Question: The net present value method determines whether or not a project meets or exceeds a desired hurdle rate. True False Project A requires a $25,000

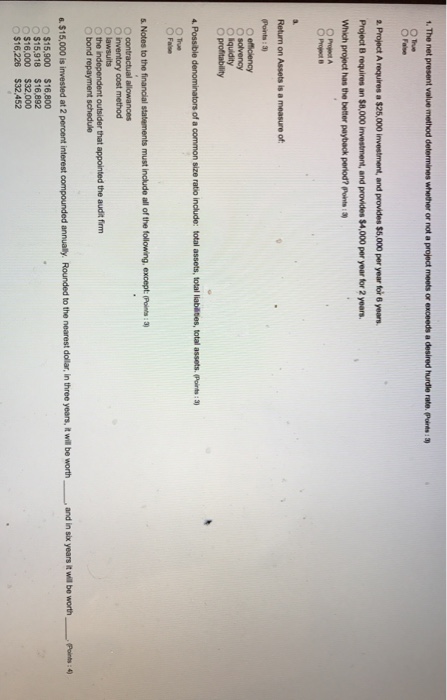

The net present value method determines whether or not a project meets or exceeds a desired hurdle rate. True False Project A requires a $25,000 investment, and provides $5,000 per year for 6 years. Project B requires an $8,000 investment, and provides S4,000 per year for 2 years. Which project has the better payback period? Project A Project B Return on Assets is a measure of efficiency activity liquidity profitability Possible denominators of a common size ratio include: total assets, total liabilities, total assets, True False Notes to the financial statements must include all of the following, except contractual allowances inventory cost method lawsuits the independent outsider that appointed the audit firm bond repayment schedule $15,000 is invested at 2 percent interest compounded annually Rounded to the nearest dollar in three years, it will be worth and in six years it will be worth Points $15, 900 $16, 800 $15, 918 $16, 892 $16,000 $32,000 $16, 226 $32, 452

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts