Question: The industry average assumption is being made based solely on the information presented in the problem. The information is not factual nor verifiable by actual

The industry average assumption is being made based solely on the information presented in the problem. The information is not factual nor verifiable by actual sources.

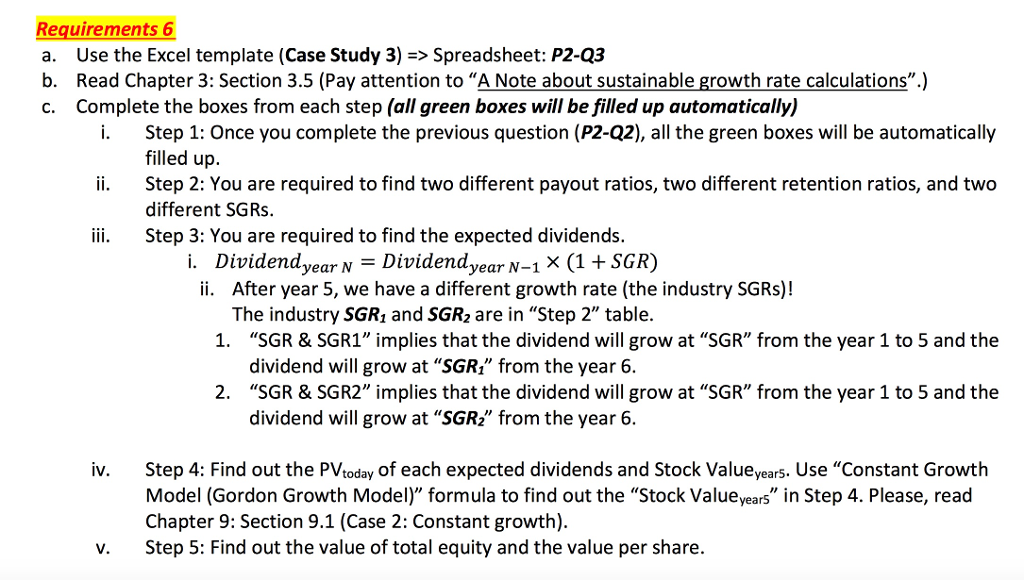

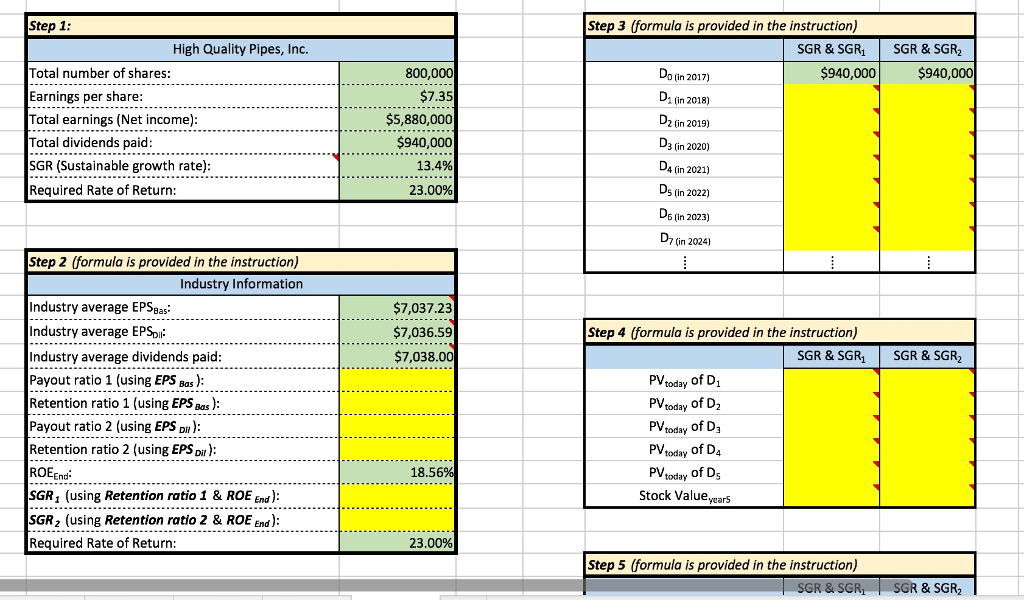

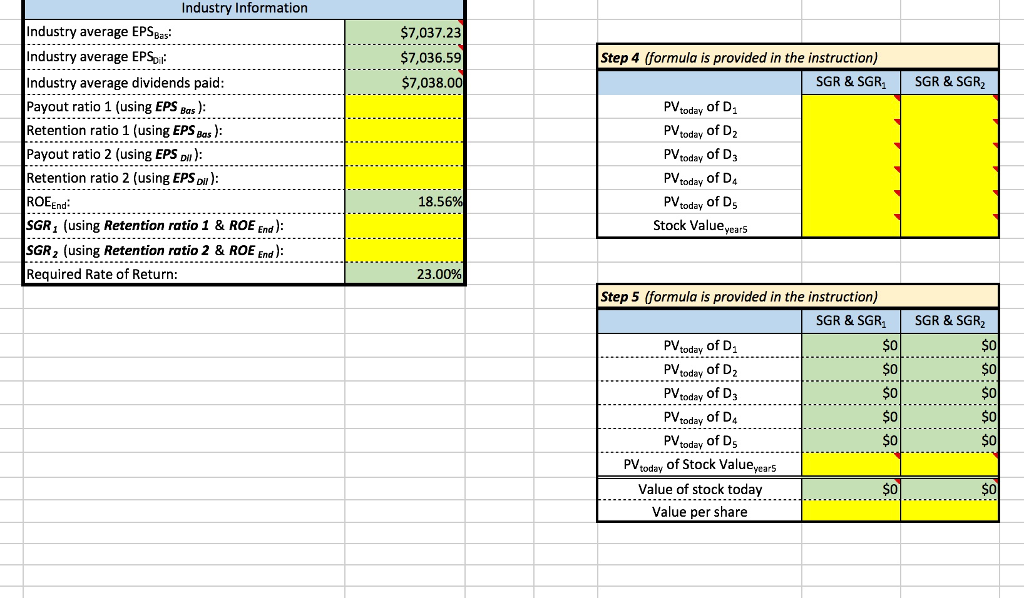

Requirements a. Use the Excel template (Case Study 3)> Spreadsheet: P2-Q3 b. Read Chapter 3: Section 3.5 (Pay attention to "A Note about sustainable growth rate calculations".) c. Complete the boxes from each step (all green boxes will be filled up automatically) 6 Step 1: Once you complete the previous question (P2-Q2), all the green boxes will be automatically filled up. Step 2: You are required to find two different payout ratios, two different retention ratios, and two different SGRs. Step 3: You are required to find the expected dividends. i. ii. iii. endvear N Dividendyear N-1 (1 + SGR) After year 5, we have a different growth rate (the industry SGRs)! The industry SGR1 and SGR2 are in "Step 2" table. ii. "SGR & SGR1" implies that the dividend will grow at "SGR" from the year 1 to 5 and the dividend will grow at "SGR1" from the year 6. "SGR & SGR2" implies that the dividend will grow at "SGR" from the year 1 to 5 and the dividend will grow at "SGR2" from the year 6. 1. 2. iv. Step 4: Find out the PVtoday of each expected dividends and Stock Valueyears. Use "Constant Growth Model (Gordon Growth Model)" formula to find out the "Stock Value years" in Step 4. Please, read Chapter 9: Section 9.1 (Case 2: Constant growth). Step 5: Find out the value of total equity and the value per share. v. Requirements a. Use the Excel template (Case Study 3)> Spreadsheet: P2-Q3 b. Read Chapter 3: Section 3.5 (Pay attention to "A Note about sustainable growth rate calculations".) c. Complete the boxes from each step (all green boxes will be filled up automatically) 6 Step 1: Once you complete the previous question (P2-Q2), all the green boxes will be automatically filled up. Step 2: You are required to find two different payout ratios, two different retention ratios, and two different SGRs. Step 3: You are required to find the expected dividends. i. ii. iii. endvear N Dividendyear N-1 (1 + SGR) After year 5, we have a different growth rate (the industry SGRs)! The industry SGR1 and SGR2 are in "Step 2" table. ii. "SGR & SGR1" implies that the dividend will grow at "SGR" from the year 1 to 5 and the dividend will grow at "SGR1" from the year 6. "SGR & SGR2" implies that the dividend will grow at "SGR" from the year 1 to 5 and the dividend will grow at "SGR2" from the year 6. 1. 2. iv. Step 4: Find out the PVtoday of each expected dividends and Stock Valueyears. Use "Constant Growth Model (Gordon Growth Model)" formula to find out the "Stock Value years" in Step 4. Please, read Chapter 9: Section 9.1 (Case 2: Constant growth). Step 5: Find out the value of total equity and the value per share. v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts