Question: The information given below relates to the forthcoming period for AWD manufacturer's operation. There are four cost centres of which two are involved in

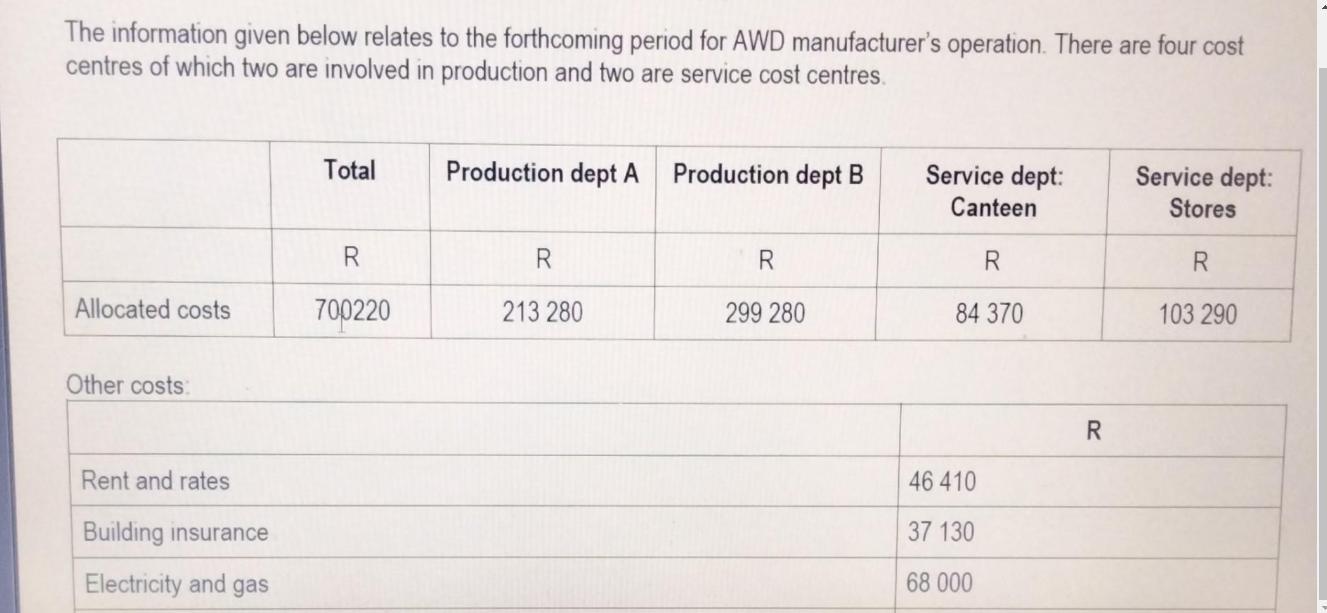

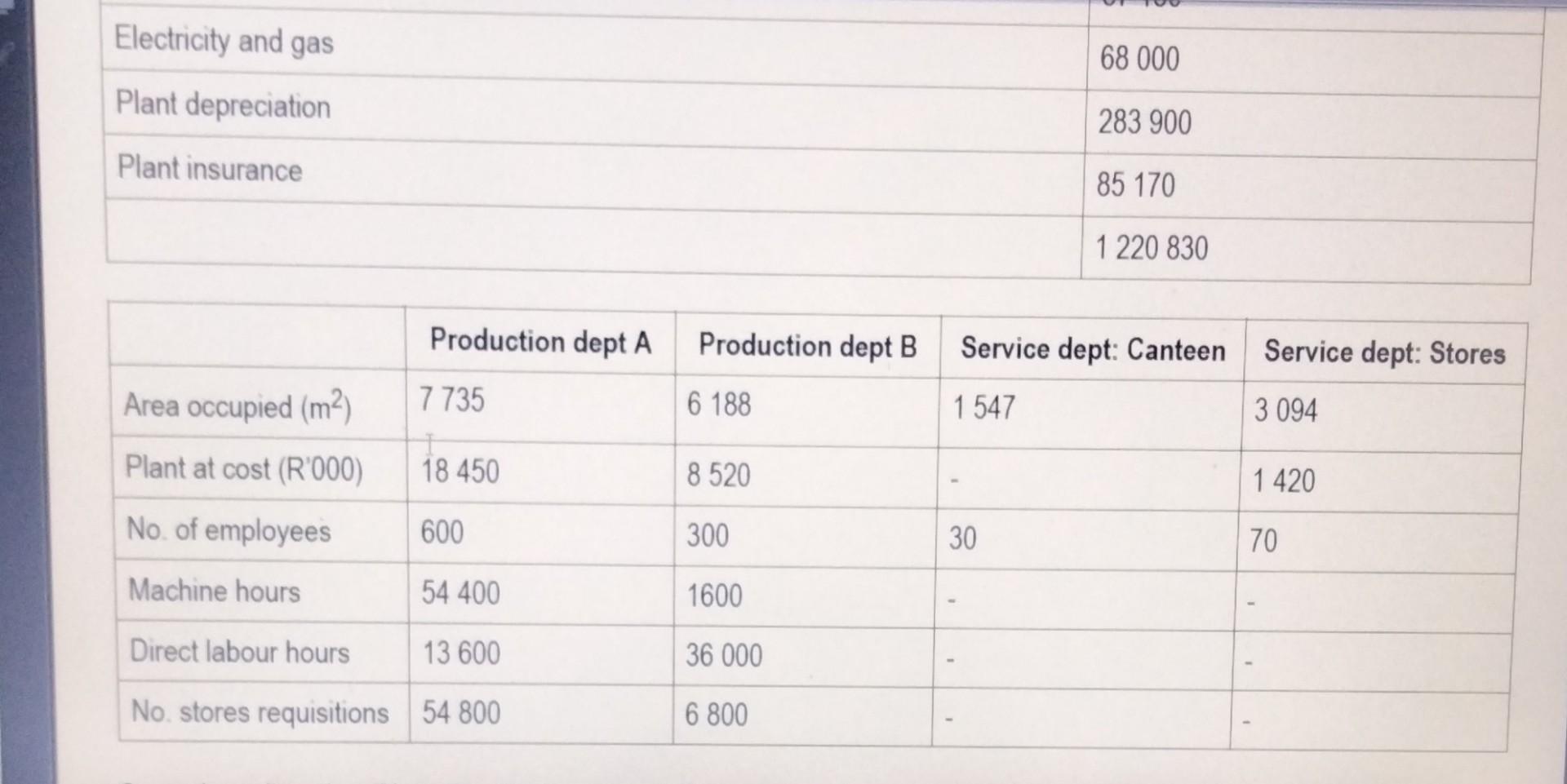

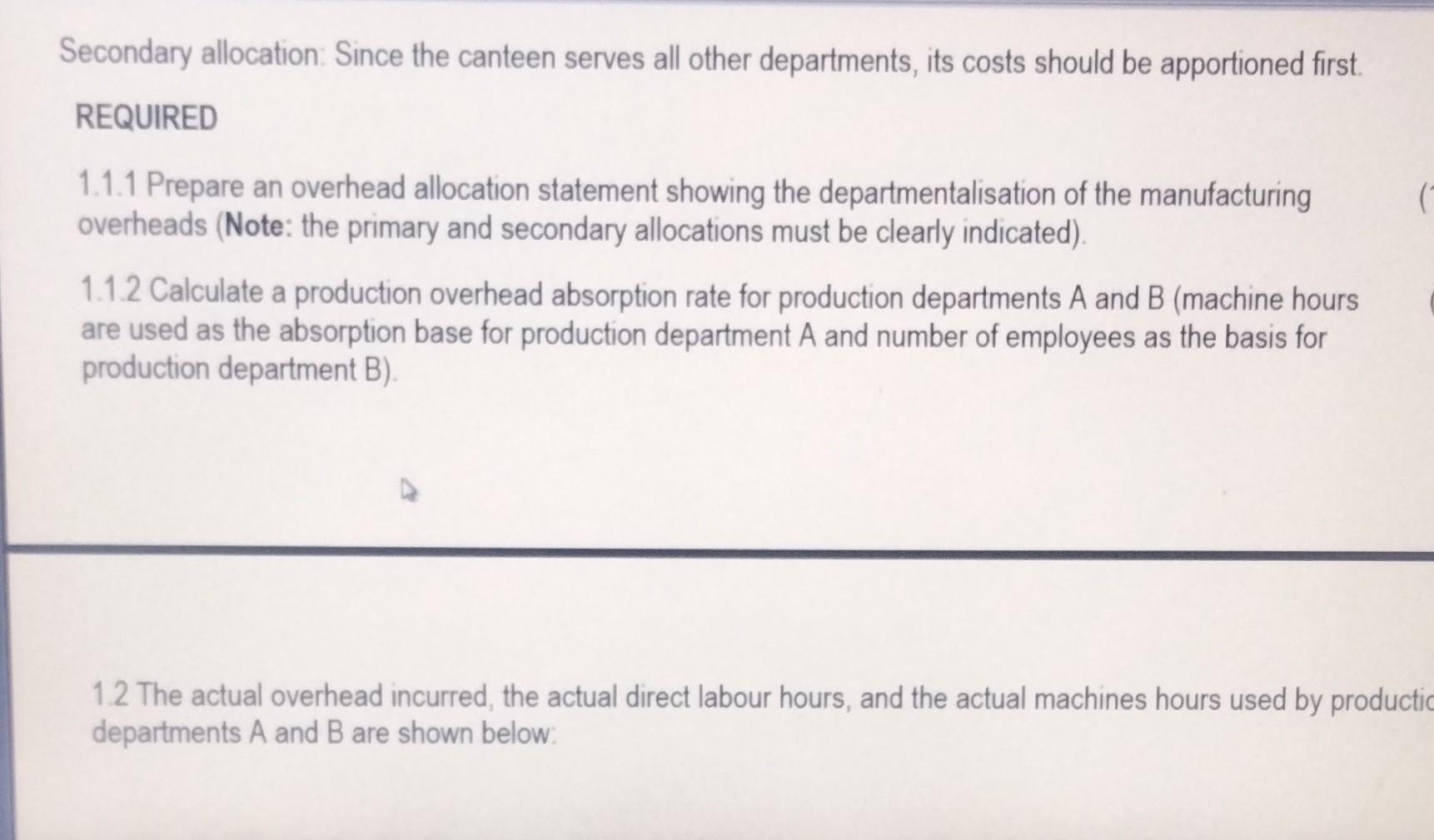

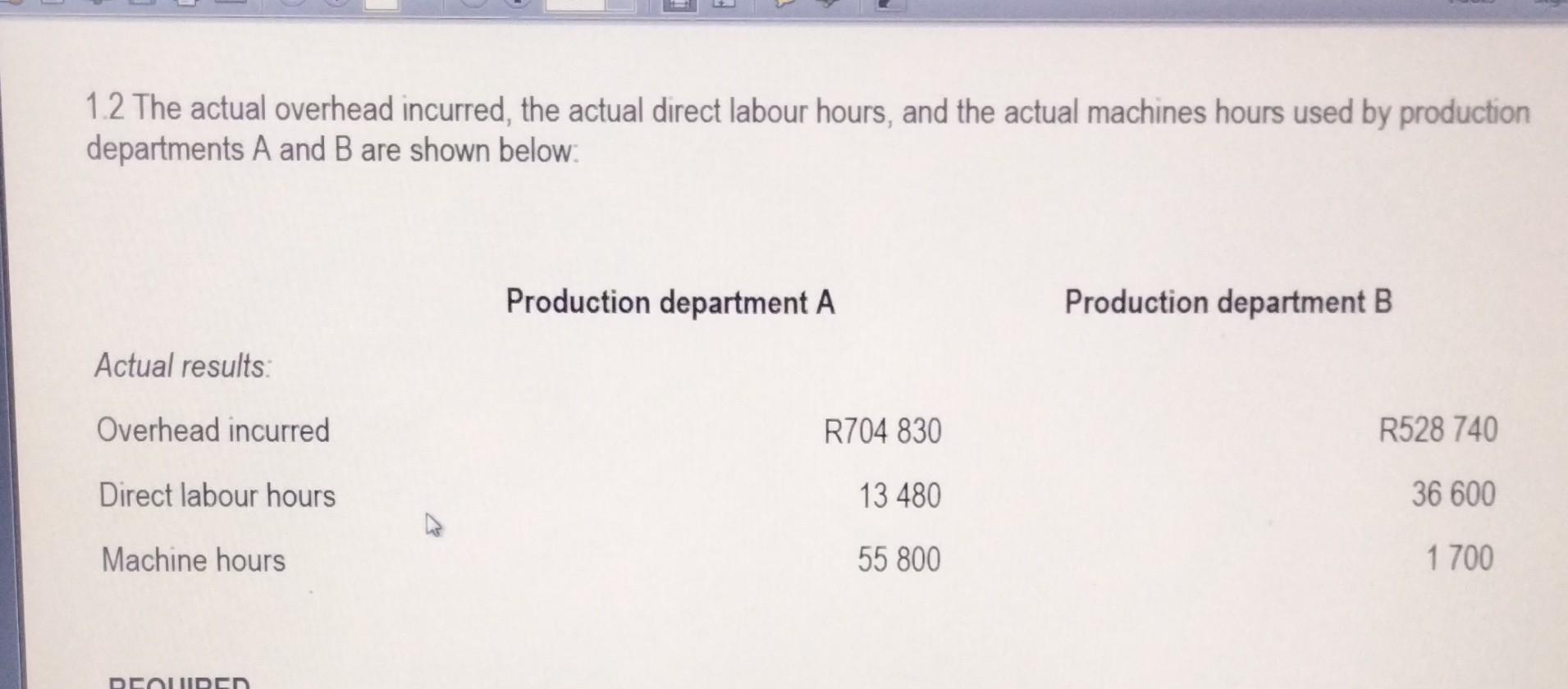

The information given below relates to the forthcoming period for AWD manufacturer's operation. There are four cost centres of which two are involved in production and two are service cost centres. Allocated costs Other costs: Rent and rates Building insurance Electricity and gas Total R 700220 Production dept A R 213 280 Production dept B R 299 280 Service dept: Canteen R 84 370 46 410 37 130 68 000 R Service dept: Stores R 103 290 Electricity and gas Plant depreciation Plant insurance Area occupied (m) Plant at cost (R'000) No. of employees Machine hours Direct labour hours No. stores requisitions Production dept A 7735 18 450 600 54 400 13 600 54 800 Production dept B 6 188 8 520 300 1600 36 000 6 800 Service dept: Canteen 1547 30 68 000 283 900 85 170 1 220 830 I Service dept: Stores 3 094 1 420 70 I Secondary allocation: Since the canteen serves all other departments, its costs should be apportioned first. REQUIRED 1.1.1 Prepare an overhead allocation statement showing the departmentalisation of the manufacturing overheads (Note: the primary and secondary allocations must be clearly indicated). 1.1.2 Calculate a production overhead absorption rate for production departments A and B (machine hours are used as the absorption base for production department A and number of employees as the basis for production department B). ( 1.2 The actual overhead incurred, the actual direct labour hours, and the actual machines hours used by productic departments A and B are shown below: 1.2 The actual overhead incurred, the actual direct labour hours, and the actual machines hours used by production departments A and B are shown below: Actual results: Overhead incurred Direct labour hours Machine hours REQUIRED Production department A R704 830 13 480 55 800 Production department B R528 740 36 600 1700 REQUIRED Calculate the under- or over-absorbed overhead in each of the departments using the information on the actual data provided and the production overhead absorption rates for production departments A and B, calculated in 1.1.2. The information given below relates to the forthcoming period for AWD manufacturer's operation. There are four cost centres of which two are involved in production and two are service cost centres. Allocated costs Other costs: Rent and rates Building insurance Electricity and gas Total R 700220 Production dept A R 213 280 Production dept B R 299 280 Service dept: Canteen R 84 370 46 410 37 130 68 000 R Service dept: Stores R 103 290 Electricity and gas Plant depreciation Plant insurance Area occupied (m) Plant at cost (R'000) No. of employees Machine hours Direct labour hours No. stores requisitions Production dept A 7735 18 450 600 54 400 13 600 54 800 Production dept B 6 188 8 520 300 1600 36 000 6 800 Service dept: Canteen 1547 30 68 000 283 900 85 170 1 220 830 I Service dept: Stores 3 094 1 420 70 I Secondary allocation: Since the canteen serves all other departments, its costs should be apportioned first. REQUIRED 1.1.1 Prepare an overhead allocation statement showing the departmentalisation of the manufacturing overheads (Note: the primary and secondary allocations must be clearly indicated). 1.1.2 Calculate a production overhead absorption rate for production departments A and B (machine hours are used as the absorption base for production department A and number of employees as the basis for production department B). ( 1.2 The actual overhead incurred, the actual direct labour hours, and the actual machines hours used by productic departments A and B are shown below: 1.2 The actual overhead incurred, the actual direct labour hours, and the actual machines hours used by production departments A and B are shown below: Actual results: Overhead incurred Direct labour hours Machine hours REQUIRED Production department A R704 830 13 480 55 800 Production department B R528 740 36 600 1700 REQUIRED Calculate the under- or over-absorbed overhead in each of the departments using the information on the actual data provided and the production overhead absorption rates for production departments A and B, calculated in 1.1.2.

Step by Step Solution

There are 3 Steps involved in it

111 Overhead Allocation Statement Lets start by preparing the overhead allocation statement including both primary and secondary allocations Well allo... View full answer

Get step-by-step solutions from verified subject matter experts