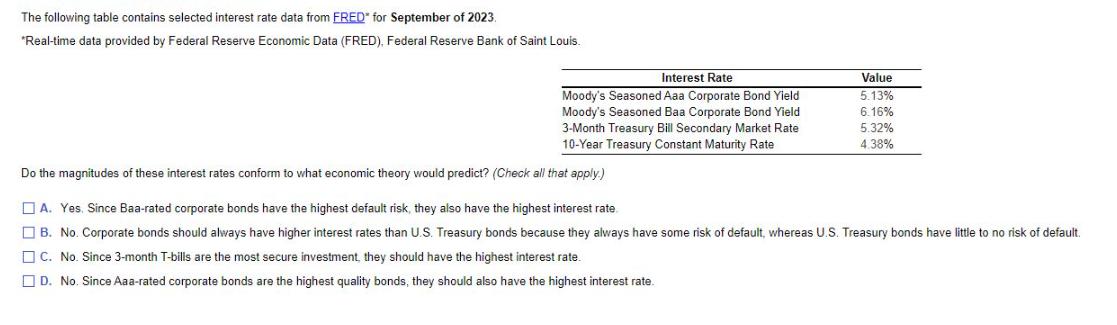

Question: The following table contains selected interest rate data from FRED for September of 2023. *Real-time data provided by Federal Reserve Economic Data (FRED), Federal

The following table contains selected interest rate data from FRED" for September of 2023. *Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis. Interest Rate Value Moody's Seasoned Aaa Corporate Bond Yield Moody's Seasoned Baa Corporate Bond Yield 3-Month Treasury Bill Secondary Market Rate 10-Year Treasury Constant Maturity Rate 5.13% 6.16% 5.32% 4.38% Do the magnitudes of these interest rates conform to what economic theory would predict? (Check all that apply.) A. Yes. Since Baa-rated corporate bonds have the highest default risk, they also have the highest interest rate B. No. Corporate bonds should always have higher interest rates than U.S. Treasury bonds because they always have some risk of default, whereas U.S. Treasury bonds have little to no risk of default. C. No. Since 3-month T-bills are the most secure investment, they should have the highest interest rate. D. No. Since Aaa-rated corporate bonds are the highest quality bonds, they should also have the highest interest rate.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts