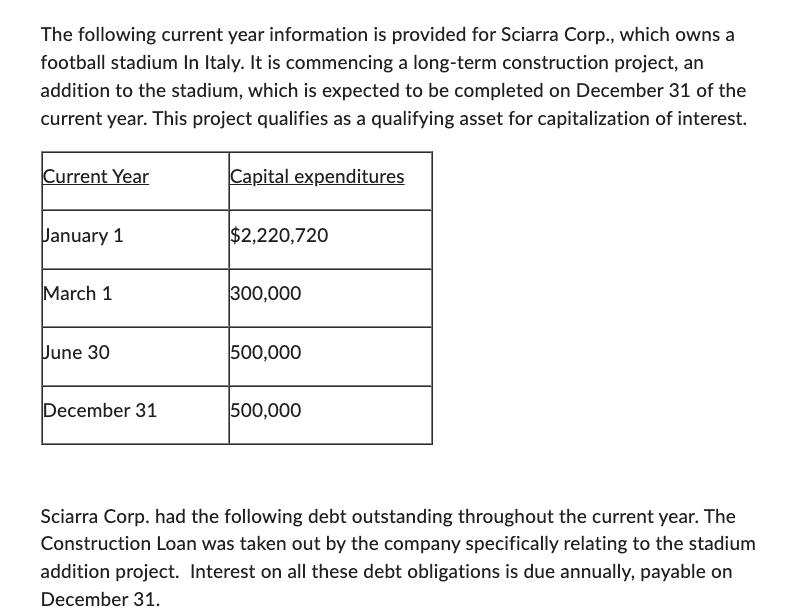

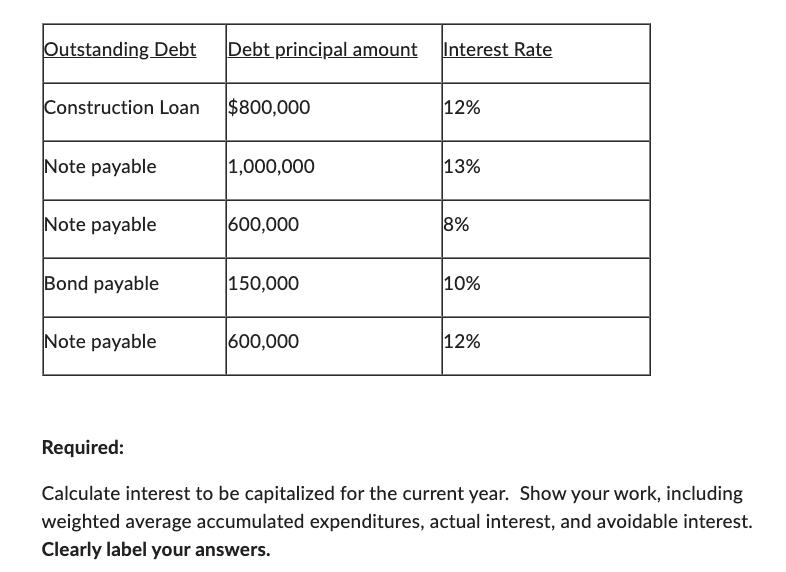

The following current year information is provided for Sciarra Corp., which owns a football stadium In Italy. It is commencing a long-term construction project, an addition to the stadium, which is expected to be completed on December 31 of the current year. This project qualifies as a qualifying asset for capitalization of interest. Current Year January 1 March 1 June 30 December 31 Capital expenditures $2,220,720 300,000 500,000 500,000 Sciarra Corp. had the following debt outstanding throughout the current year. The Construction Loan was taken out by the company specifically relating to the stadium addition project. Interest on all these debt obligations is due annually, payable on December 31. Outstanding Debt Debt principal amount Interest Rate Construction Loan $800,000 Note payable Note payable Bond payable Note payable 1,000,000 600,000 150,000 600,000 12% 13% 8% 10% 12% Required: Calculate interest to be capitalized for the current year. Show your work, including weighted average accumulated expenditures, actual interest, and avoidable interest. Clearly label your answers.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the interest to be capitalized for the current year we need to determine the weighted average accumulated expenditures actual interest an... View full answer

Get step-by-step solutions from verified subject matter experts