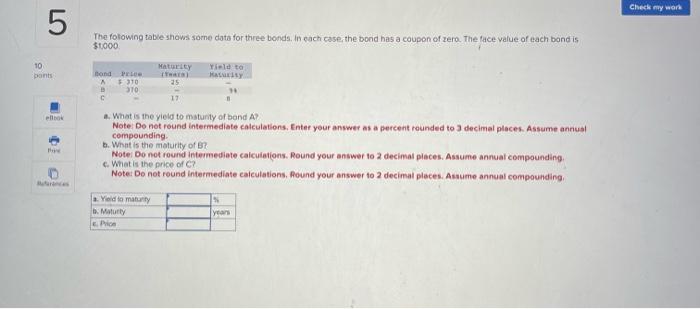

Question: The folowing table shows some data for three bonds. In each case, the bond has a coupon of zero. The face value of each bond

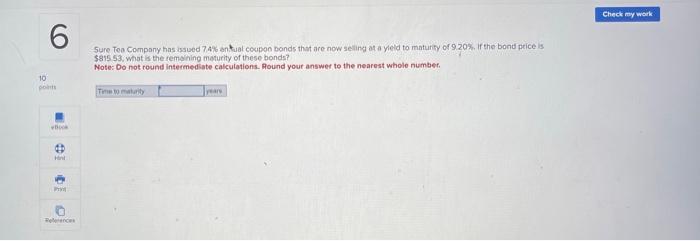

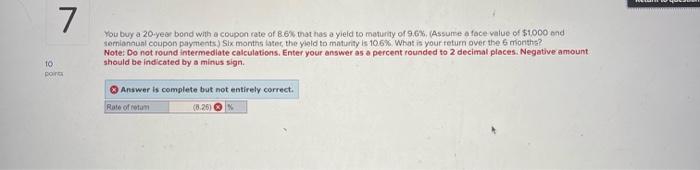

The folowing table shows some data for three bonds. In each case, the bond has a coupon of zero. The face value of each bond is $1000 a. What is the yield to maturity of bond A ? Note: Do not round intermediate calculations, Enter your answer as a percent rounded to 3 decimal places. Assume annusi compounding. b. What is the maturity of B ? Notei Do not round intermediate calculations. Round your answer to 2 decimal piaces. Assume annual compounding. c. What is the price of C ? Note: Do not round intermediate calculations. Pound your answer to 2 decimal places. Assume annual compounding: Sure Tea Company has issued 7,4% antual coupon bonds that are now seling af a yeld to maturify of 9.20% if the bond price is 5815 53, whot is the remeining maturity of these bonds? Note: Do not round intermedsate calculations. Aound yout answer to the nearest whole number. You buy a 20-yeor bond with a coupon rete of 8.6% that nas a yiefd to meturity of 9.6%, (Assurre a foce value of $1,000 and semianausl coupon payments) Six monting later, the yiald to maturity is 10.6%. What is your teturn over the 6 miontha? Note: Do not round intermedlate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign. 3. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts