Question: The last one is a little tricky, did Input something wrong? Can u help thank u for ur time! Bond X is a premium bond

The last one is a little tricky, did Input something wrong? Can u help thank u for ur time!

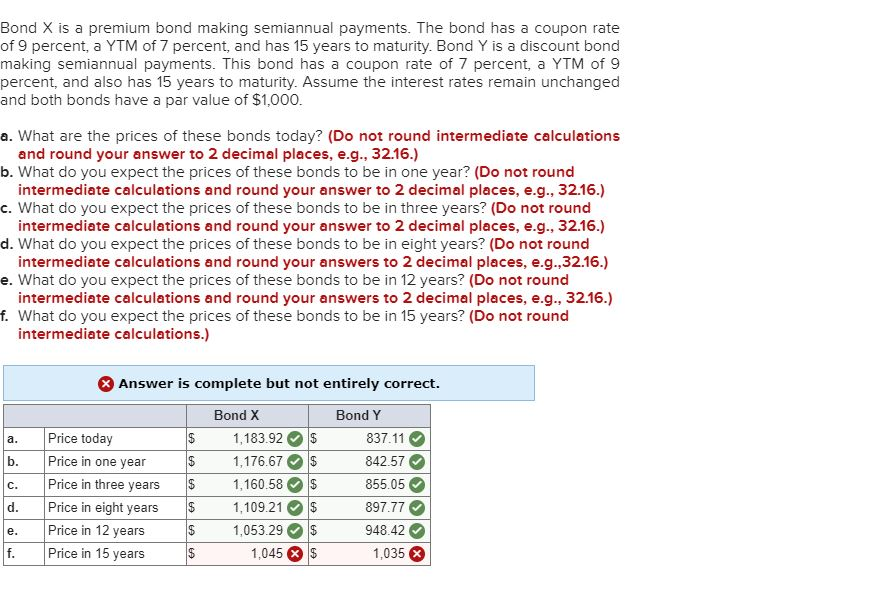

Bond X is a premium bond making semiannual payments. The bond has a coupon rate of 9 percent, a YTM of 7 percent, and has 15 years to maturity. Bond Y is a discount bond making semiannual payments. This bond has a coupon rate of 7 percent, a YTM of 9 percent, and also has 15 years to maturity. Assume the interest rates remain unchanged and both bonds have a par value of $1,000. a. What are the prices of these bonds today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What do you expect the prices of these bonds to be in one year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What do you expect the prices of these bonds to be in three years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What do you expect the prices of these bonds to be in eight years? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g.,32.16.) e. What do you expect the prices of these bonds to be in 12 years? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. What do you expect the prices of these bonds to be in 15 years? (Do not round intermediate calculations.) & Answer is complete but not entirely correct. $ Price today Price in one year Price in three years Price in eight years Price in 12 years Price in 15 years Bond X 1,183.92 $ 1,176.67 $ 1,160.58 $ 1,109.21 $ 1,053.29 $ 1,045 $ Bond Y 837.11 842.57 855.05 897.77 948.42 1,035 d. $ f. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts