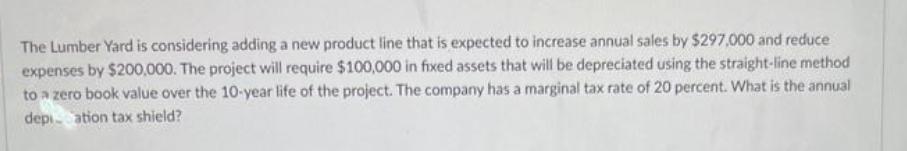

Question: The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $297,000 and reduce expenses by $200,000.

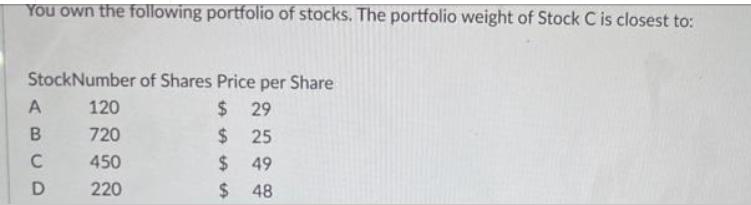

The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $297,000 and reduce expenses by $200,000. The project will require $100,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 10-year life of the project. The company has a marginal tax rate of 20 percent. What is the annual depi ation tax shield? You own the following portfolio of stocks. The portfolio weight of Stock C is closest to: StockNumber of Shares Price per Share $ 29 $ 25 A B C D 120 720 450 220 $49 $48

Step by Step Solution

3.46 Rating (178 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the annual depreciation tax shield we need to determine the annual depreciatio... View full answer

Get step-by-step solutions from verified subject matter experts