Question: The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future

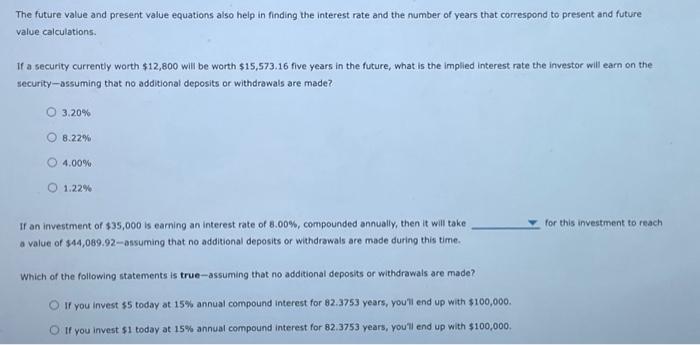

The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $12,800 will be worth $15,573.16 five years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 3.20% 8.22% 4.00% 1.22% If an investment of $35,000 is earning an interest rate of 8.00%, compounded annually, then it will take for this investment to reach a value of $44,089.92-assuming that no additional deposits or whitrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? If you invest $5 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000. If you invest $1 today at 15% annual compound interest for 82.3753 years, youll end up with $100,000. The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $12,800 will be worth $15,573.16 five years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 3.20% 8.22% 4.00% 1.22% If an investment of $35,000 is earning an interest rate of 8.00%, compounded annually, then it will take for this investment to reach a value of $44,089.92-assuming that no additional deposits or whitrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? If you invest $5 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000. If you invest $1 today at 15% annual compound interest for 82.3753 years, youll end up with $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts