Question: the info you need to answer these questions Download Case Study A, take all provided assumptions as given to complete the financial model and answer

the info you need to answer these questions

the info you need to answer these questions

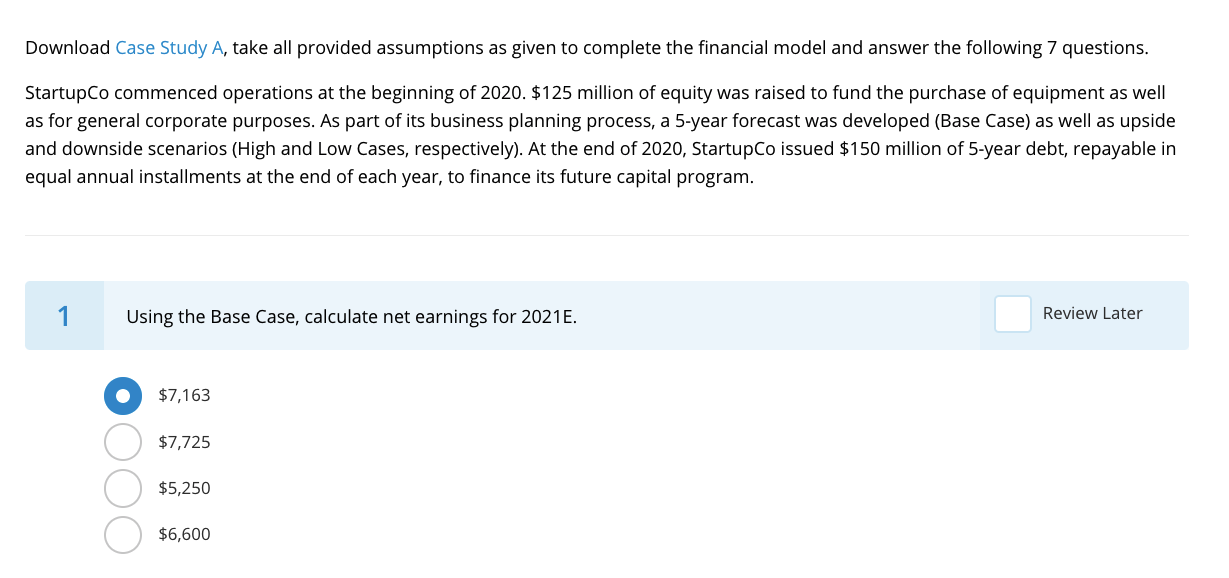

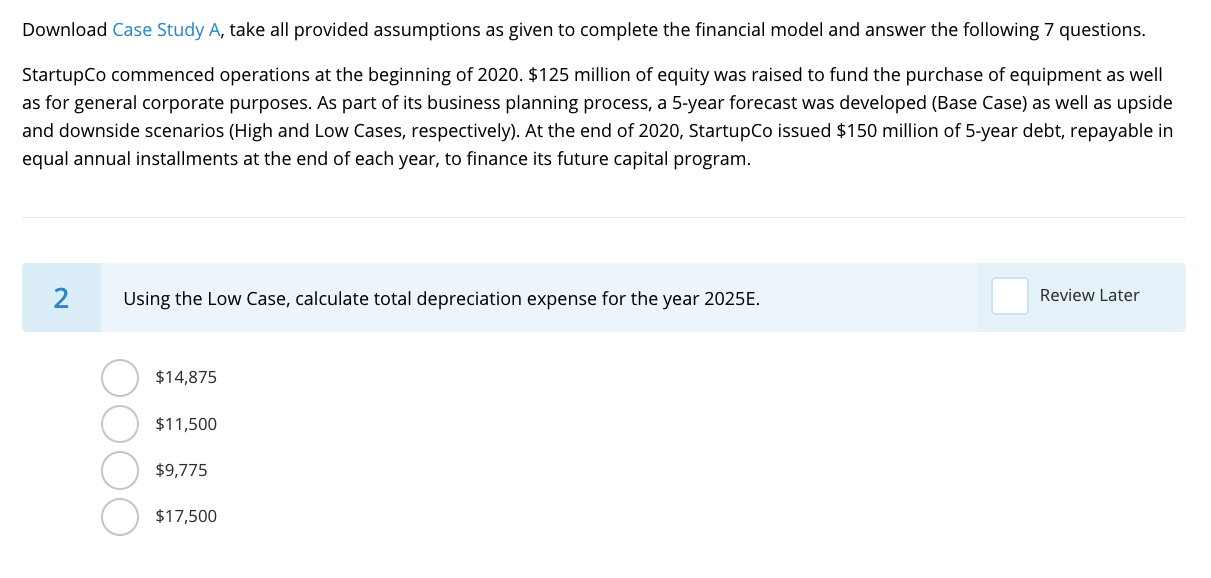

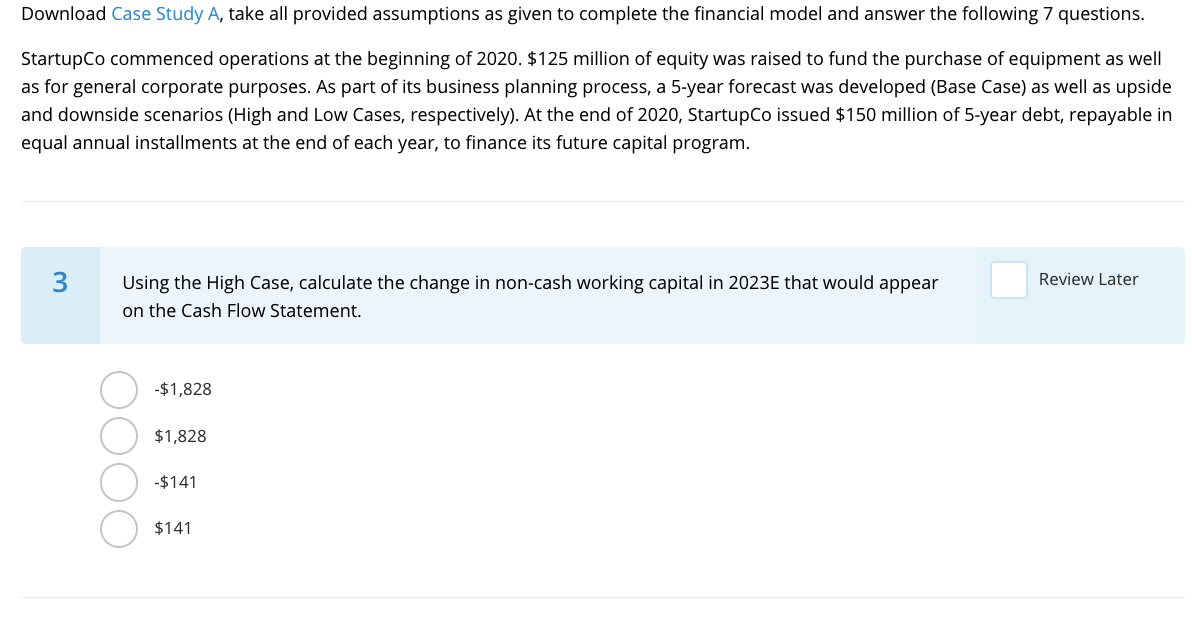

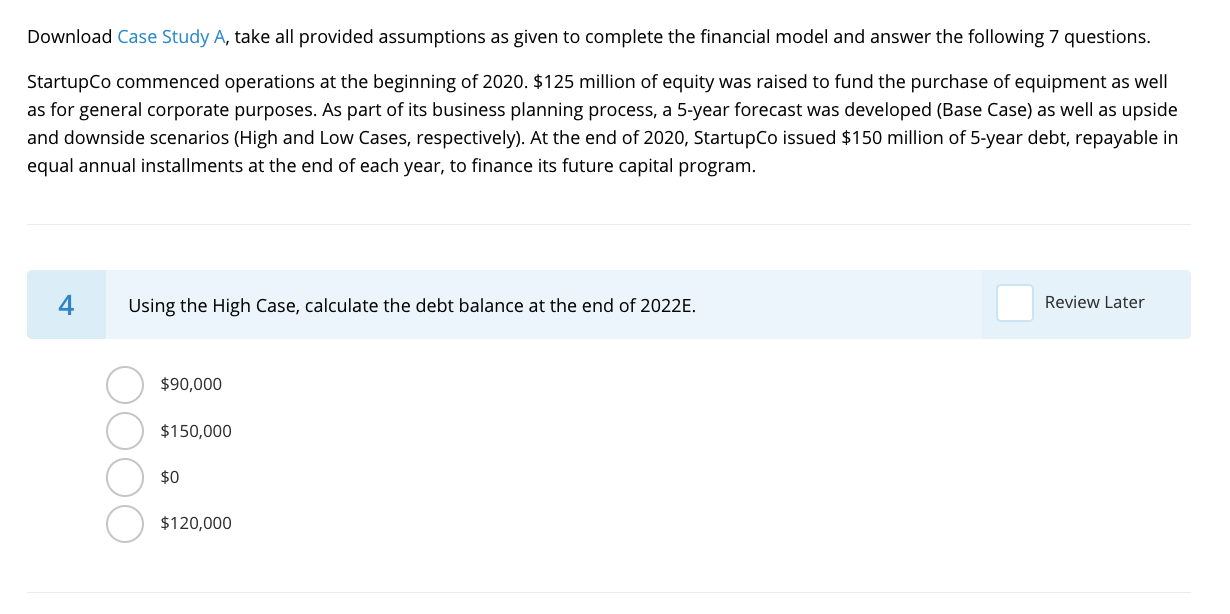

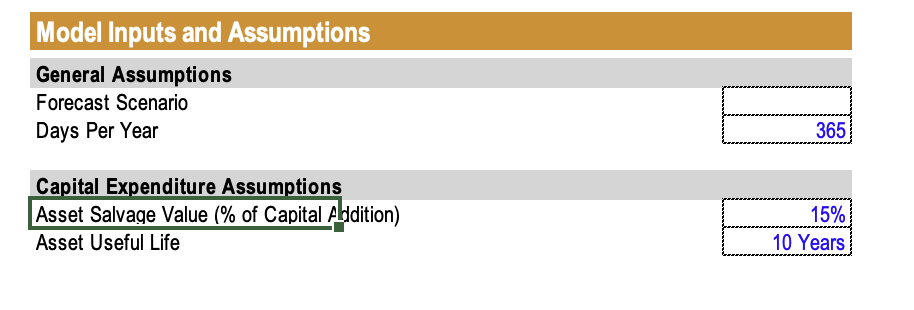

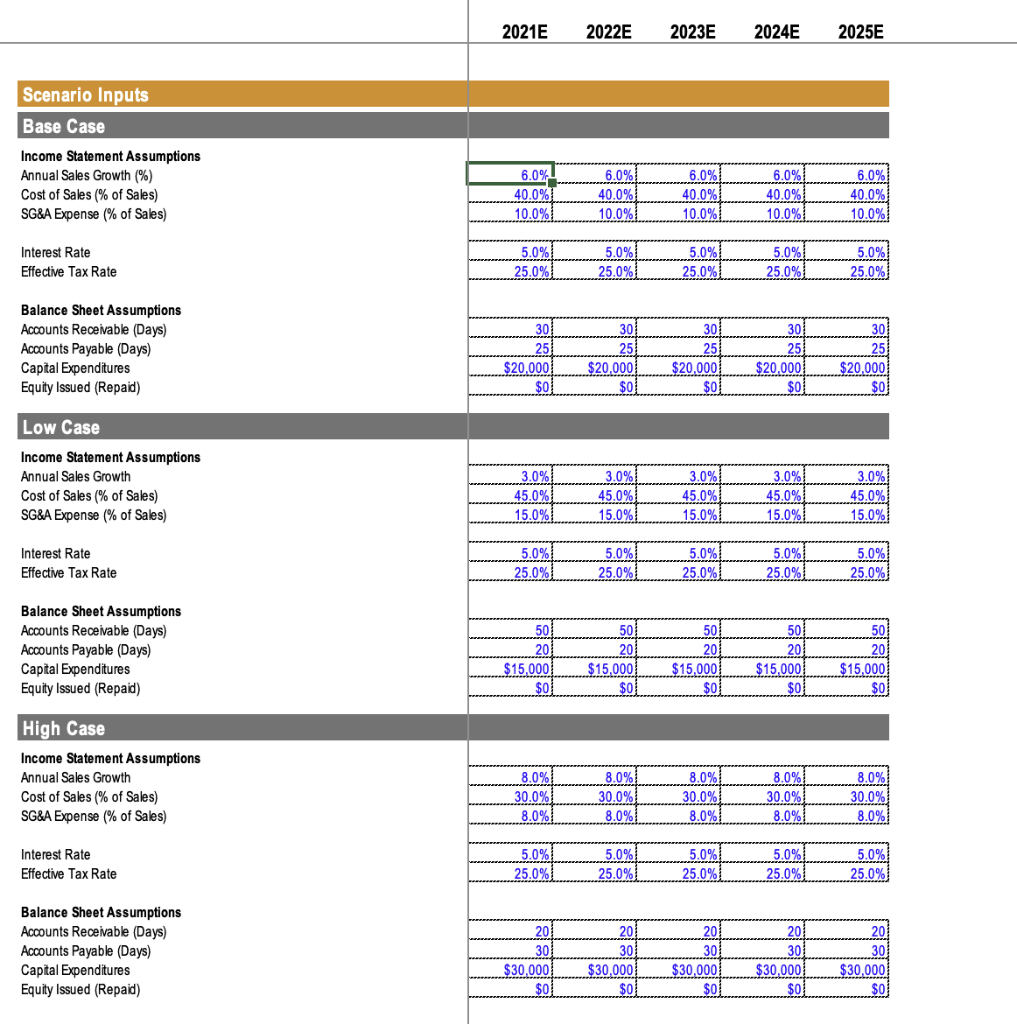

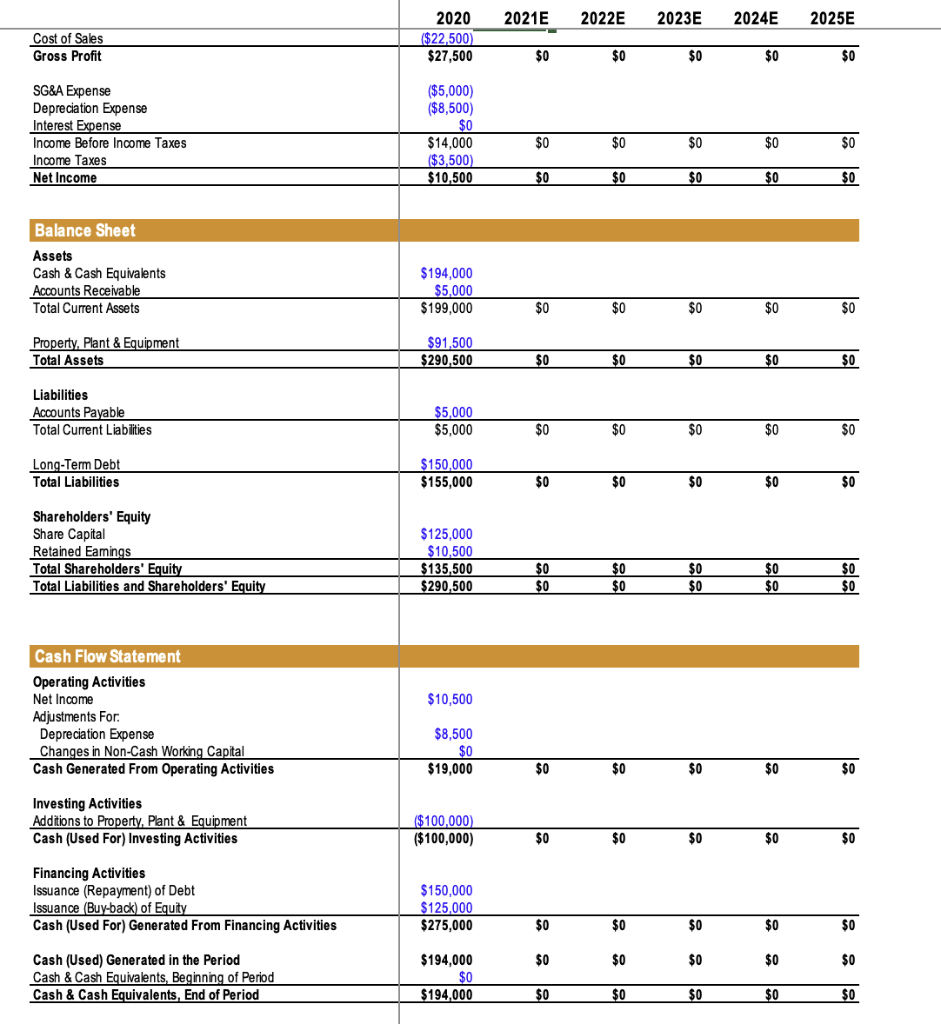

Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 1 Using the Base Case, calculate net earnings for 2021E. Review Later $7,163 $7,725 $5,250 $6,600 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 2 Using the Low Case, calculate total depreciation expense for the year 2025E. Review Later $14,875 $11,500 $9,775 $17,500 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 3 Review Later Using the High Case, calculate the change in non-cash working capital in 2023E that would appear on the Cash Flow Statement. -$1,828 $1,828 $141 $141 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 4 Using the High Case, calculate the debt balance at the end of 2022E. Review Later $90,000 $150,000 $0 $120,000 Model Inputs and Assumptions General Assumptions Forecast Scenario Days Per Year 365 Capital Expenditure Assumptions Asset Salvage Value (% of Capital Abdition) Asset Useful Life 15% 10 Years 2021E 2022E 2023E 2024E 2025E Scenario Inputs Base Case Income Statement Assumptions Annual Sales Growth (%) Cost of Sales (% of Sales) SG&A Expense (% of Sales) 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 5.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 25.0% Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 301 25 $20,000 $0 30 25 $20,000 $0 30 25 $20.000 $0 30 25 $20.000 $0 30 25 $20.000 $0 Low Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense (% of Sales) 3.0% 3.0% 3.0% 45.0% 15.0% 3.0% 45.0% 15.0% 45.0% 15.0% 45.0% 15.0% 3.0% 45.0% 15.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 50 Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 50 20 $15.000 $0 50 20 $15.000 $0 50 20 $15.000 $0 50 20 $15.000 $0 $15.000 $0 High Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense (% of Sales) 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 20 30 $30.000 $0 201 30 $30.000 $0 20 30 $30.000 $0 20 30 $30,000 $0 20 30 $30.000 $0 2021E 2022E 2023E 2024E 2025E Cost of Sales Gross Profit 2020 ($22,500) $27,500 $0 $0 $0 $0 $0 SG&A Expense Depreciation Expense Interest Expense Income Before Income Taxes Income Taxes Net Income ($5,000) ($8,500) $0 $14,000 ($3,500) $10,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Balance Sheet Assets Cash & Cash Equivalents Accounts Receivable Total Current Assets $194,000 $5,000 $199,000 $0 $0 $0 $0 $0 Property. Plant & Equipment Total Assets $91,500 $290,500 $0 $0 $0 $0 $0 Liabilities Accounts Payable Total Current Liabilities $5,000 $5,000 $0 $0 $0 $0 $0 Long-Term Debt Total Liabilities $150,000 $155,000 $0 $0 $0 $0 $0 Shareholders' Equity Share Capital Retained Eamings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $125,000 $10,500 $135,500 $290,500 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $10,500 Cash Flow Statement Operating Activities Net Income Adjustments For Depreciation Expense Changes in Non-Cash Working Capital Cash Generated From Operating Activities $8,500 $0 $19,000 $0 $0 $0 $0 $0 Investing Activities Additions to Property. Plant & Equipment Cash (Used For) Investing Activities ($100,000) ($100,000) $0 $0 $0 $0 $0 Financing Activities Issuance (Repayment) of Debt Issuance (Buy-back) of Equity Cash (Used For) Generated From Financing Activities $150,000 $125,000 $275,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Cash (Used) Generated in the Period Cash & Cash Equivalents, Beginning of Period Cash & Cash Equivalents, End of Period $194,000 $0 $194,000 $0 $0 $0 $0 $0 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 1 Using the Base Case, calculate net earnings for 2021E. Review Later $7,163 $7,725 $5,250 $6,600 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 2 Using the Low Case, calculate total depreciation expense for the year 2025E. Review Later $14,875 $11,500 $9,775 $17,500 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 3 Review Later Using the High Case, calculate the change in non-cash working capital in 2023E that would appear on the Cash Flow Statement. -$1,828 $1,828 $141 $141 Download Case Study A, take all provided assumptions as given to complete the financial model and answer the following 7 questions. StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 4 Using the High Case, calculate the debt balance at the end of 2022E. Review Later $90,000 $150,000 $0 $120,000 Model Inputs and Assumptions General Assumptions Forecast Scenario Days Per Year 365 Capital Expenditure Assumptions Asset Salvage Value (% of Capital Abdition) Asset Useful Life 15% 10 Years 2021E 2022E 2023E 2024E 2025E Scenario Inputs Base Case Income Statement Assumptions Annual Sales Growth (%) Cost of Sales (% of Sales) SG&A Expense (% of Sales) 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 5.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 25.0% Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 301 25 $20,000 $0 30 25 $20,000 $0 30 25 $20.000 $0 30 25 $20.000 $0 30 25 $20.000 $0 Low Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense (% of Sales) 3.0% 3.0% 3.0% 45.0% 15.0% 3.0% 45.0% 15.0% 45.0% 15.0% 45.0% 15.0% 3.0% 45.0% 15.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 50 Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 50 20 $15.000 $0 50 20 $15.000 $0 50 20 $15.000 $0 50 20 $15.000 $0 $15.000 $0 High Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense (% of Sales) 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 20 30 $30.000 $0 201 30 $30.000 $0 20 30 $30.000 $0 20 30 $30,000 $0 20 30 $30.000 $0 2021E 2022E 2023E 2024E 2025E Cost of Sales Gross Profit 2020 ($22,500) $27,500 $0 $0 $0 $0 $0 SG&A Expense Depreciation Expense Interest Expense Income Before Income Taxes Income Taxes Net Income ($5,000) ($8,500) $0 $14,000 ($3,500) $10,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Balance Sheet Assets Cash & Cash Equivalents Accounts Receivable Total Current Assets $194,000 $5,000 $199,000 $0 $0 $0 $0 $0 Property. Plant & Equipment Total Assets $91,500 $290,500 $0 $0 $0 $0 $0 Liabilities Accounts Payable Total Current Liabilities $5,000 $5,000 $0 $0 $0 $0 $0 Long-Term Debt Total Liabilities $150,000 $155,000 $0 $0 $0 $0 $0 Shareholders' Equity Share Capital Retained Eamings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $125,000 $10,500 $135,500 $290,500 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $10,500 Cash Flow Statement Operating Activities Net Income Adjustments For Depreciation Expense Changes in Non-Cash Working Capital Cash Generated From Operating Activities $8,500 $0 $19,000 $0 $0 $0 $0 $0 Investing Activities Additions to Property. Plant & Equipment Cash (Used For) Investing Activities ($100,000) ($100,000) $0 $0 $0 $0 $0 Financing Activities Issuance (Repayment) of Debt Issuance (Buy-back) of Equity Cash (Used For) Generated From Financing Activities $150,000 $125,000 $275,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Cash (Used) Generated in the Period Cash & Cash Equivalents, Beginning of Period Cash & Cash Equivalents, End of Period $194,000 $0 $194,000 $0 $0 $0 $0 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts