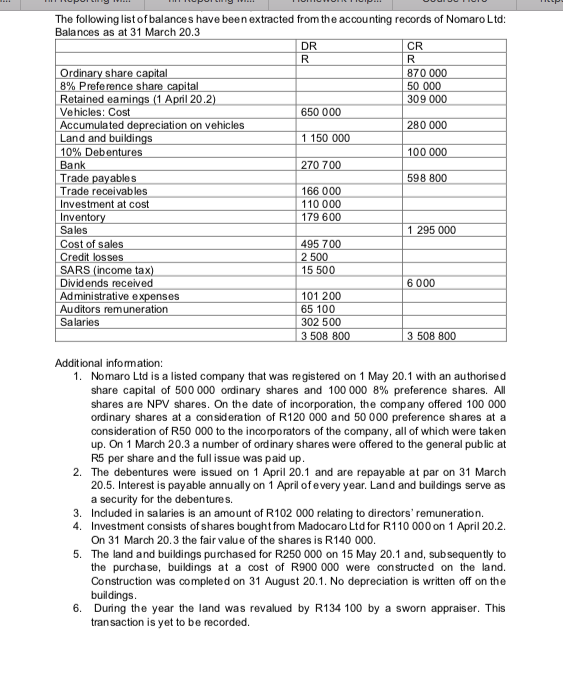

The following list of balances have been extracted from the accounting records of Nomaro Ltd: Balances...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

The following list of balances have been extracted from the accounting records of Nomaro Ltd: Balances as at 31 March 20.3 DR R Ordinary share capital CR R 870 000 8% Preference share capital 50 000 Retained eamings (1 April 20.2) 309 000 Vehicles: Cost 650 000 Accumulated depreciation on vehicles 280 000 Land and buildings 1 150 000 10% Debentures 100 000 270 700 598 800 Bank Trade payables Trade receivables Investment at cost Inventory Sales Cost of sales Credit losses SARS (income tax) Dividends received Administrative expenses Auditors remuneration Salaries Additional information: 166 000 110 000 179 600 495 700 2 500 15 500 101 200 65 100 302 500 1 295 000 6 000 3 508 800 3 508 800 1. Nomaro Ltd is a listed company that was registered on 1 May 20.1 with an authorised share capital of 500 000 ordinary shares and 100 000 8% preference shares. All shares are NPV shares. On the date of incorporation, the company offered 100 000 ordinary shares at a consideration of R120 000 and 50 000 preference shares at a consideration of R50 000 to the incorporators of the company, all of which were taken up. On 1 March 20.3 a number of ordinary shares were offered to the general public at R5 per share and the full issue was paid up. 2. The debentures were issued on 1 April 20.1 and are repayable at par on 31 March 20.5. Interest is payable annually on 1 April of every year. Land and buildings serve as a security for the debentures. 3. Included in salaries is an amount of R102 000 relating to directors' remuneration. 4. Investment consists of shares bought from Madocaro Ltd for R110 000 on 1 April 20.2. On 31 March 20.3 the fair value of the shares is R140 000. 5. The land and buildings purchased for R250 000 on 15 May 20.1 and, subsequently to the purchase, buildings at a cost of R900 000 were constructed on the land. Construction was completed on 31 August 20.1. No depreciation is written off on the buildings. 6. During the year the land was revalued by R134 100 by a sworn appraiser. This transaction is yet to be recorded. The following list of balances have been extracted from the accounting records of Nomaro Ltd: Balances as at 31 March 20.3 DR R Ordinary share capital CR R 870 000 8% Preference share capital 50 000 Retained eamings (1 April 20.2) 309 000 Vehicles: Cost 650 000 Accumulated depreciation on vehicles 280 000 Land and buildings 1 150 000 10% Debentures 100 000 270 700 598 800 Bank Trade payables Trade receivables Investment at cost Inventory Sales Cost of sales Credit losses SARS (income tax) Dividends received Administrative expenses Auditors remuneration Salaries Additional information: 166 000 110 000 179 600 495 700 2 500 15 500 101 200 65 100 302 500 1 295 000 6 000 3 508 800 3 508 800 1. Nomaro Ltd is a listed company that was registered on 1 May 20.1 with an authorised share capital of 500 000 ordinary shares and 100 000 8% preference shares. All shares are NPV shares. On the date of incorporation, the company offered 100 000 ordinary shares at a consideration of R120 000 and 50 000 preference shares at a consideration of R50 000 to the incorporators of the company, all of which were taken up. On 1 March 20.3 a number of ordinary shares were offered to the general public at R5 per share and the full issue was paid up. 2. The debentures were issued on 1 April 20.1 and are repayable at par on 31 March 20.5. Interest is payable annually on 1 April of every year. Land and buildings serve as a security for the debentures. 3. Included in salaries is an amount of R102 000 relating to directors' remuneration. 4. Investment consists of shares bought from Madocaro Ltd for R110 000 on 1 April 20.2. On 31 March 20.3 the fair value of the shares is R140 000. 5. The land and buildings purchased for R250 000 on 15 May 20.1 and, subsequently to the purchase, buildings at a cost of R900 000 were constructed on the land. Construction was completed on 31 August 20.1. No depreciation is written off on the buildings. 6. During the year the land was revalued by R134 100 by a sworn appraiser. This transaction is yet to be recorded.

Expert Answer:

Answer rating: 100% (QA)

Statement of Comprehensive Income for the Year Ended 31 March 203 1 Revenue Sales R3508800 2 Cost of Sales Cost of Sales R1295000 3 Gross Profit Gross Profit Sales Cost of Sales R3508800 R1295000 R221... View the full answer

Posted Date:

Students also viewed these accounting questions

-

Xbox Game Pass has 25 million subscribers, and generated $2.9 billion in revenue in 2021, accounting for nearly 20 percent of total Xbox revenue ($16.3 billion). After growing during the pandemic,...

-

The following list of balances have been extracted from the accounting records of Nomaro Ltd: Balances as at 3 1 March 2 0 . 3 DR CR R R Ordinary share capital 8 7 0 0 0 0 8 % Preference share...

-

Question 1 This question has two parts, (A) and (B). Answer both parts. 100% Liverpool plc is a company that manufactures a number of different types of electrical goods and has a year end of 31...

-

You are given the following information about two stocks: (a) Calculate the mean and standard deviation for each stock. (b) Compare the mean, standard deviation, and coefficient of variation of each...

-

Claim: 8550; = 0.02; = 314 Sample statistics: = 8420, n = 38 Test the claim about the population mean at the level of significance . Assume the population is normally distributed. If...

-

Consider the following information from Alliance Data Systems Corporation 2009 10K. On October 30, 2009, the Company assumed the operations of the Charming Shoppes' credit card program, including the...

-

The trial balance of a business called Saturdays, a sole trader, at 1 January 2007 is as follows: During the financial year, the following transactions took place: At 31 December 2007 the closing...

-

Kitty Wonderland (KW) makes toys for cats and kittens. KWs managers have recently learned that they can calculate the average waiting time for an order from the time an order is received and the time...

-

The daily temperature in degrees Fahrenheit of Phoenix in the summer can be modeled by the function on where x is hours after midnight. Find the rate at which the temperature is changing at 10.1 p.m....

-

Read the Crocs, Inc. Case Assignment and respond to the following: Part A: Prepare a one-page executive summary that gives an overview of the company within the time period specified by the case....

-

A beam is clamped at one end and has a horizontal spring attached at the other. Its axial vibrations are modelled using 7 axial elements. How many modes are captured in this model?

-

E-Tech Initiatives Limited plans to issue $650,000, 10-year, 7.00 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2022. Show how the bonds...

-

What are five different sources of power used at Ford Motor Company

-

5 . State the first law of thermodynamics applied to closed system process and steady flow process. Derive steady flow energy equation.

-

Hilsch Vortex Tube: Calculate the mass flow rate of entering air. Calculate the cooling capacity (what units?) of your cold stream and heating capacity of your hot stream. The cooling capacity, in...

-

reword the following: Considering the five forces, Apple must focus its attention on competitive rivalry and the bargaining power of buyers. This external analysis supports the company's current...

-

Tanaka Company's cost and production data for two recent months included the following: March April Production (units).........300................600 Rent.....................$1,800............$1,800...

-

Tektronix, Inc., an Oregon-based MNE, manufactures scientific instruments. Jerry Davies, Treasurer, needs to choose an instrument to hedge a \( 2,000,000\) sale to Siemens in Germany, with payment...

-

Call Options on British Pounds (Option.xls) The set of assumptions used throughout the second half of this chapter assumed a spot rate of \(\$ 1.70 / \), a 90 -day maturity, U.S. dollar and British...

-

Jos Ballini is a currency trader and speculator for Bozano Simonsen, one of the largest investment banking firms in So Paulo. The current spot rate is \(\mathrm{R} \$ 1.7800 / \$\), and the 360 -day...

Study smarter with the SolutionInn App