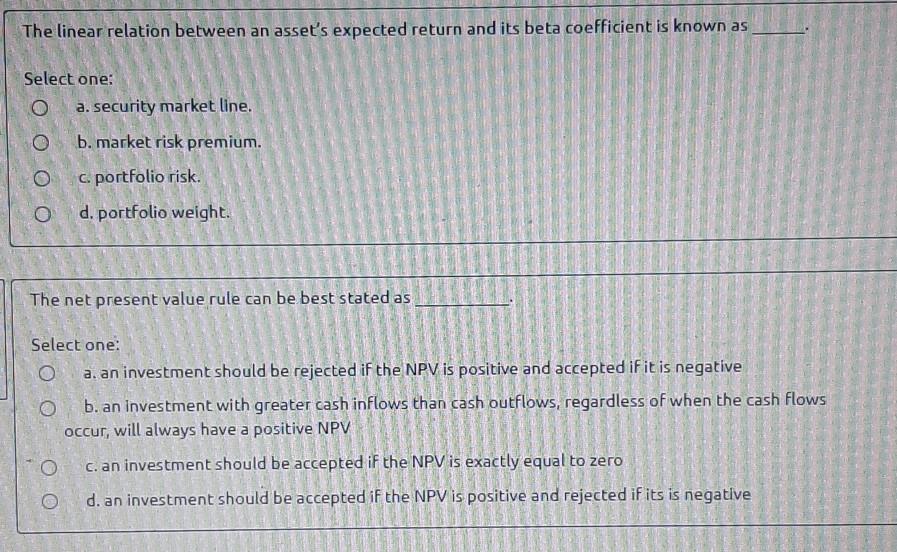

Question: The linear relation between an asset's expected return and its beta coefficient is known as Select one: a. security market line. O b.market risk premium.

The linear relation between an asset's expected return and its beta coefficient is known as Select one: a. security market line. O b.market risk premium. c. portfolio risk. O d. portfolio weight. The net present value rule can be best stated as Select one: O a. an investment should be rejected if the NPV is positive and accepted if it is negative O b. an investment with greater cash inflows than cash outflows, regardless of when the cash flows occur, will always have a positive NPV O C. an investment should be accepted if the NPV is exactly equal to zero d. an investment should be accepted if the NPV is positive and rejected if its is negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts