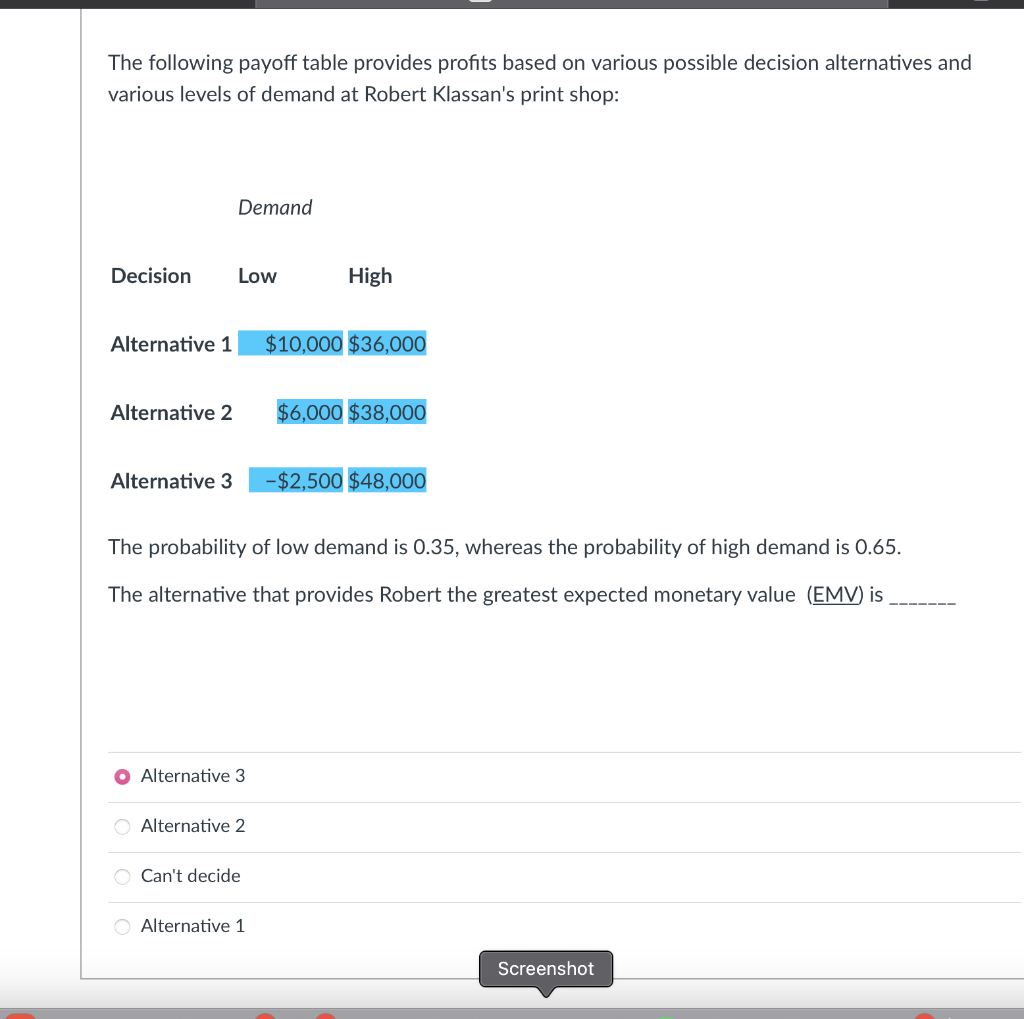

Question: The following payoff table provides profits based on various possible decision alternatives and various levels of demand at Robert Klassan's print shop: The probability of

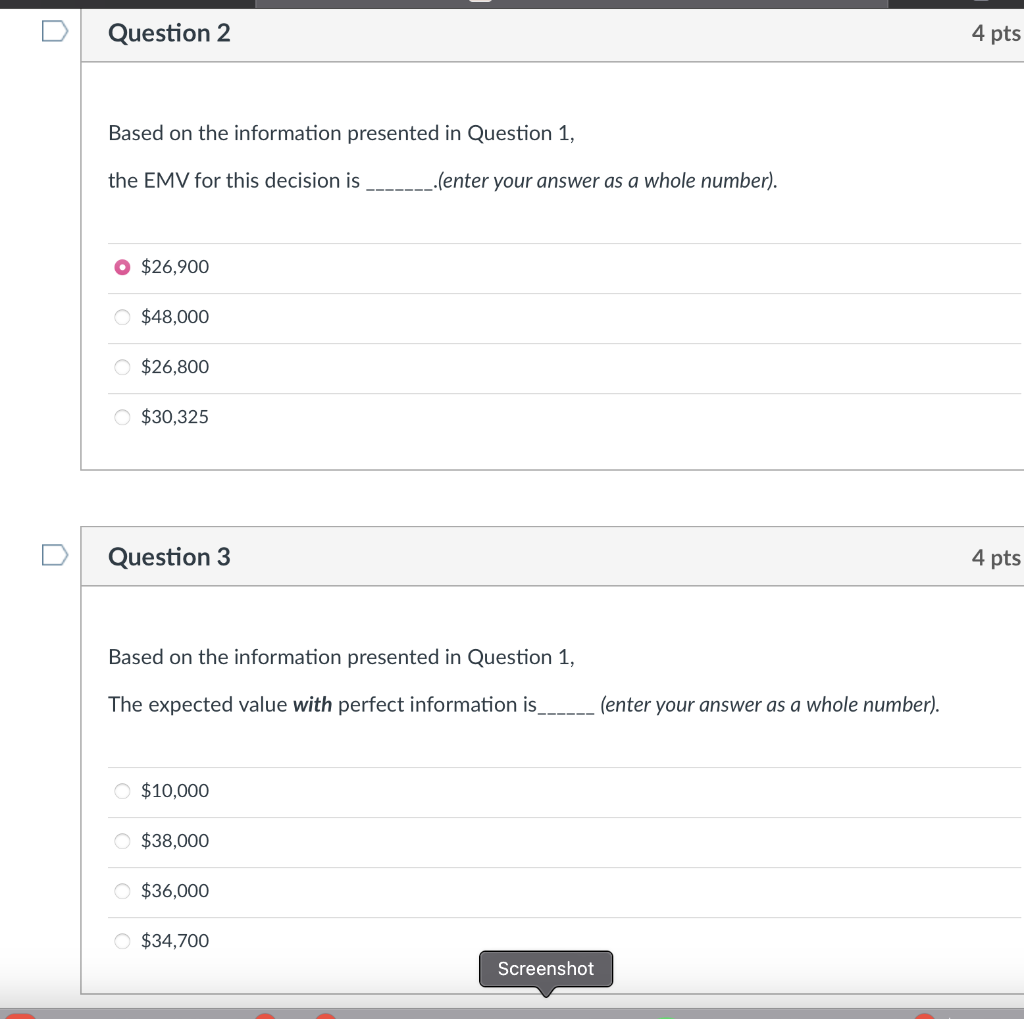

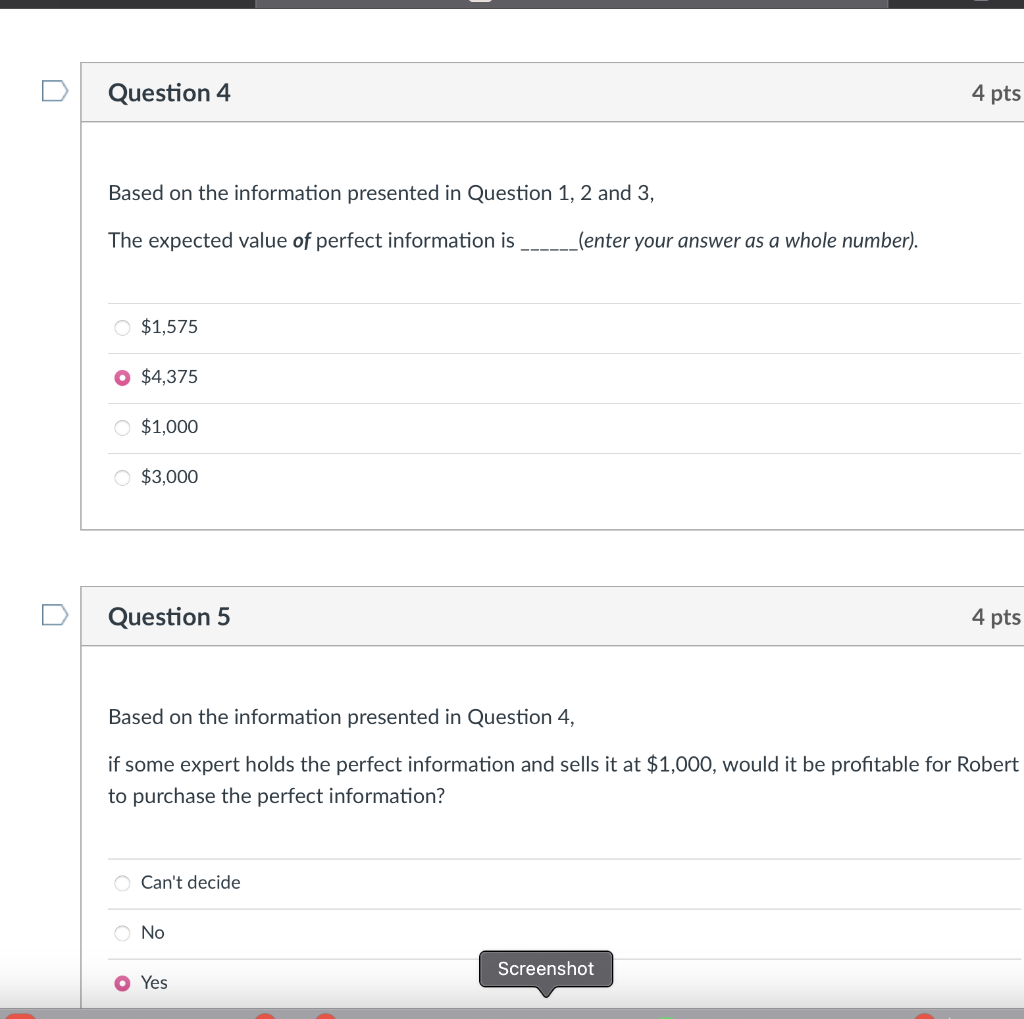

The following payoff table provides profits based on various possible decision alternatives and various levels of demand at Robert Klassan's print shop: The probability of low demand is 0.35 , whereas the probability of high demand is 0.65 . The alternative that provides Robert the greatest expected monetary value (EMV) is Alternative 3 Alternative 2 Can't decide Alternative 1 Based on the information presented in Question 1, the EMV for this decision is .(enter your answer as a whole number). $26,900$48,000$26,800$30,325 Question 3 Based on the information presented in Question 1, The expected value with perfect information is (enter your answer as a whole number). $10,000$38,000$36,000$34,700 Based on the information presented in Question 1, 2 and 3, The expected value of perfect information is (enter your answer as a whole number). $1,575 $,375 $1,000 $,000 Question 5 4pts Based on the information presented in Question 4, if some expert holds the perfect information and sells it at $1,000, would it be profitable for Robert to purchase the perfect information? Can't decide No Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts