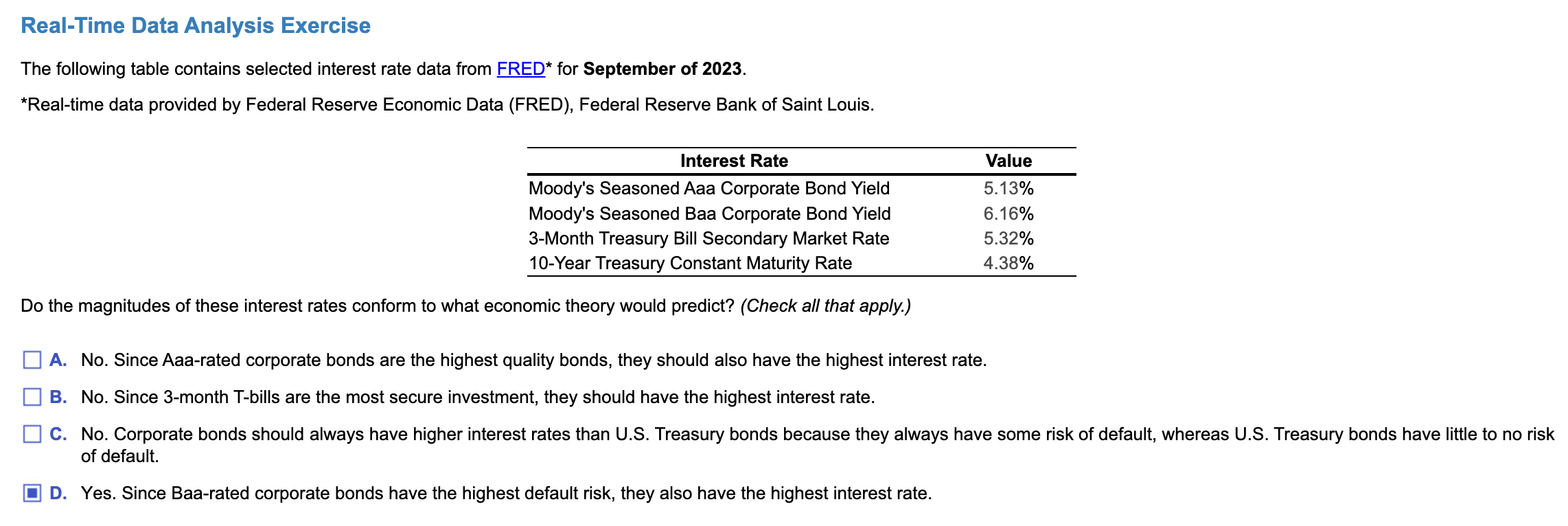

Question: The following table contains selected interest rate data from FREDopens in a new tab * for September of 2 0 2 3 . * Real

The following table contains selected interest rate data from FREDopens in a new tab for September of

Realtime data provided by Federal Reserve Economic DataFRED Federal Reserve Bank of Saint Louis.

Interest Rate

Value

Moodys Seasoned Aaa Corporate Bond Yield

Moodys Seasoned Baa Corporate Bond Yield

Month Treasury Bill Secondary Market Rate

Year Treasury Constant Maturity Rate

Part

Do the magnitudes of these interest rates conform to what economic theory would predict? Check all that apply.

A

No Since Aaarated corporate bonds are the highest quality bonds, they should also have the highest interest rate.

B

No Sincemonth Tbills are the most secure investment, they should have the highest interest rate.

C

No Corporate bonds should always have higher interest rates than US Treasury bonds because they always have some risk of default, whereas US Treasury bonds have little to no risk of default.

D

Yes. Since Baarated corporate bonds have the highest default risk, they also have the highest interest rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock