Question: The following question concerns the Rylon example discussed in Section 3. 9. After defining RB = Ounces of Regular Brute produced annually LB = ounces

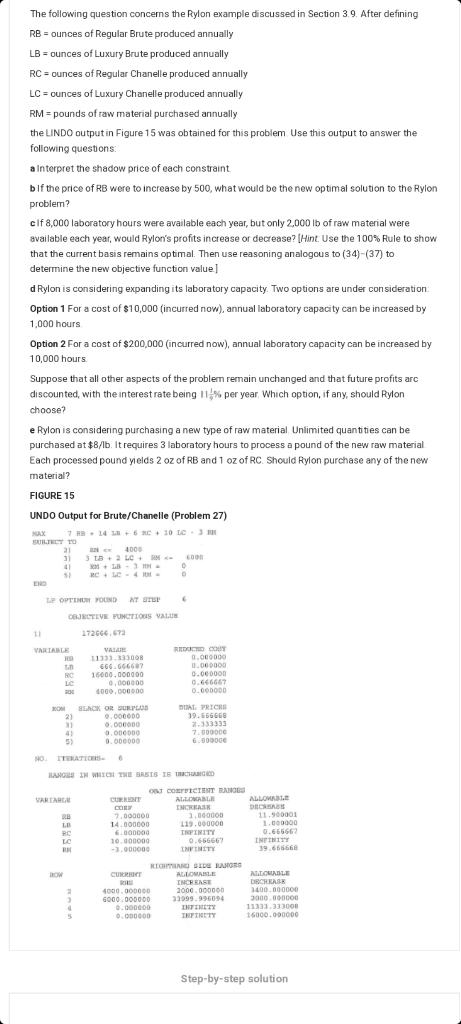

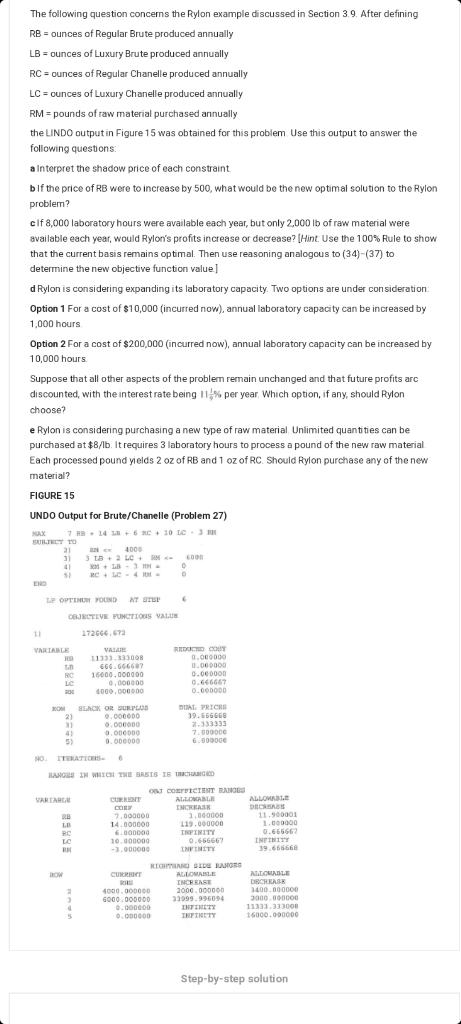

The following question concerns the Rylon example discussed in Section 3. 9. After defining RB = Ounces of Regular Brute produced annually LB = ounces of Luxury Brute produced annually RC = Ounces of Regular Chanelle produced annually LC = ounces of Luxury Chanelle produced annually RM = pounds of raw material purchased annually the LINDO output in Figure 15 was obtained for this problem Use this output to answer the following questions a interpret the shadow price of each constraint bif the price of RB were to increase by 500, what would be the new optimal solution to the Rylon problem? cIf 8,000 laboratory hours were available each year, but only 2,000 lb of raw material were available each year, would Rylon's profits increase or decrease? [Hint. Use the 100% Rule to show that the current basis remains optimal. Then use reasoning analogous to (34)-(37) to determine the new objective function value] d Rylon is considering expanding its laboratory capacity. Two options are under consideration Option 1 For a cost of $10,000 (incurred now), annual laboratory capacity can be increased by 1,000 hours Option 2 For a cost of $200,000 (incurred now), annual laboratory capacity can be increased by 10,000 hours Suppose that all other aspects of the problem remain unchanged and that future profits arc discounted, with the interest rate being 11% per year Which option, if any, should Rylon choose? e Rylon is considering purchasing a new type of raw material Unlimited quantities can be purchased at $8/1b. It requires 3 laboratory hours to process a pound of the new raw material Each processed pound yields 2 oz of RB and 1 oz of RC Should Rylon purchase any of the new material? FIGURE 15 UNDO Output for Brute/Chanelle (Problem 27) X 7.146 10 LC STILTE 21 4000 3+2 LOW ED + L 0 LP OPTIMOW POUND IT IS 6 OBJECTIVE FUNCTIONS VALUE 172666.67 11 VARIABLE VALE RED COUT 11331100 0.000000 . 666666687 0.000000 16000.000000 0.000000 LC 0.000000 0.666667 1000.000000 0.000000 SECK OR SUPOS DUAL PRICE 0.000000 19.5660 0.000000 0.000000 7.000000 0.000000 6.000000 HOTELS HAUS IM WITH SRS 16 HD ON CORRECTET BANO VARTA CHER ALLOMALE ALLOWE INCREAN DIOS BB 7.000000 1.000000 11.900001 LO 14.000000 119.000000 1.000000 6.000000 TIPINITY 0.665662 LC 10.000000 0.656667 INFINITY -2.000000 TNTHETY 39.66666 RPG SIDEBAR BOW CURRIT ALLOMAINE ALLOMALE DRCHASE 4000.000000 2000.000000 1400.000000 6000.000000 33099.996094 3000000000 0.000000 INTEREST 11331333000 0.000000 THTRETY 16000.000000 THE EAST Step-by-step solution The following question concerns the Rylon example discussed in Section 3. 9. After defining RB = Ounces of Regular Brute produced annually LB = ounces of Luxury Brute produced annually RC = Ounces of Regular Chanelle produced annually LC = ounces of Luxury Chanelle produced annually RM = pounds of raw material purchased annually the LINDO output in Figure 15 was obtained for this problem Use this output to answer the following questions a interpret the shadow price of each constraint bif the price of RB were to increase by 500, what would be the new optimal solution to the Rylon problem? cIf 8,000 laboratory hours were available each year, but only 2,000 lb of raw material were available each year, would Rylon's profits increase or decrease? [Hint. Use the 100% Rule to show that the current basis remains optimal. Then use reasoning analogous to (34)-(37) to determine the new objective function value] d Rylon is considering expanding its laboratory capacity. Two options are under consideration Option 1 For a cost of $10,000 (incurred now), annual laboratory capacity can be increased by 1,000 hours Option 2 For a cost of $200,000 (incurred now), annual laboratory capacity can be increased by 10,000 hours Suppose that all other aspects of the problem remain unchanged and that future profits arc discounted, with the interest rate being 11% per year Which option, if any, should Rylon choose? e Rylon is considering purchasing a new type of raw material Unlimited quantities can be purchased at $8/1b. It requires 3 laboratory hours to process a pound of the new raw material Each processed pound yields 2 oz of RB and 1 oz of RC Should Rylon purchase any of the new material? FIGURE 15 UNDO Output for Brute/Chanelle (Problem 27) X 7.146 10 LC STILTE 21 4000 3+2 LOW ED + L 0 LP OPTIMOW POUND IT IS 6 OBJECTIVE FUNCTIONS VALUE 172666.67 11 VARIABLE VALE RED COUT 11331100 0.000000 . 666666687 0.000000 16000.000000 0.000000 LC 0.000000 0.666667 1000.000000 0.000000 SECK OR SUPOS DUAL PRICE 0.000000 19.5660 0.000000 0.000000 7.000000 0.000000 6.000000 HOTELS HAUS IM WITH SRS 16 HD ON CORRECTET BANO VARTA CHER ALLOMALE ALLOWE INCREAN DIOS BB 7.000000 1.000000 11.900001 LO 14.000000 119.000000 1.000000 6.000000 TIPINITY 0.665662 LC 10.000000 0.656667 INFINITY -2.000000 TNTHETY 39.66666 RPG SIDEBAR BOW CURRIT ALLOMAINE ALLOMALE DRCHASE 4000.000000 2000.000000 1400.000000 6000.000000 33099.996094 3000000000 0.000000 INTEREST 11331333000 0.000000 THTRETY 16000.000000 THE EAST Step-by-step solution