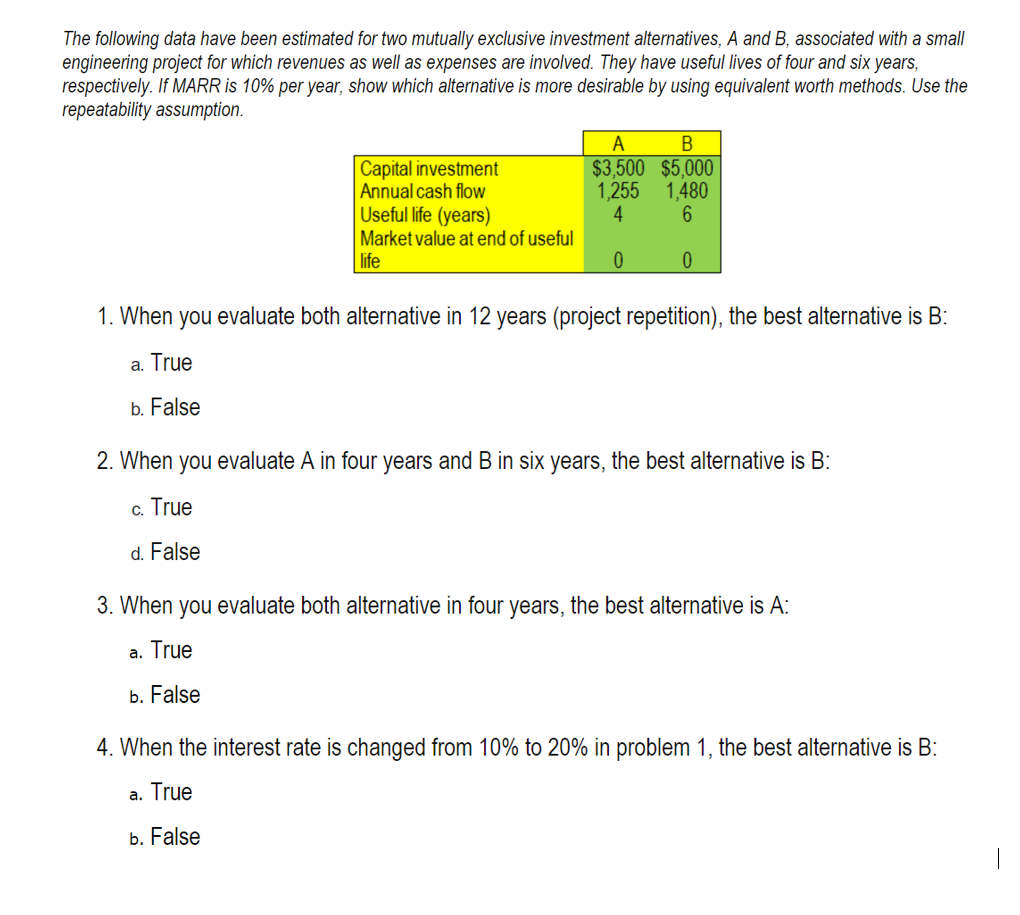

Question: The following data have been estimated for two mutually exclusive investment alternatives, A and B, associated with a small engineering project for which revenues as

The following data have been estimated for two mutually exclusive investment alternatives, A and B, associated with a small engineering project for which revenues as well as expenses are involved. They have useful lives of four and six years, respectively. If MARR is 10% per year, show which alternative is more desirable by using equivalent worth methods. Use the repeatability assumption $3,500 $5,000 1,255 1,480 Capital investment Annual cash flow Useful life (years) Market value at end of useful ife 4 1. When you evaluate both alternative in 12 years (project repetition), the best alternative is B a. True b. False 2. When you evaluate A in four years and B in six years, the best alternative is B c. True d. False 3. When you evaluate both alternative in four years, the best alternative is A a. True b. False 4. When the interest rate is changed from 10% to 20% in problem 1, the best alternative is B a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts