Question: The following table reports the expected annual return and beta for three stocks. The riskless. interest rate is 0.8% per year. Assume that the

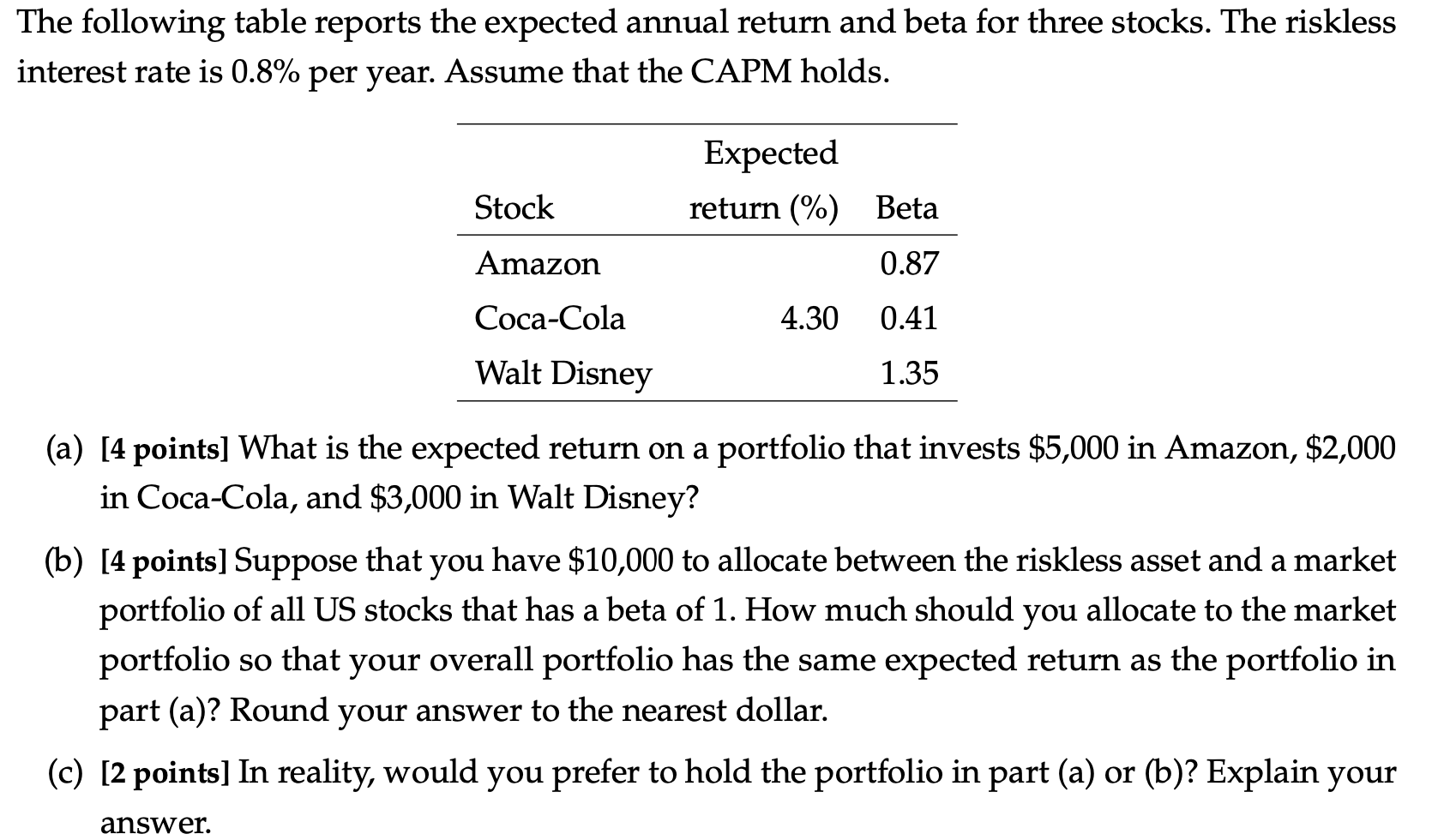

The following table reports the expected annual return and beta for three stocks. The riskless. interest rate is 0.8% per year. Assume that the CAPM holds. Expected Stock return (%) Beta Amazon 0.87 4.30 0.41 1.35 Coca-Cola Walt Disney (a) [4 points] What is the expected return on a portfolio that invests $5,000 in Amazon, $2,000 in Coca-Cola, and $3,000 in Walt Disney? (b) [4 points] Suppose that you have $10,000 to allocate between the riskless asset and a market portfolio of all US stocks that has a beta of 1. How much should you allocate to the market portfolio so that your overall portfolio has the same expected return as the portfolio in part (a)? Round your answer to the nearest dollar. (c) [2 points] In reality, would you prefer to hold the portfolio in part (a) or (b)? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts