Question: the last one wasnt clear enough to see. owing data for Apple S&P 500 adjusted b. Calculate the 9. Sharpe. Jensen's alpha, Treynor) Consider the

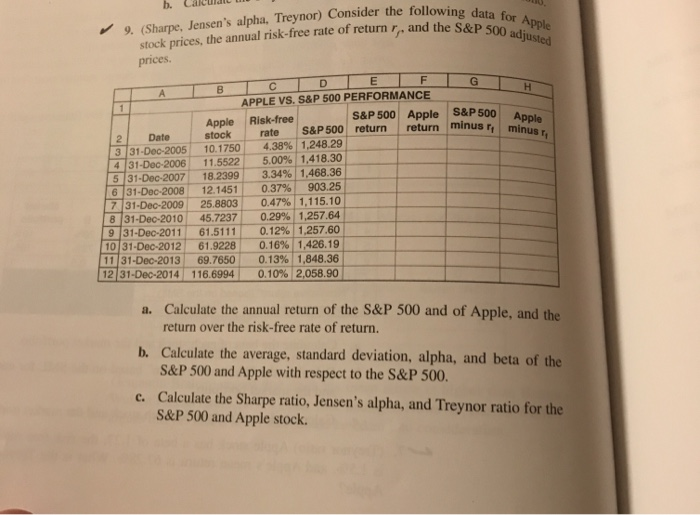

owing data for Apple S&P 500 adjusted b. Calculate the 9. Sharpe. Jensen's alpha, Treynor) Consider the following data stock prices, the annual risk-free rate of return and the S&P prices. Apple minu minus, TD EF G APPLE VS. S&P 500 PERFORMANCE Apple Risk-free S&P 500 Apple S&P 500 stock Date rate S&P 500 return return minus 3 31-Dec-2005 10.1750 4.38% 1.248.29 4 31-Dec-2006 11.5522 5.00% 1,418.30 5 31-Dec-2007 18.2399 3.34% 1,468.36 6 31-Dec-2008 12.1451 0.37% 903.25 7 31-Dec-2009 25.8803 0.47% 1,115.10 B 31-Dec-2010 45.7237 0.29% 1,257.64 9 31-Dec-2011 61.5111 0.12% 1,257.60 10 31-Dec-2012 61.9228 0.16% 1,426.19 11 31-Dec-2013 69.7650 0.13% 1,848.36 12 31-Dec-2014 116.6994 0.10% 2,058.90 a. Calculate the annual return of the S&P 500 and of Apple, and the return over the risk-free rate of return. b. Calculate the average, standard deviation, alpha, and beta of the S&P 500 and Apple with respect to the S&P 500. c. Calculate the Sharpe ratio, Jensen's alpha, and Treynor ratio for the S&P 500 and Apple stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts