Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following events pertain to Super Cleaning Company: 1. Acquired $15,700 cash from the issue of common stock. 2. Provided $13,700 of services on

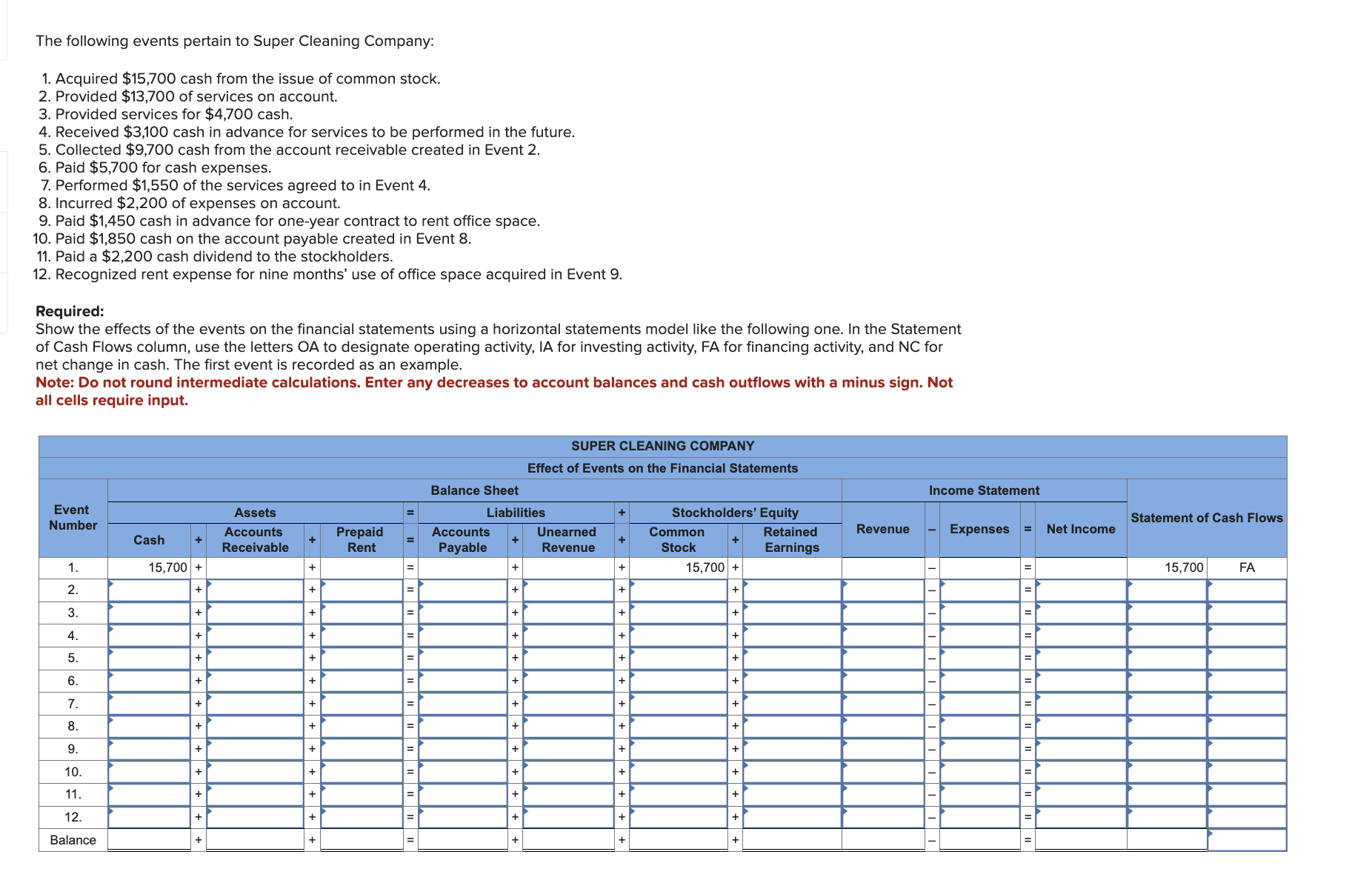

The following events pertain to Super Cleaning Company: 1. Acquired $15,700 cash from the issue of common stock. 2. Provided $13,700 of services on account. 3. Provided services for $4,700 cash. 4. Received $3,100 cash in advance for services to be performed in the future. 5. Collected $9,700 cash from the account receivable created in Event 2. 6. Paid $5,700 for cash expenses. 7. Performed $1,550 of the services agreed to in Event 4. 8. Incurred $2,200 of expenses on account. 9. Paid $1,450 cash in advance for one-year contract to rent office space. 10. Paid $1,850 cash on the account payable created in Event 8. 11. Paid a $2,200 cash dividend to the stockholders. 12. Recognized rent expense for nine months' use of office space acquired in Event 9. Required: Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Statement of Cash Flows column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity, and NC for net change in cash. The first event is recorded as an example. Note: Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Not all cells require input. SUPER CLEANING COMPANY Effect of Events on the Financial Statements Balance Sheet Event Number Cash + Assets Accounts Receivable Liabilities + Prepaid + Rent Accounts Payable Unearned Revenue 1. 15,700 + Common Stock Stockholders' Equity Retained Earnings Revenue Income Statement Statement of Cash Flows Expenses = Net Income + = + + 2. 15,700 + + = + = 15,700 + FA + 3. + + 4. + + 5. + + + + + + + 6. + + + + + 7. + + + + + 8. + + + + + 9. + + = + + + 10. + = + + + + 11. + = + = + + + 12. + + + + + Balance + + + + +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started