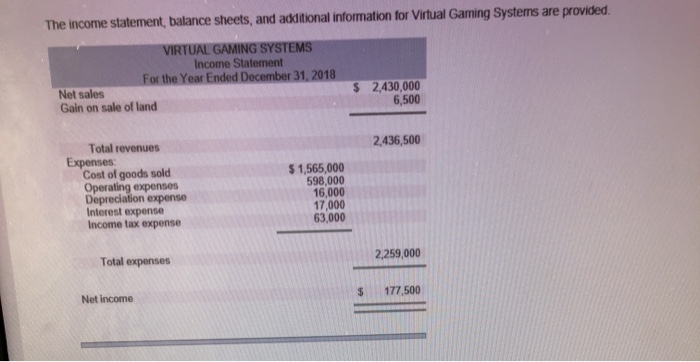

Question: The income statement, balance sheets, and additional information for Virtual Gaming Systems are provided VIRTUAL GAMING SYSTEMS Income Statement For the Year Ended December 31,

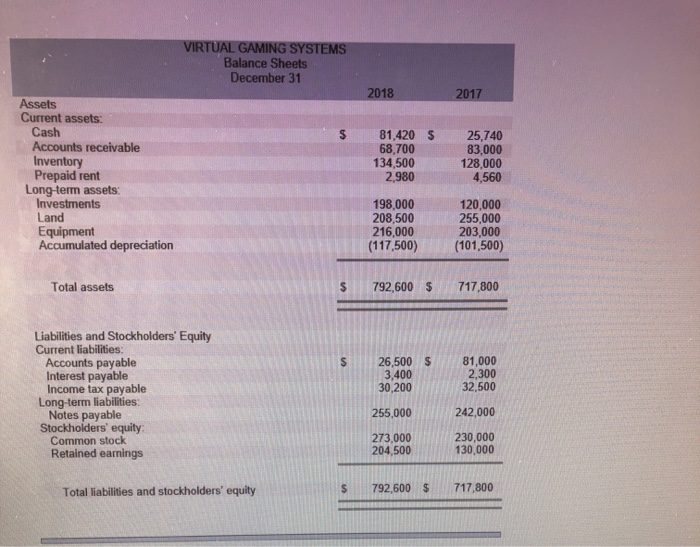

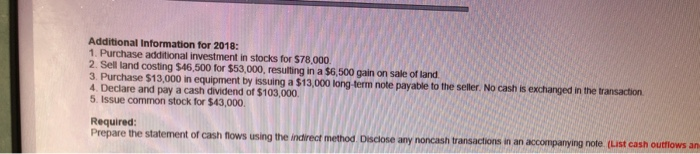

The income statement, balance sheets, and additional information for Virtual Gaming Systems are provided VIRTUAL GAMING SYSTEMS Income Statement For the Year Ended December 31, 2018 $ 2,430,000 6,500 Net sales Gain on sale of land 2,436,500 Total revenues Expenses Cost of goods sold Operating expenses Depreciation expense Interest expense Income tax expense $1,565,000 598,000 16,000 17,000 63,000 2,259,000 Total expenses $ 177,500 Net income VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2018 2017 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land 81,420 S 68,700 134,500 2,980 25,740 83,000 128,000 4,560 198.000 208,500 216,000 (117,500) 120,000 255,000 203,000 (101.500) Equipment Accumulated depreciation Total assets 792,600 $ 717,800 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders' equity: Common stock Retained earnings 26,500 S 3,400 30,200 81,000 2,300 32,500 242,000 255,000 230,000 130,000 273,000 204,500 717,800 792,600 $ Total liabilities and stockholders' equity Additional Information for 2018: 1. Purchase additional investment in stocks for $78,000. 2. Sell land costing $46,500 for $53,000, resulting in a $6,500 gain on sale of land 3. Purchase $13,000 in equipment by issuing a $13,000 long-term note payable to the seller. No cash is exchanged in the transaction 4. Declare and pay a cash dividend of $103,000. 5. Issue common stock for $43,000. Required: Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note. (List cash outflows an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts