Question: The formula for a down-and-out call option VDO (S, t) is given by 1-2r/o VDO (S, t) = C (S, t) - S Sa C

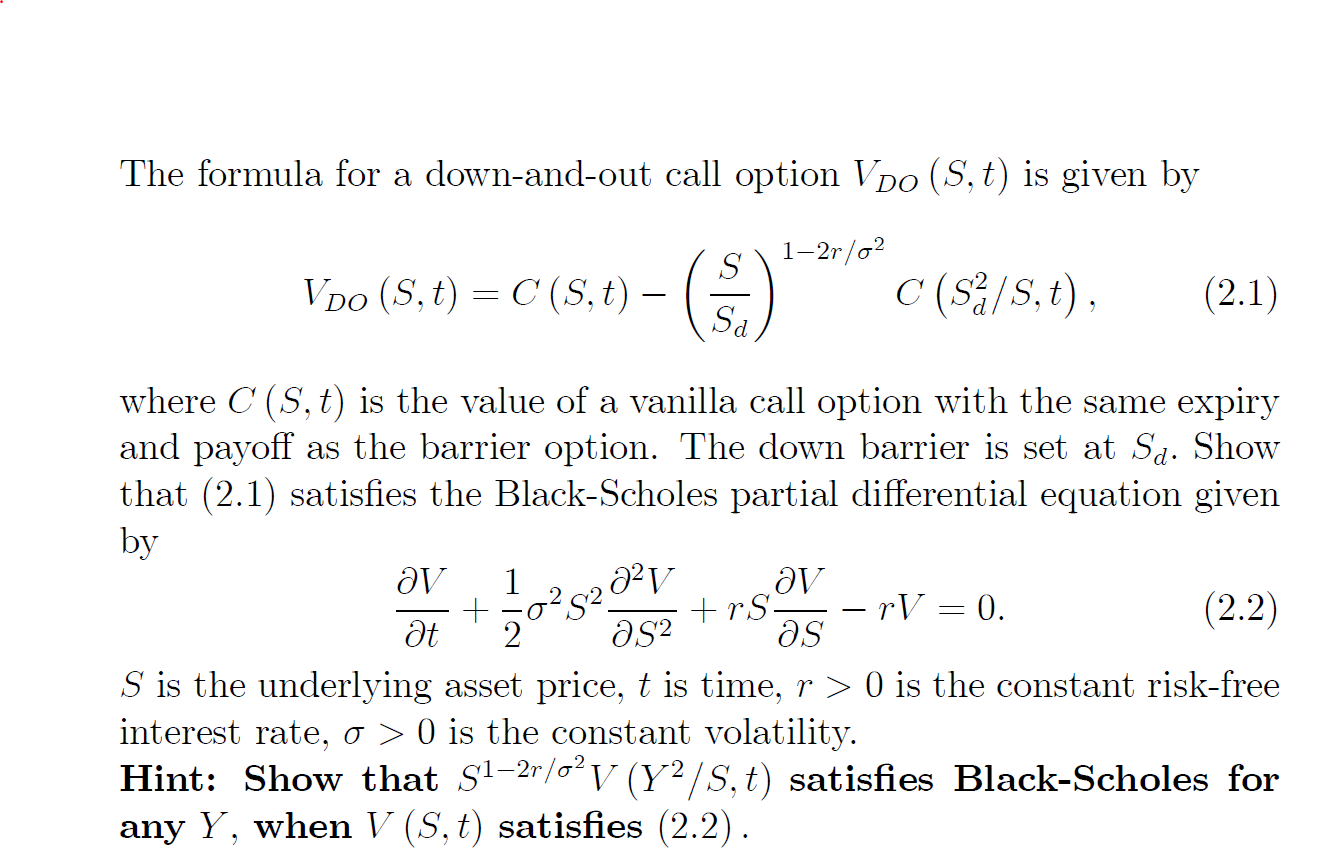

The formula for a down-and-out call option VDO (S, t) is given by 1-2r/o VDO (S, t) = C (S, t) - S Sa C (S/S, t), (2.1) where C (S, t) is the value of a vanilla call option with the same expiry and payoff as the barrier option. The down barrier is set at Sa. Show that (2.1) satisfies the Black-Scholes partial differential equation given by 1 2 + t 2 0 80 52 PV +rS= rV = 0. as (2.2) S2 S is the underlying asset price, t is time, r > 0 is the constant risk-free interest rate, o > 0 is the constant volatility. Hint: Show that S-r/0 V (Y/S, t) satisfies Black-Scholes for any Y, when V (S, t) satisfies (2.2). The formula for a down-and-out call option VDO (S, t) is given by 1-2r/o VDO (S, t) = C (S, t) - S Sa C (S/S, t), (2.1) where C (S, t) is the value of a vanilla call option with the same expiry and payoff as the barrier option. The down barrier is set at Sa. Show that (2.1) satisfies the Black-Scholes partial differential equation given by 1 2 + t 2 0 80 52 PV +rS= rV = 0. as (2.2) S2 S is the underlying asset price, t is time, r > 0 is the constant risk-free interest rate, o > 0 is the constant volatility. Hint: Show that S-r/0 V (Y/S, t) satisfies Black-Scholes for any Y, when V (S, t) satisfies (2.2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts