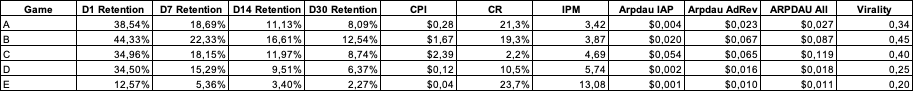

Question: The game and source data is attached as an image. a ) a . 1 - Calculate the profitability ratio of games A , B

The game and source data is attached as an image.

a

a Calculate the profitability ratio of games A B C D E in days LTV according to the attached data.

a Considering that a fixed budget is spent every day, how many days are the daily and total breakeven points of the C game?

a Based on the data given, what kind of comments can be made for games A B C D E

b

Evaluate Source performances based on data:

b How would you change CPI targets and budgets by examining sources according to their profitability?

b Which sources would you blacklist and why?

b Can you evaluate the total profitability of Platform A

Explanations :

Networks: Partners that deliver our Ads.

ROAS: Return on Ad Spend of Revenue to Spend

D ROAS: Return on Ad Spend of a specific group on the day they installed the app.

DX ROAS: Cumulative Return on Ad Spend of a specific group on X days after install. ex: We spend dollars on D users download the app on D on day we earned dollars from them, D ROAS of that group is

CPI: Cost Per Install Total Spend#Installs

IPM: Install Per Mille Impression #Install#Impressionx

CR: Conversion Rate #Installs#Clicks

CTR: Click Through Rate #Click#Impression

Explanations :

DayX Retention: From a specific group of people who downloaded the app, the of users who opened the app on the Xth day after they download the app. ex: people downloaded the app today, have opened the app. D Retention is ; on D have opened the app, D Retention is

ARPDAU: Average Revenue Per Daily Active User Total Daily Revenue#Daily Active Users

AdRev: Ad Revenue Revenue generated from Ads shown in the game

IAP: In App Purchase

Rating: App Store or Play Store Rating

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock