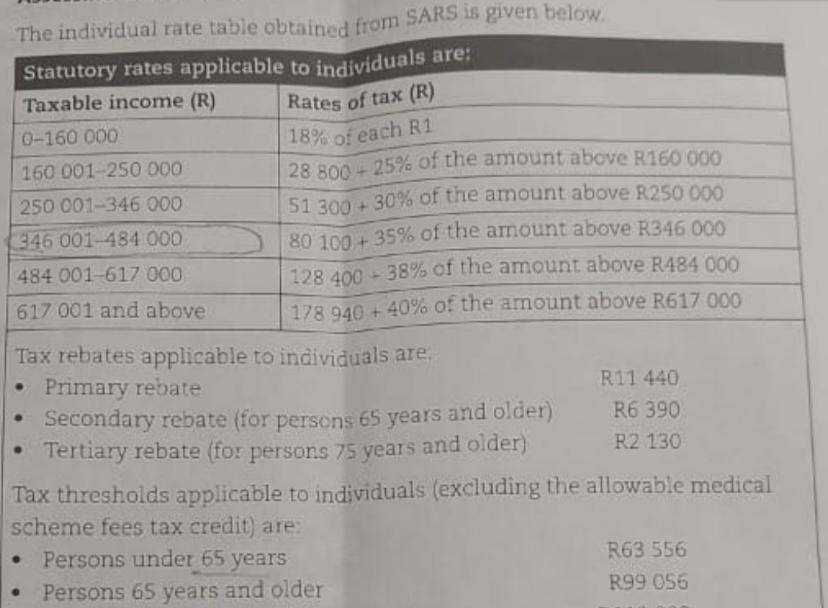

Question: The individual rate table obtained from SARS is given below. Statutory rates applicable to individuals are: Taxable income (R) Rates of tax (R) 0-160

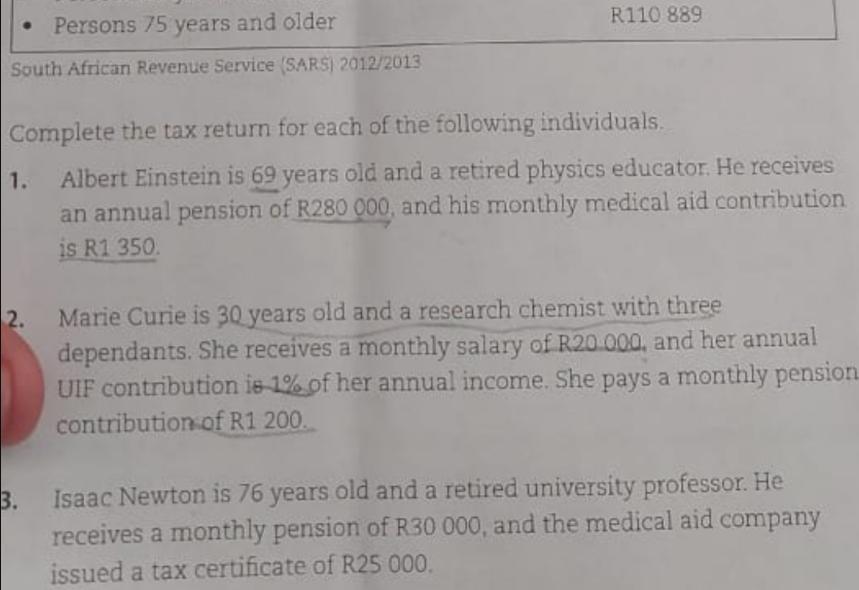

The individual rate table obtained from SARS is given below. Statutory rates applicable to individuals are: Taxable income (R) Rates of tax (R) 0-160 000 18% of each R1 160 001-250 000 250 001-346 000 346 001-484 000 484 001-617 000 617 001 and above 28 800+ 25% of the amount above R160 000 51 300 +30% of the amount above R250 000 80 100+ 35% of the amount above R346 000 128 400-38% of the amount above R484 000 178 940 + 40% of the amount above R617 000 Tax rebates applicable to individuals are: Primary rebate Secondary rebate (for persons 65 years and older) Tertiary rebate (for persons 75 years and older) R11 440 R6 390 R2 130 Tax thresholds applicable to individuals (excluding the allowable medical scheme fees tax credit) are: Persons under 65 years Persons 65 years and older R63 556 R99 056 Persons 75 years and older South African Revenue Service (SARS) 2012/2013 Complete the tax return for each of the following individuals. Albert Einstein is 69 years old and a retired physics educator. He receives an annual pension of R280 000, and his monthly medical aid contribution is R1 350. 1. 2. R110 889 3. Marie Curie is 30 years old and a research chemist with three dependants. She receives a monthly salary of R20 000, and her annual UIF contribution is 1% of her annual income. She pays a monthly pension contribution of R1 200. Isaac Newton is 76 years old and a retired university professor. He receives a monthly pension of R30 000, and the medical aid company issued a tax certificate of R25 000. . Pierre de Fermat is a 40 year old mathematician with two dependants. The following information was provided to a tax expert: Monthly salary: R30 000,00 Monthly medical aid contribution: R2500,00 Annual pension fund contribution: R40 000,00 Annual bonus: R50 000,00 Ilse the individual rate table to calculate the annual tax due.

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

To calculate the annual tax due for each individual use the provided individual rate table and the information given for each person Calculate the tax ... View full answer

Get step-by-step solutions from verified subject matter experts