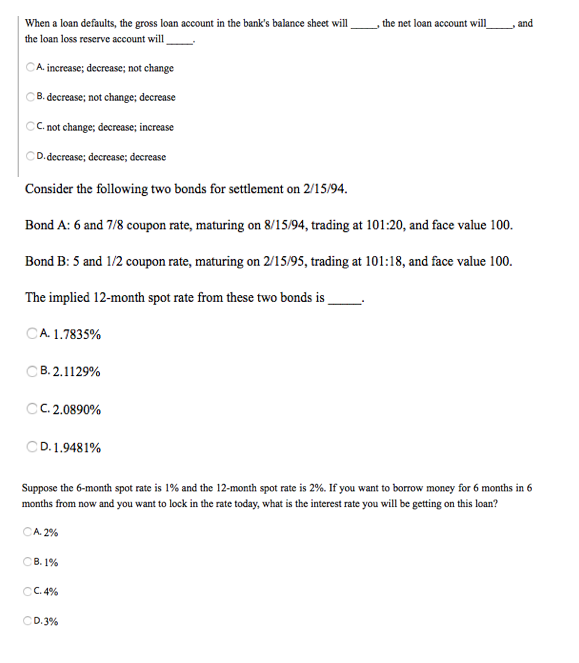

Question: the net loan account will and When a loan defaults, the gross loan account in the bank's balance sheet will the loan loss reserve account

the net loan account will and When a loan defaults, the gross loan account in the bank's balance sheet will the loan loss reserve account will CA. increase; decrease; not change B. decrease; not change; decrease CC. not change; decrease; increase D.decrease; decrease; decrease Consider the following two bonds for settlement on 2/15/94. Bond A: 6 and 7/8 coupon rate, maturing on 8/15/94, trading at 101:20, and face value 100. Bond B: 5 and 1/2 coupon rate, maturing on 2/15/95, trading at 101:18, and face value 100. The implied 12-month spot rate from these two bonds is CA. 1.7835% B.2.1129% CC.2.0890% CD. 1.9481% Suppose the 6-month spot rate is 1% and the 12-month spot rate is 2%. If you want to borrow money for 6 months in 6 months from now and you want to lock in the rate today, what is the interest rate you will be getting on this loan? CA.2% . 1% C.4% D.3% the net loan account will and When a loan defaults, the gross loan account in the bank's balance sheet will the loan loss reserve account will CA. increase; decrease; not change B. decrease; not change; decrease CC. not change; decrease; increase D.decrease; decrease; decrease Consider the following two bonds for settlement on 2/15/94. Bond A: 6 and 7/8 coupon rate, maturing on 8/15/94, trading at 101:20, and face value 100. Bond B: 5 and 1/2 coupon rate, maturing on 2/15/95, trading at 101:18, and face value 100. The implied 12-month spot rate from these two bonds is CA. 1.7835% B.2.1129% CC.2.0890% CD. 1.9481% Suppose the 6-month spot rate is 1% and the 12-month spot rate is 2%. If you want to borrow money for 6 months in 6 months from now and you want to lock in the rate today, what is the interest rate you will be getting on this loan? CA.2% . 1% C.4% D.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts