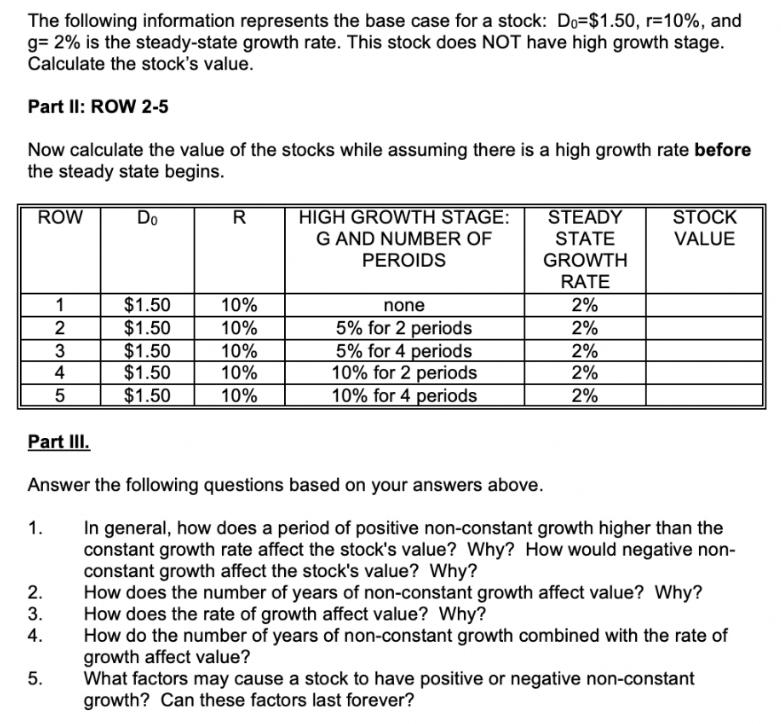

Question: The following information represents the base case for a stock: Do-$1.50, r=10%, and g= 2% is the steady-state growth rate. This stock does NOT

The following information represents the base case for a stock: Do-$1.50, r=10%, and g= 2% is the steady-state growth rate. This stock does NOT have high growth stage. Calculate the stock's value. Part II: ROW 2-5 Now calculate the value of the stocks while assuming there is a high growth rate before the steady state begins. ROW Part III. 1. 1 2 3 4 5 2. 3. 4. 5. Do $1.50 $1.50 $1.50 $1.50 $1.50 R 10% 10% 10% 10% 10% HIGH GROWTH STAGE: G AND NUMBER OF PEROIDS none 5% for 2 periods 5% for 4 periods 10% for 2 periods 10% for 4 periods STEADY STATE GROWTH RATE 2% 2% Answer the following questions based on your answers above. In general, how does a period of positive non-constant growth higher than the constant growth rate affect the stock's value? Why? How would negative non- constant growth affect the stock's value? Why? How does the number of years of non-constant growth affect value? Why? How does the rate of growth affect value? Why? How do the number of years of non-constant growth combined with the rate of growth affect value? What factors may cause a stock to have positive or negative non-constant growth? Can these factors last forever? 2% 2% 2% STOCK VALUE

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

1 Stocks value is the present value of the future cash flows ie dividends Higher the dividends highe... View full answer

Get step-by-step solutions from verified subject matter experts