Question: THE GAP, INC. CONSOLIDATED BALANCE SHEETS table [ [ table [ [ ( $ and shares in millions except par value ) ]

THE GAP, INC.

CONSOLIDATED BALANCE SHEETS

tabletable $ and shares in millions except par valueASSETStableJanuary tableJanuary Current assets:Cash and cash equivalents,$$Merchandise inventory,,Other current assets,,Total current assets,,Property and equipment, net of accumulated depreciation,,Operating lease assets,,Other longterm assets,,Total assets,$$LIABILITIES AND STOCKHOLDERS' EQUITYCurrent liabilities:Accounts payable,$$Accrued expenses and other current liabilities,,Current portion of operating lease liabilities,,Income taxes payable,,Total current liabilities,,Longterm liabilities:Revolving credit facility,,Longterm debt,,Longterm operating lease liabilities,,Other longterm liabilities,,Total longterm liabilities,,

Commitments and contingencies see Note

Stockholders' equity:

Common stock $ par value

Authorized shares for all periods presented; Issued and Outstanding and shares

Additional paidin capital

Retained earnings

Accumulated other comprehensive income

Total stockholders' equity

Total liabilities and stockholders' equity

table$

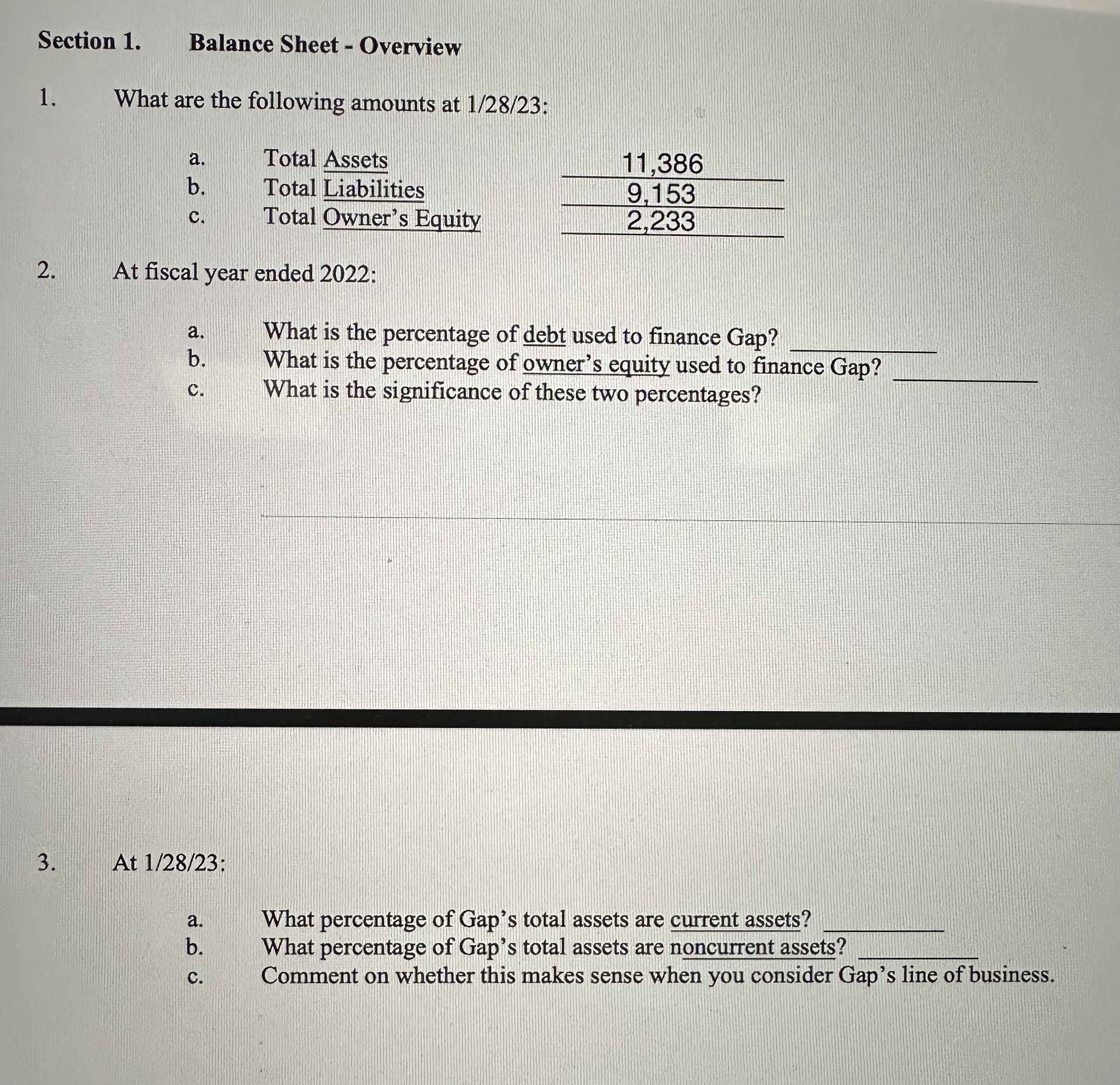

Section

Balance Sheet Overview

What are the following amounts at :

a Total Assets

b Total Liabilities

c Total Owner's Equity

At fiscal year ended :

a What is the percentage of debt used to finance Gap?

b What is the percentage of owner's equity used to finance Gap?

c What is the significance of these two percentages?

At :

a What percentage of Gap's total assets are current assets?

b What percentage of Gap's total assets are noncurrent assets?

c Comment on whether this makes sense when you consider Gap's line of business.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock