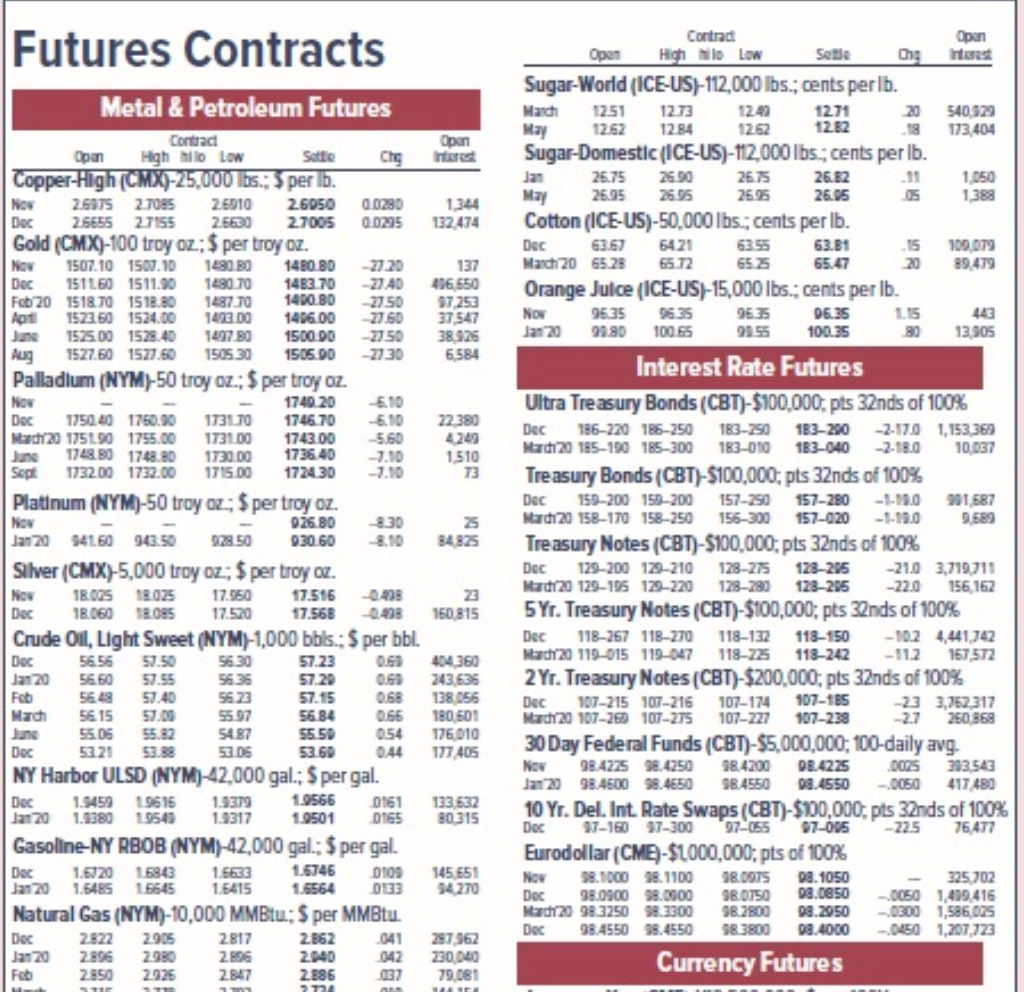

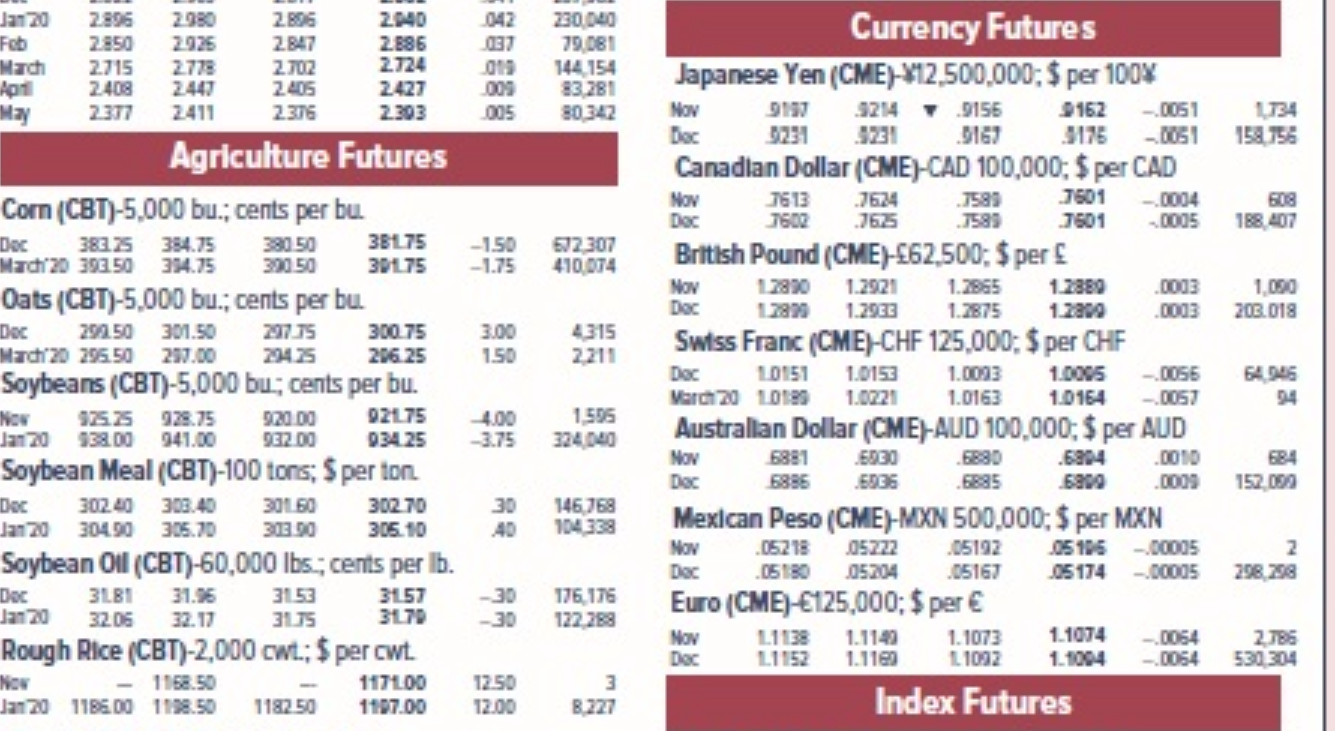

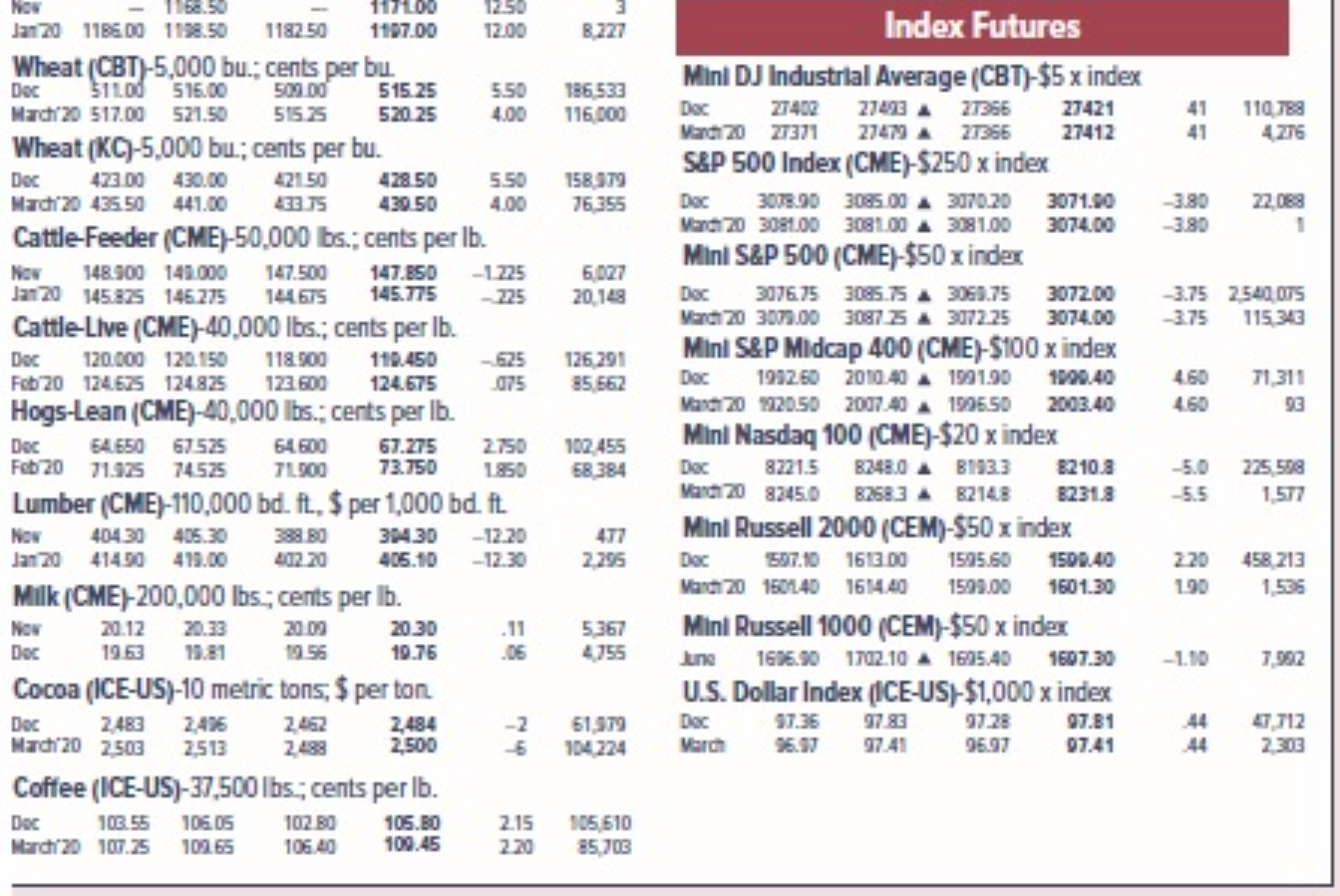

Question: The image file for the data is super small, so please try to zoom in because I can't expand it anymore . Coffee (ICE-US)-37,500 lbs.;

The image file for the data is super small, so please try to zoom in because I can't expand it anymore

The image file for the data is super small, so please try to zoom in because I can't expand it anymore

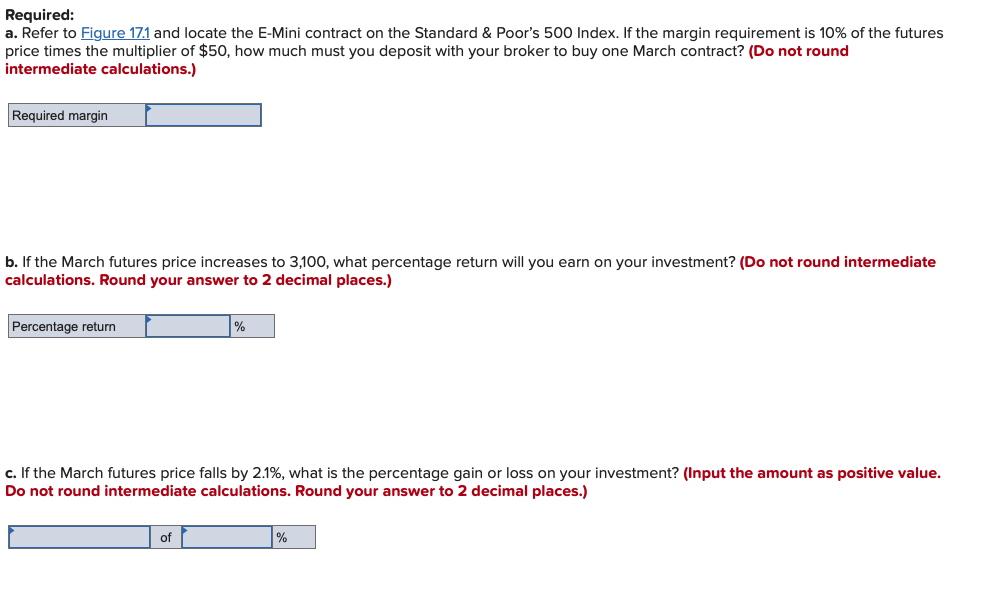

. Coffee (ICE-US)-37,500 lbs.; cents per lb. DocMerci20103.55100.25105.05102.65102.80106.40105.60100.452.152.20105,61085,703 Required: a. Refer to Figure 17.1 and locate the E-Mini contract on the Standard \& Poor's 500 Index. If the margin requirement is 10% of the futures price times the multiplier of $50, how much must you deposit with your broker to buy one March contract? (Do not round intermediate calculations.) b. If the March futures price increases to 3,100, what percentage return will you earn on your investment? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. If the March futures price falls by 2.1%, what is the percentage gain or loss on your investment? (Input the amount as positive value. Do not round intermediate calculations. Round your answer to 2 decimal places.) . Coffee (ICE-US)-37,500 lbs.; cents per lb. DocMerci20103.55100.25105.05102.65102.80106.40105.60100.452.152.20105,61085,703 Required: a. Refer to Figure 17.1 and locate the E-Mini contract on the Standard \& Poor's 500 Index. If the margin requirement is 10% of the futures price times the multiplier of $50, how much must you deposit with your broker to buy one March contract? (Do not round intermediate calculations.) b. If the March futures price increases to 3,100, what percentage return will you earn on your investment? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. If the March futures price falls by 2.1%, what is the percentage gain or loss on your investment? (Input the amount as positive value. Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts