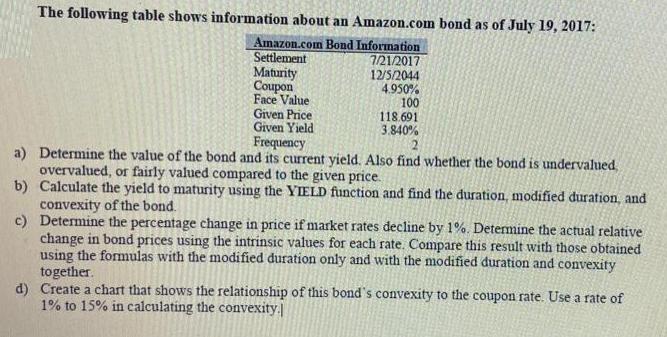

Question: The following table shows information about an Amazon.com bond as of July 19, 2017: Amazon.com Bond Information Settlement Maturity Coupon Face Value 7/21/2017 12/5/2044

The following table shows information about an Amazon.com bond as of July 19, 2017: Amazon.com Bond Information Settlement Maturity Coupon Face Value 7/21/2017 12/5/2044 4.950% 100 Given Price Given Yield 118.691 3.840% 2 Frequency a) Determine the value of the bond and its current yield. Also find whether the bond is undervalued overvalued, or fairly valued compared to the given price. b) Calculate the yield to maturity using the YIELD function and find the duration, modified duration, and convexity of the bond. c) Determine the percentage change in price if market rates decline by 1%. Determine the actual relative change in bond prices using the intrinsic values for each rate. Compare this result with those obtained using the formulas with the modified duration only and with the modified duration and convexity together. d) Create a chart that shows the relationship of this bond's convexity to the coupon rate. Use a rate of 1% to 15% in calculating the convexity.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Solution a To determine the value of the bond we can use the formula for bond valuation V C rm 1 1 rmn FV 1 rmn where V is the bonds value C is the co... View full answer

Get step-by-step solutions from verified subject matter experts