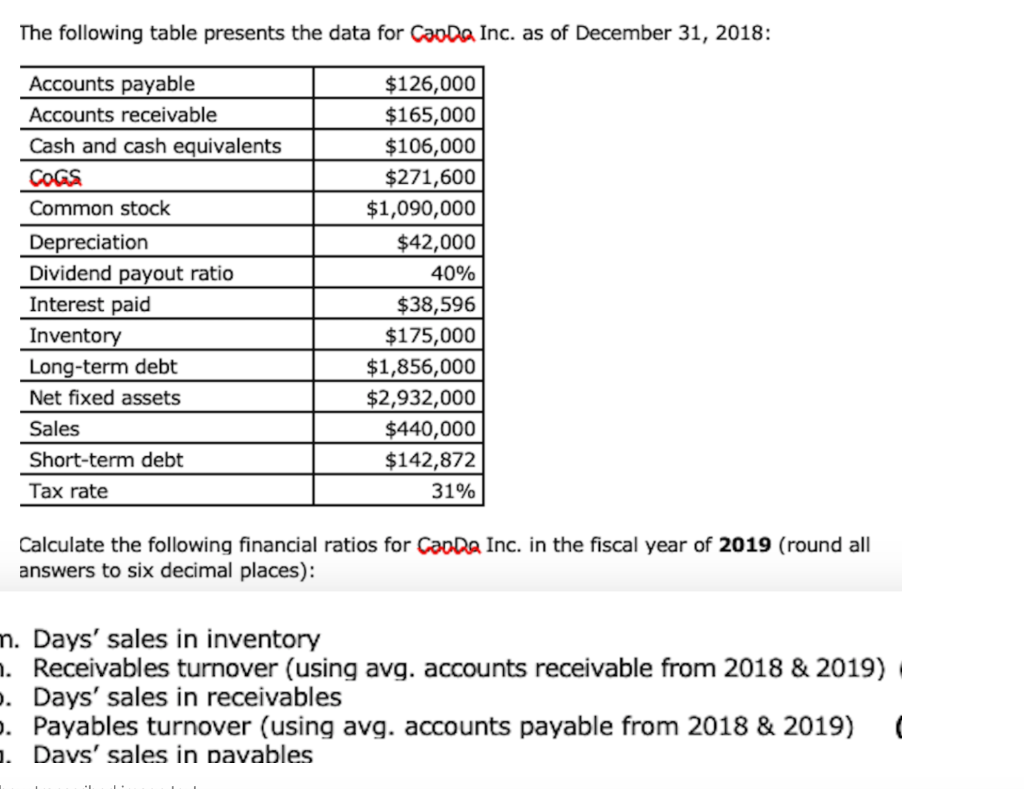

Question: The following table presents the data for Cao Da Inc. as of December 31, 2018: Accounts payable Accounts receivable Cash and cash equivalents COGS Common

The following table presents the data for Cao Da Inc. as of December 31, 2018: Accounts payable Accounts receivable Cash and cash equivalents COGS Common stock Depreciation Dividend payout ratio Interest paid Inventory Long-term debt Net fixed assets Sales Short-term debt Tax rate $126,000 $165,000 $106,000 $271,600 $1,090,000 $42,000 40% $38,596 $175,000 $1,856,000 $2,932,000 $440,000 $142,872 31% Calculate the following financial ratios for CanDe Inc. in the fiscal year of 2019 (round all answers to six decimal places): n. Days' sales in inventory 1. Receivables turnover (using avg. accounts receivable from 2018 & 2019) . Days' sales in receivables . Payables turnover (using avg. accounts payable from 2018 & 2019) ( 1. Davs' sales in pavables The following table presents the data for Cao Da Inc. as of December 31, 2018: Accounts payable Accounts receivable Cash and cash equivalents COGS Common stock Depreciation Dividend payout ratio Interest paid Inventory Long-term debt Net fixed assets Sales Short-term debt Tax rate $126,000 $165,000 $106,000 $271,600 $1,090,000 $42,000 40% $38,596 $175,000 $1,856,000 $2,932,000 $440,000 $142,872 31% Calculate the following financial ratios for CanDe Inc. in the fiscal year of 2019 (round all answers to six decimal places): n. Days' sales in inventory 1. Receivables turnover (using avg. accounts receivable from 2018 & 2019) . Days' sales in receivables . Payables turnover (using avg. accounts payable from 2018 & 2019) ( 1. Davs' sales in pavables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts