Question: The next 2 problems are based on the following: Suppose you are the treasurer of company A and you expect to make a payment of

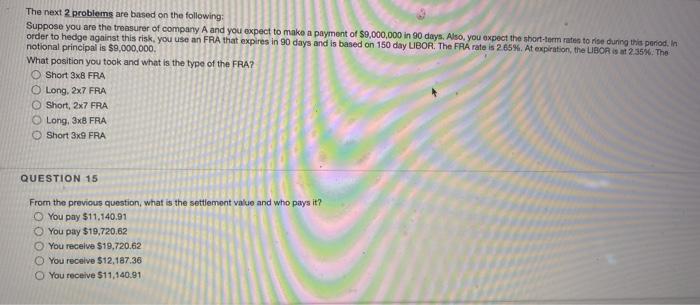

The next 2 problems are based on the following: Suppose you are the treasurer of company A and you expect to make a payment of $9,000,000 in 90 days. Also, you expect the short-term rates to rise during this period. In order to hedge against this risk. you use an FRA that expires in 90 days and is based on 150 day LIBOR. The FRA rate is 265%. At expiration, the LIBOR is 2.35%. The notional principal is $9,000,000. What position you took and what is the type of the FRA? Short 3x8 FRA O Long, 2x7 FRA Short, 2x7 FRA Long, 3x8 FRA Short 3x9 FRA QUESTION 15 From the previous question, what is the settlement value and who pays it? You pay $11.140.91 You pay $19,720.62 You receive $19,720.62 0 You receive $12,187.36 You receive $11,140.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts