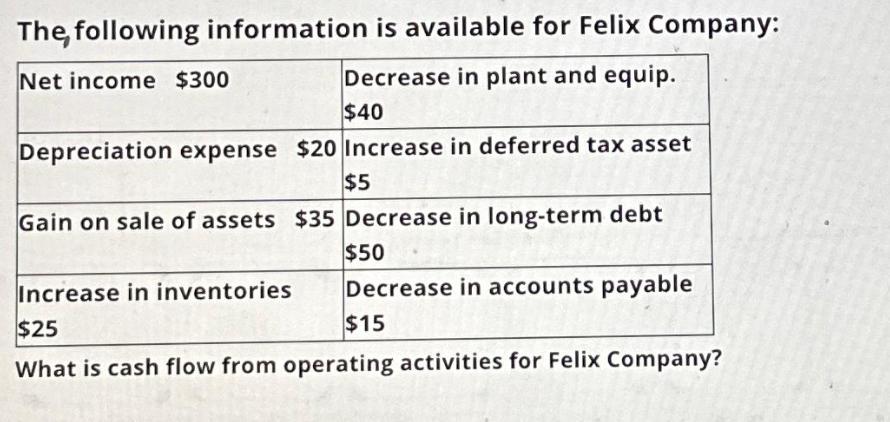

Question: The following information is available for Felix Company: Decrease in plant and equip. Net income $300 $40 Depreciation expense $20 Increase in deferred tax

The following information is available for Felix Company: Decrease in plant and equip. Net income $300 $40 Depreciation expense $20 Increase in deferred tax asset Gain on sale of assets $35 Decrease in long-term debt Increase in inventories $25 $5 $50 Decrease in accounts payable $15 What is cash flow from operating activities for Felix Company?

Step by Step Solution

There are 3 Steps involved in it

We can calculate the cash flow from operating activities for Felix Company using the indirect method ... View full answer

Get step-by-step solutions from verified subject matter experts