Question: The industry standard of reporting the yield - to - maturity ( YTM ) of bonds is as follows: Annual coupons: the YTM is an

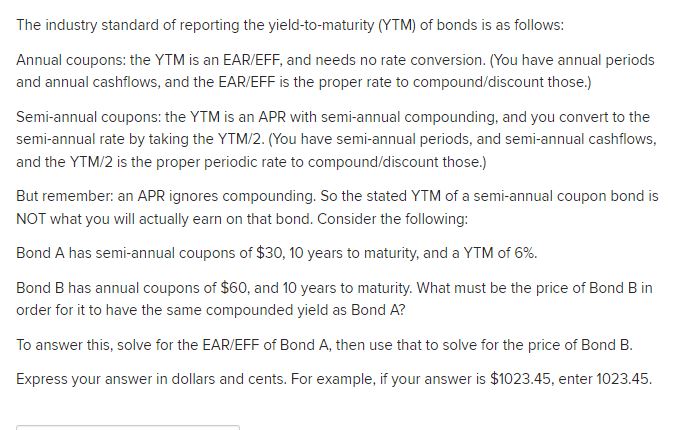

The industry standard of reporting the yieldtomaturity YTM of bonds is as follows:

Annual coupons: the YTM is an EAREFF and needs no rate conversion. You have annual periods

and annual cashflows, and the EAREFF is the proper rate to compounddiscount those.

Semiannual coupons: the YTM is an APR with semiannual compounding, and you convert to the

semiannual rate by taking the YTMYou have semiannual periods, and semiannual cashflows,

and the YTM is the proper periodic rate to compounddiscount those.

But remember: an APR ignores compounding. So the stated YTM of a semiannual coupon bond is

NOT what you will actually earn on that bond. Consider the following:

Bond A has semiannual coupons of $ years to maturity, and a YTM of

Bond has annual coupons of $ and years to maturity. What must be the price of ond in

order for it to have the same compounded yield as Bond A

To answer this, solve for the EAREFF of Bond A then use that to solve for the price of Bond B

Express your answer in dollars and cents. For example, if your answer is $ enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock