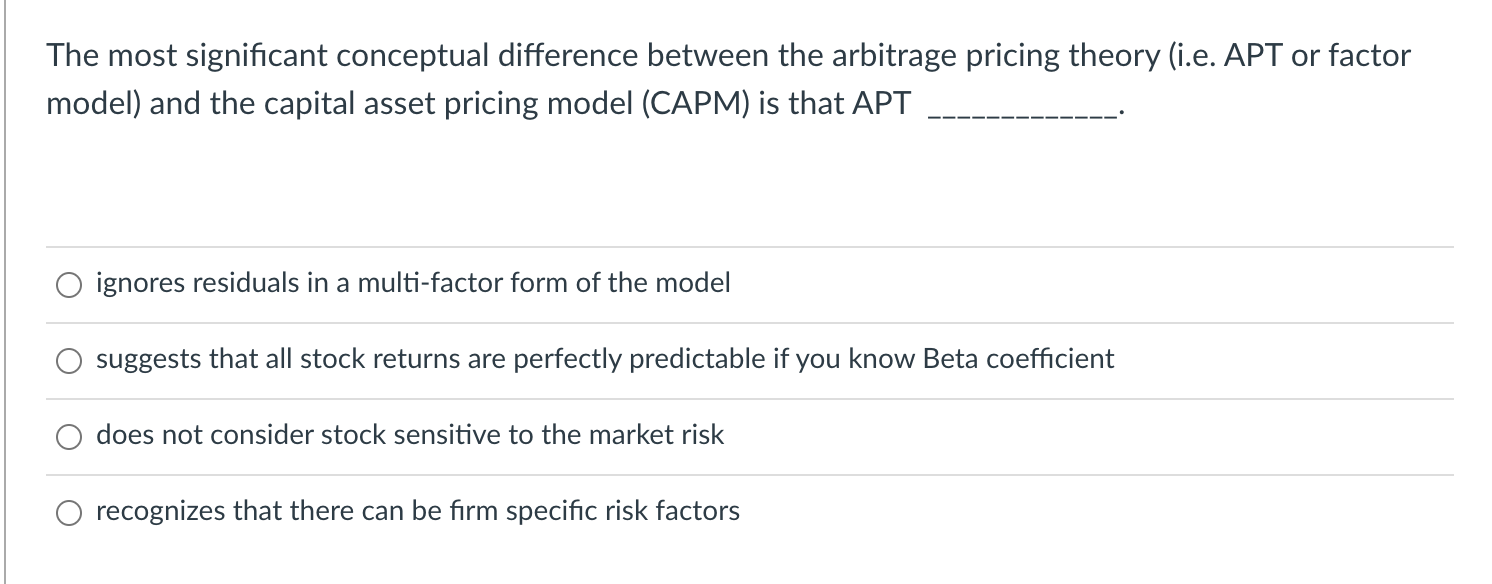

Question: The most significant conceptual difference between the arbitrage pricing theory (i.e. APT or factor model) and the capital asset pricing model (CAPM) is that APT

The most significant conceptual difference between the arbitrage pricing theory (i.e. APT or factor model) and the capital asset pricing model (CAPM) is that APT ignores residuals in a multi-factor form of the model suggests that all stock returns are perfectly predictable if you know Beta coefficient does not consider stock sensitive to the market risk recognizes that there can be firm specific risk factors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts