Question: The hurdle rate is 15% 3. Using the information given in Exhibit A, compute Longwood's WACC. Assume Longwood has no preferred stock. Should the company

The hurdle rate is 15%

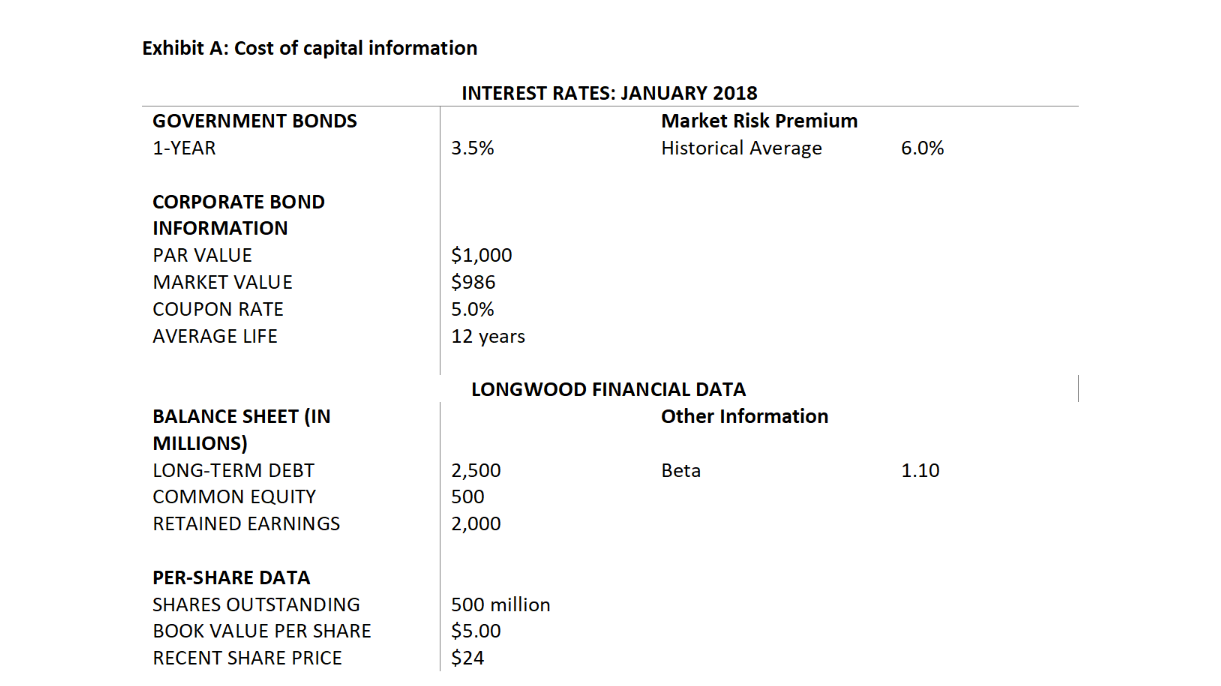

3. Using the information given in Exhibit A, compute Longwood's WACC. Assume Longwood has no preferred stock. Should the company continue to use it's historic hurdle rate, yes or no? Support your answer. COMMON EQUITY COST DEBT COST Exhibit A: Cost of capital information GOVERNMENT BONDS 1-YEAR INTEREST RATES: JANUARY 2018 Market Risk Premium 3.5% Historical Average 6.0% CORPORATE BOND INFORMATION PAR VALUE MARKET VALUE COUPON RATE AVERAGE LIFE $1,000 $986 5.0% 12 years LONGWOOD FINANCIAL DATA Other Information BALANCE SHEET (IN MILLIONS) LONG-TERM DEBT COMMON EQUITY RETAINED EARNINGS Beta 1.10 2,500 500 2,000 PER-SHARE DATA SHARES OUTSTANDING BOOK VALUE PER SHARE RECENT SHARE PRICE 500 million $5.00 $24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts