Question: The following Income statement does not reflect Intraperlod tax allocation. INCOME STATEMENT For the Fiscal Year Ended March 31, 2018 ($ in millions) Revenues Cost

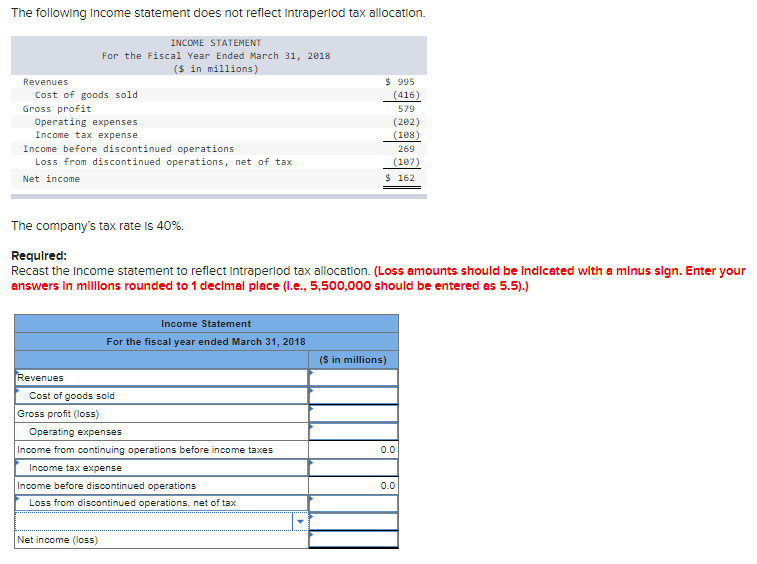

The following Income statement does not reflect Intraperlod tax allocation. INCOME STATEMENT For the Fiscal Year Ended March 31, 2018 ($ in millions) Revenues Cost of goods sold Gross profit Operating expenses Income tax expense Income before discontinued operations Loss from discontinued operations, net of tax Net income $ 995 (416) 579 (202) (108) 269 (107) $ 162 The company's tax rate is 40%. Required: Recast the income statement to reflect Intraperlod tax allocation. (Loss amounts should be Indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (l.e., 5,500,000 should be entered as 5.5).) Income Statement For the fiscal year ended March 31, 2018 ($ in millions) Revenues Cost of goods sold Gross profit (loss) Operating expenses Income from continuing operations before income taxes Income tax expense Income before discontinued operations Loss from discontinued operations, net of tax 0.0 0.0 Net income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts