Question: The income statement and comparative balance sheets for Steele Inc. are shown below. The statement of retained earnings (not shown) indicates that Steele paid $147,000

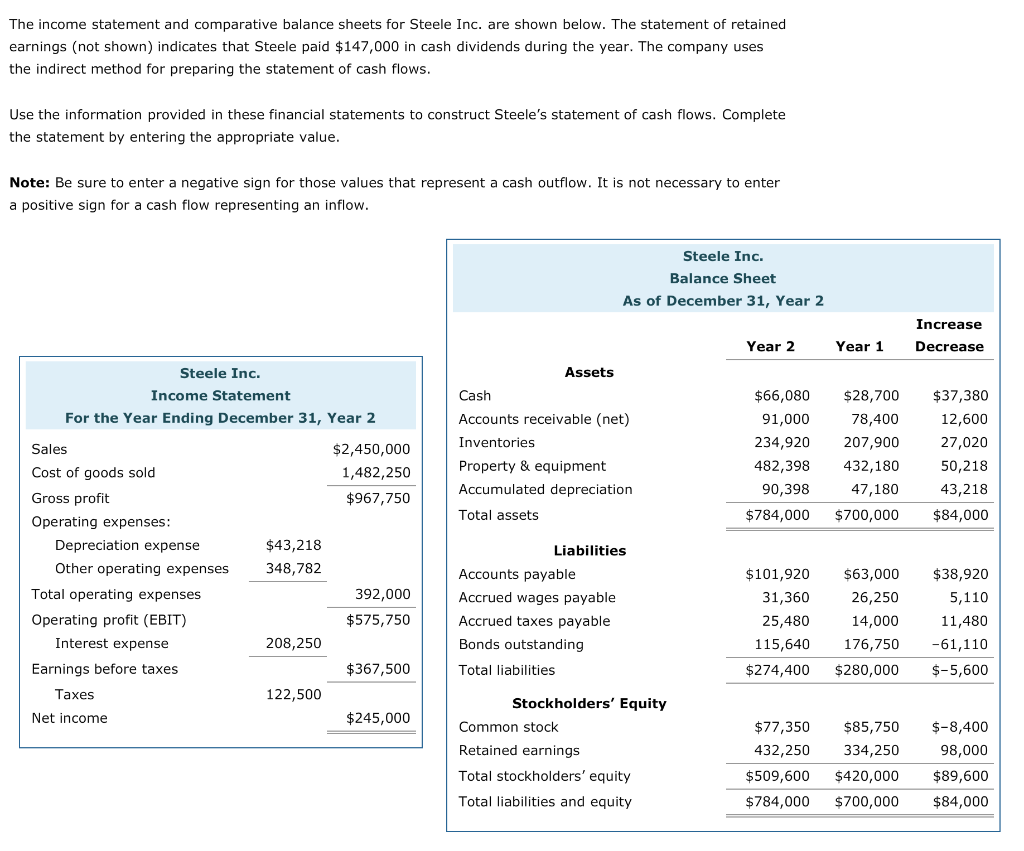

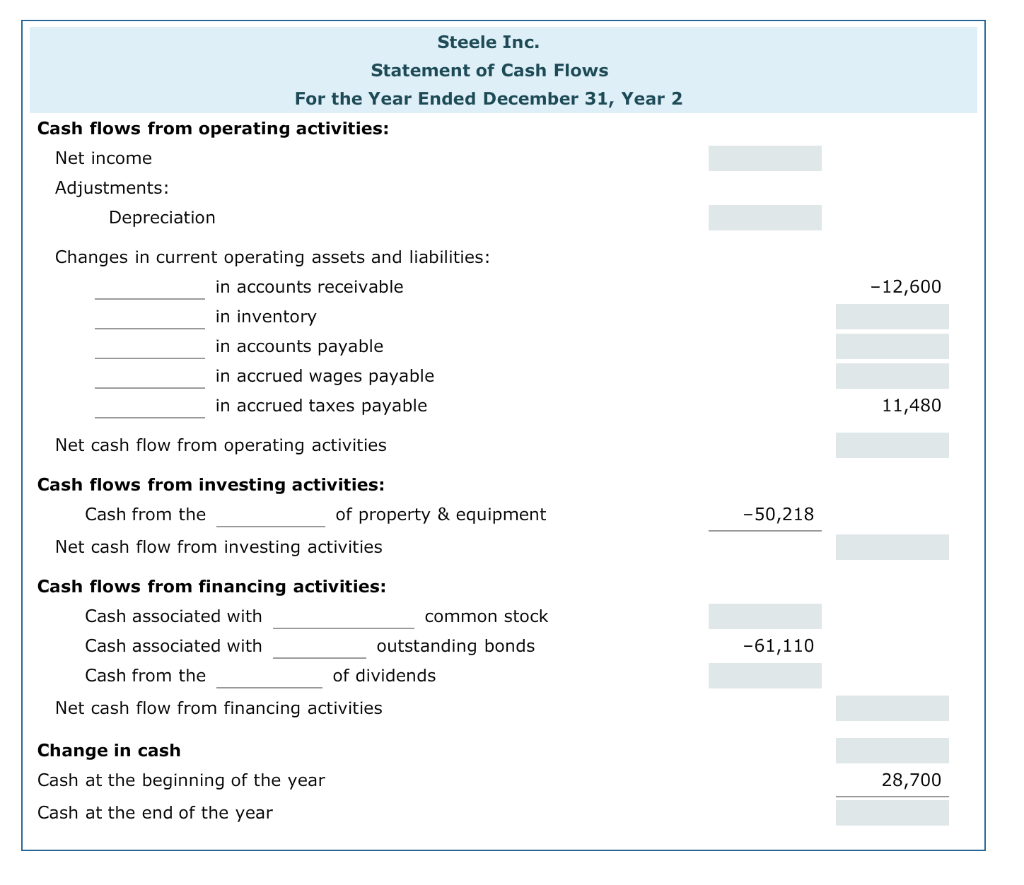

The income statement and comparative balance sheets for Steele Inc. are shown below. The statement of retained earnings (not shown) indicates that Steele paid $147,000 in cash dividends during the year. The company uses the indirect method for preparing the statement of cash flows. Use the information provided in these financial statements to construct Steele's statement of cash flows. Complete the statement by entering the appropriate value. Note: Be sure to enter a negative sign for those values that represent a cash outflow. It is not necessary to enter a positive sign for a cash flow representing an inflow. Steele Inc. Balance Sheet As of December 31, Year 2 Increase Decrease Year 2 Year 1 Assets Steele Inc. Income Statement For the Year Ending December 31, Year 2 Cash $2,450,000 1,482,250 $967,750 Accounts receivable (net) Inventories Property & equipment Accumulated depreciation Total assets $66,080 91,000 234,920 482,398 90,398 $784,000 $28,700 78,400 207,900 432,180 47,180 $700,000 $37,380 12,600 27,020 50,218 43,218 $84,000 Liabilities Sales Cost of goods sold Gross profit Operating expenses: Depreciation expense Other operating expenses Total operating expenses Operating profit (EBIT) Interest expense Earnings before taxes Taxes $43,218 348,782 392,000 $575,750 Accounts payable Accrued wages payable Accrued taxes payable Bonds outstanding Total liabilities $101,920 31,360 25,480 115,640 $274,400 $63,000 26,250 14,000 176,750 $280,000 $38,920 5,110 11,480 -61,110 $-5,600 208,250 $367,500 122,500 Net income $245,000 Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and equity $77,350 432,250 $85,750 334,250 $420,000 $700,000 $-8,400 98,000 $89,600 $84,000 $509,600 $784,000 Steele Inc. Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Net income Adjustments: Depreciation -12,600 Changes in current operating assets and liabilities: in accounts receivable in inventory in accounts payable in accrued wages payable in accrued taxes payable 11,480 Net cash flow from operating activities Cash flows from investing activities: Cash from the of property & equipment Net cash flow from investing activities -50,218 Cash flows from financing activities: Cash associated with common stock Cash associated with outstanding bonds Cash from the of dividends Net cash flow from financing activities -61,110 Change in cash Cash at the beginning of the year Cash at the end of the year 28,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts