Question: The following data have been estimated for two mutually exclusive investment alternatives, A and B, associated with a small engineering project for which revenues as

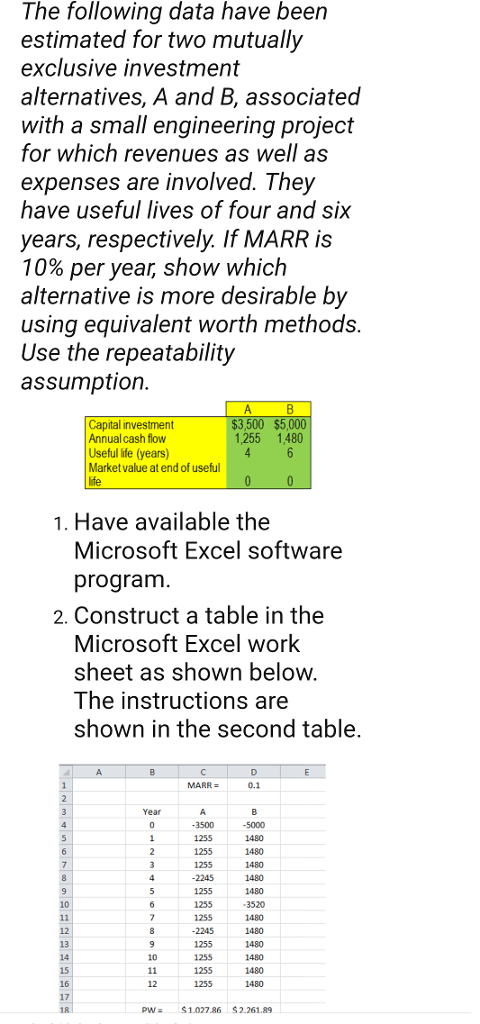

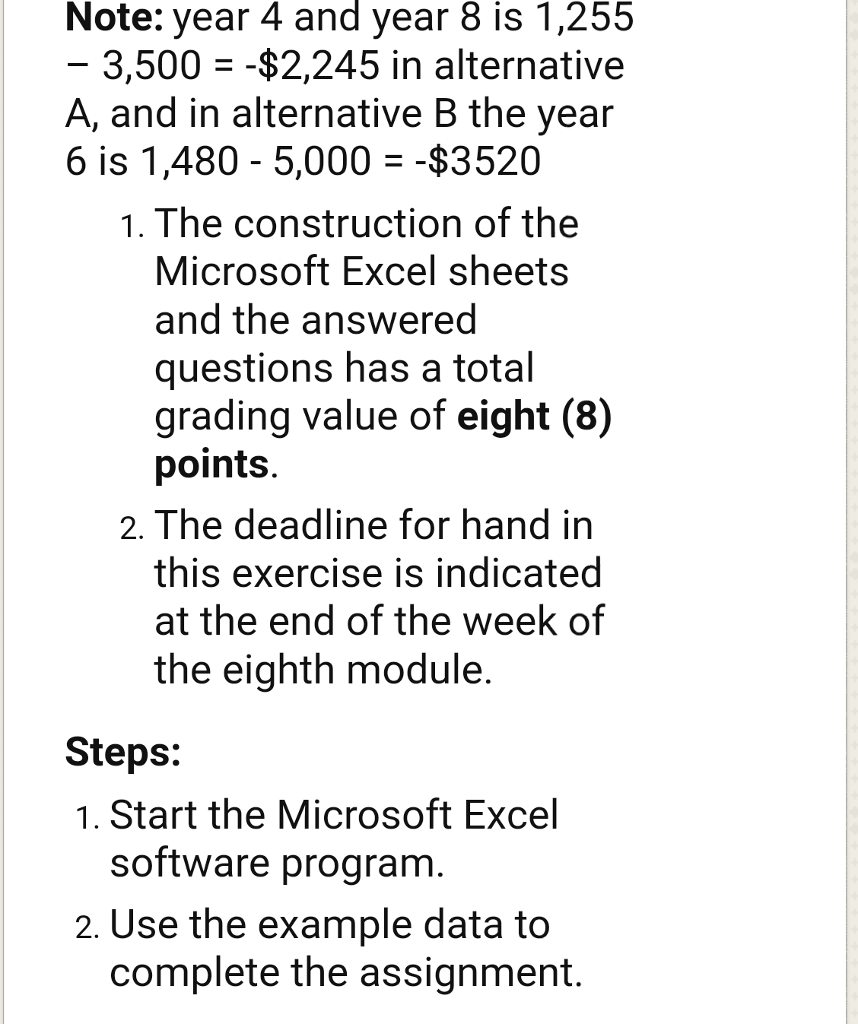

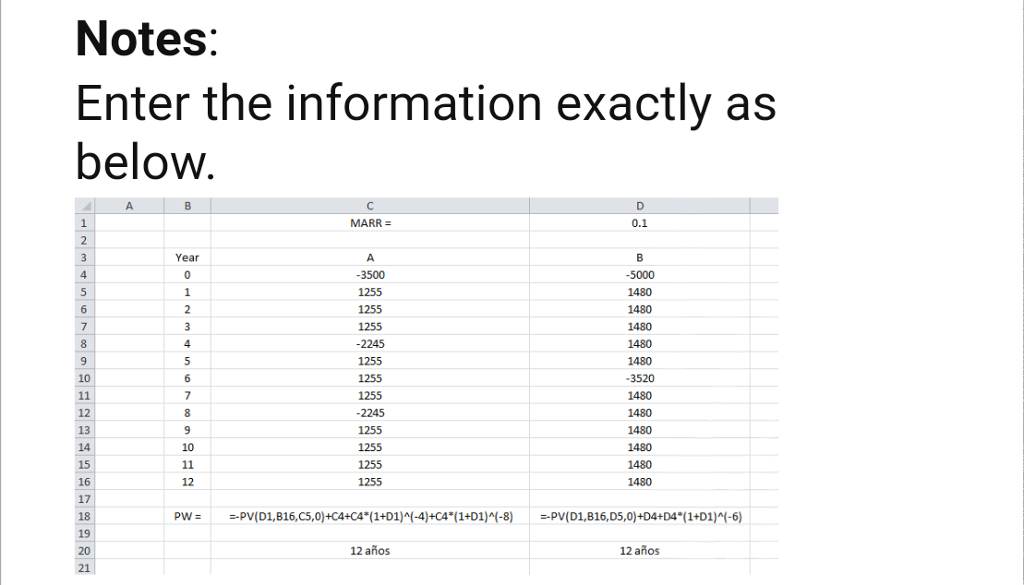

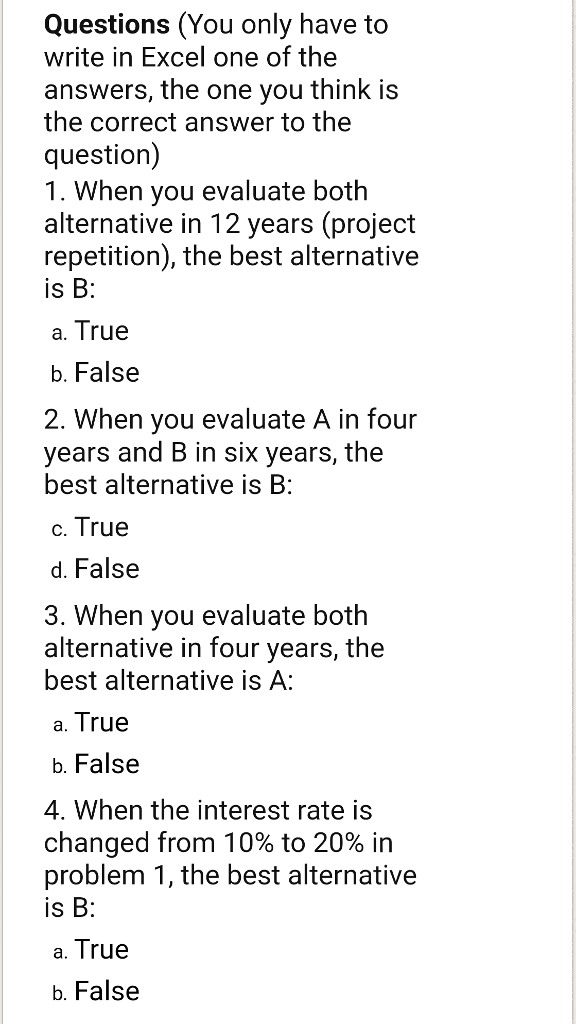

The following data have been estimated for two mutually exclusive investment alternatives, A and B, associated with a small engineering project for which revenues as well as expenses are involved. They have useful lives of four and six years, respectively. If MARR is 10% per year, show which alternative is more desirable by using equivalent worth methods. Use the repeatability assumption. Capital investment Annual cash flow Useful life (years) Market value at end of useful 1,255 1,480 1. Have available the Microsoft Excel software program 2. Construct a table in the Microsoft Excel work sheet as shown below The instructions are shown in the second table. MARR 0.1 1255 5000 125 1480 2245 1480 3520 22451480 125s 1480 12551480 12 13 15 16 17 12 Pw $1.027.86 $2.261.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts