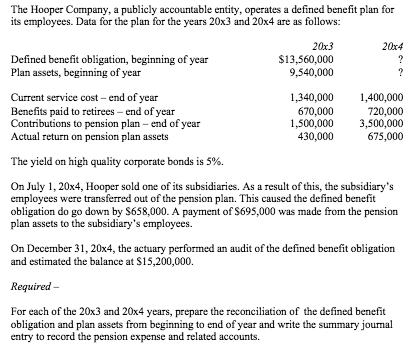

Question: The Hooper Company , & publicly accountable Entity , operates a defined benefit plan for it's Employees . Late for the plan for the Year

"The Hooper Company , & publicly accountable Entity , operates a defined benefit plan for it's Employees . Late for the plan for the Year Long and {``x'4 {It Is follow's` Defined benefit obligation , beginning of' year Plan assets , beginning of YCUT Current service cost - end of your 1. 140. 01001 1. 4010, 0 0^ Benefits paid to retirees - End of Year Contributions to pension plan - end of year Actual return on pension plan assets 430.010 0 $75,000 The wield on high quality corporate bonds in 5%/`. On July 1, 201x4, Hooper sold any of its subsidiaries . As a result of this , the subsidiary " s Employ'cos were transferred out of" the pension plan . This caused the defined benefit obligation do go down by BASE. and A payment of Says, and was made from the pension plan assets to the subsidiary,'s Employees . On December $ 1. 24x'4, the actuary performed an audit of the defined benefit obligation and Estimated the balance at $15, 200, 090. Required - For each of the 2{} and {`` 4 Years , prepare the reconciliation of the defined benefit obligation and plan assets from beginning to end of year and write the summary" journal ! Entry to record the pension expense and related accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts