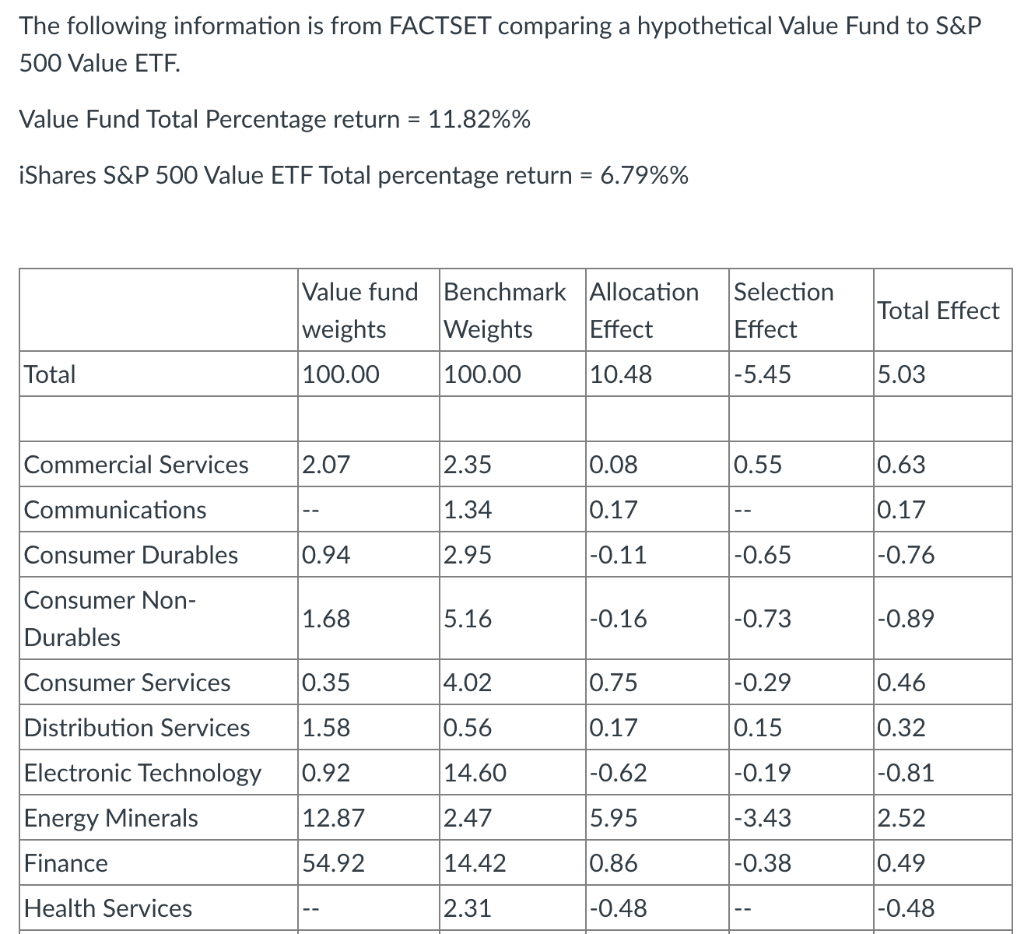

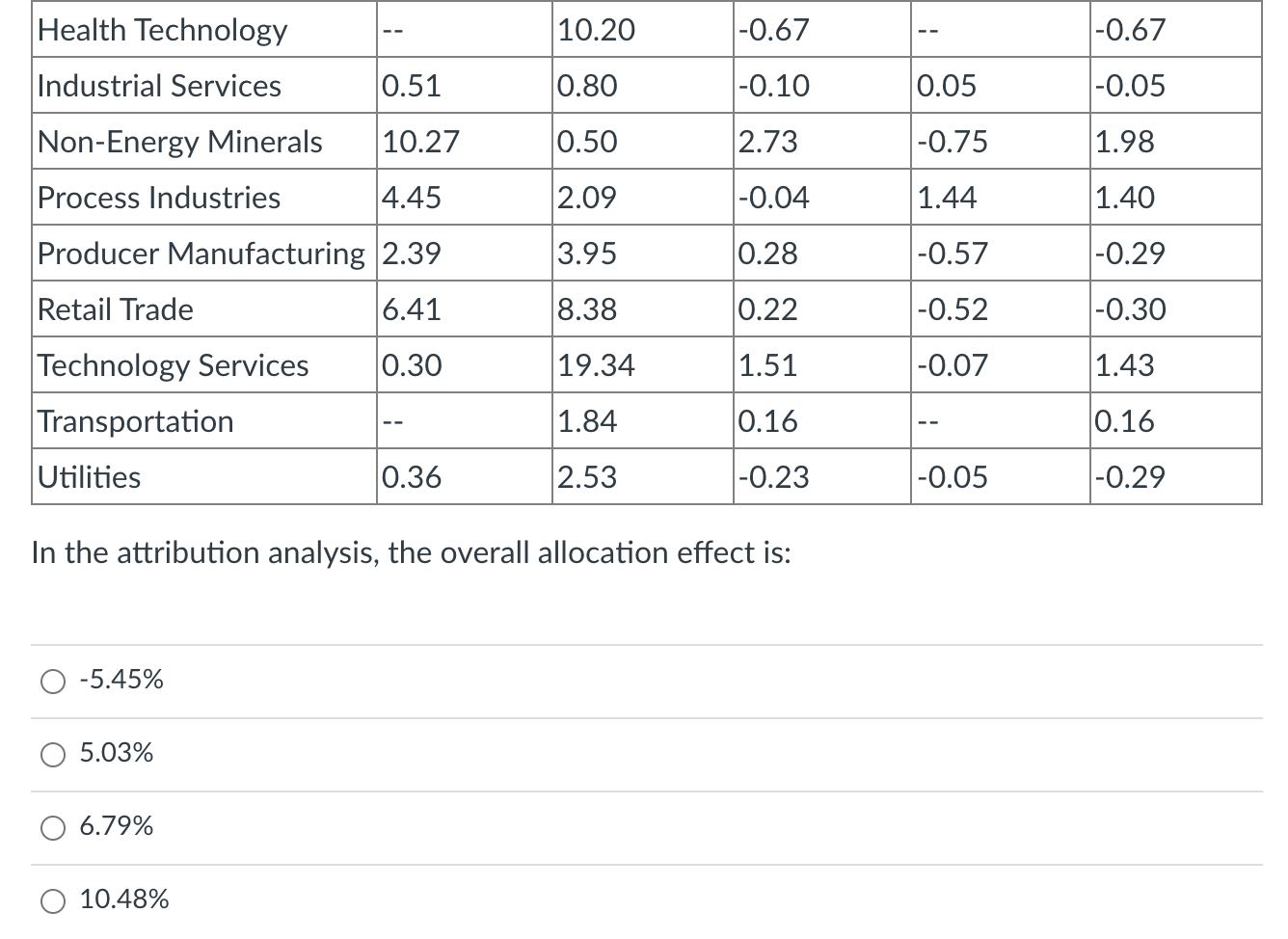

Question: The following information is from FACTSET comparing a hypothetical Value Fund to S&P 500 Value ETF. Value Fund Total Percentage return = 11.82%% iShares S&P

The following information is from FACTSET comparing a hypothetical Value Fund to S&P 500 Value ETF. Value Fund Total Percentage return = 11.82%% iShares S&P 500 Value ETF Total percentage return = 6.79%% Value fund Benchmark Allocation Selection Total Effect weights Weights Effect Effect Total 100.00 100.00 10.48 -5.45 5.03 Commercial Services 2.07 2.35 0.08 0.55 0.63 Communications 1.34 0.17 0.17 -- Consumer Durables 0.94 2.95 -0.11 -0.65 -0.76 Consumer Non- 1.68 5.16 -0.16 -0.73 -0.89 Durables Consumer Services 0.35 4.02 0.75 -0.29 0.46 Distribution Services 1.58 0.56 0.17 0.15 0.32 Electronic Technology 0.92 14.60 -0.62 -0.19 -0.81 Energy Minerals 12.87 2.47 5.95 -3.43 2.52 Finance 54.92 14.42 0.86 -0.38 0.49 Health Services 2.31 -0.48 -0.48 Health Technology 10.20 -0.67 Industrial Services 0.51 0.80 -0.10 Non-Energy Minerals 10.27 0.50 2.73 Process Industries 4.45 2.09 -0.04 Producer Manufacturing 2.39 3.95 0.28 Retail Trade 6.41 8.38 0.22 Technology Services 0.30 19.34 1.51 Transportation 1.84 0.16 Utilities 0.36 2.53 -0.23 In the attribution analysis, the overall allocation effect is: -5.45% 5.03% 6.79% 10.48% 0.05 -0.75 1.44 -0.57 -0.52 -0.07 -0.05 -0.67 -0.05 1.98 1.40 -0.29 -0.30 1.43 0.16 -0.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts