Question: The main topic here is Bond Valuation, please open image up to see questions. It is 5 different points, for each pleasure provide a sentence

The main topic here is Bond Valuation, please open image up to see questions. It is 5 different points, for each pleasure provide a sentence or two and show work if needed!

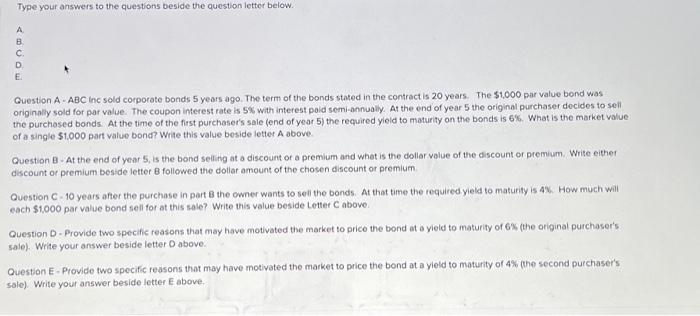

Type your answers to the questions beside the question letter below. A B c D E Question A. ABC Inc sold corporate bonds 5 years ago. The term of the bonds stated in the contract is 20 years. The $1.000 par value bond was originally sold for par value. The coupon interest rate is 5% with interest pold semi-annually. At the end of year 5 the original purchaser decides to sell the purchased bonds. At the time of the first purchaser's sale (end of year 5) the required yield to maturity on the bonds is 6%. What is the market value of a single $1.000 part value bond? Write this value beside letter A above Question - At the end of year 5, is the bond selling at a discount or a premium and what is the dollar value of the discount or premium Write either discount or premium beside letter followed the dollar amount of the chosen discount or premium Question C 10 years after the purchase in part the owner wants to sell the bonds. At that time the required yield to maturity is 4% How much will each $1.000 par value bond sell for at this sale? Write this value beside Letter C above Question - Provide two specific reasons that may have motivated the market to price the bond at a yield to maturity of 6% (the original purchaser's sale). Write your answer beside letter above. Question E. Provide two specific reasons that may have motivated the market to price the bond at a yield to maturity of 4% (the second purchaser's sale). Write your answer beside letter E above. Type your answers to the questions beside the question letter below. A B c D E Question A. ABC Inc sold corporate bonds 5 years ago. The term of the bonds stated in the contract is 20 years. The $1.000 par value bond was originally sold for par value. The coupon interest rate is 5% with interest pold semi-annually. At the end of year 5 the original purchaser decides to sell the purchased bonds. At the time of the first purchaser's sale (end of year 5) the required yield to maturity on the bonds is 6%. What is the market value of a single $1.000 part value bond? Write this value beside letter A above Question - At the end of year 5, is the bond selling at a discount or a premium and what is the dollar value of the discount or premium Write either discount or premium beside letter followed the dollar amount of the chosen discount or premium Question C 10 years after the purchase in part the owner wants to sell the bonds. At that time the required yield to maturity is 4% How much will each $1.000 par value bond sell for at this sale? Write this value beside Letter C above Question - Provide two specific reasons that may have motivated the market to price the bond at a yield to maturity of 6% (the original purchaser's sale). Write your answer beside letter above. Question E. Provide two specific reasons that may have motivated the market to price the bond at a yield to maturity of 4% (the second purchaser's sale). Write your answer beside letter E above thanks!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock