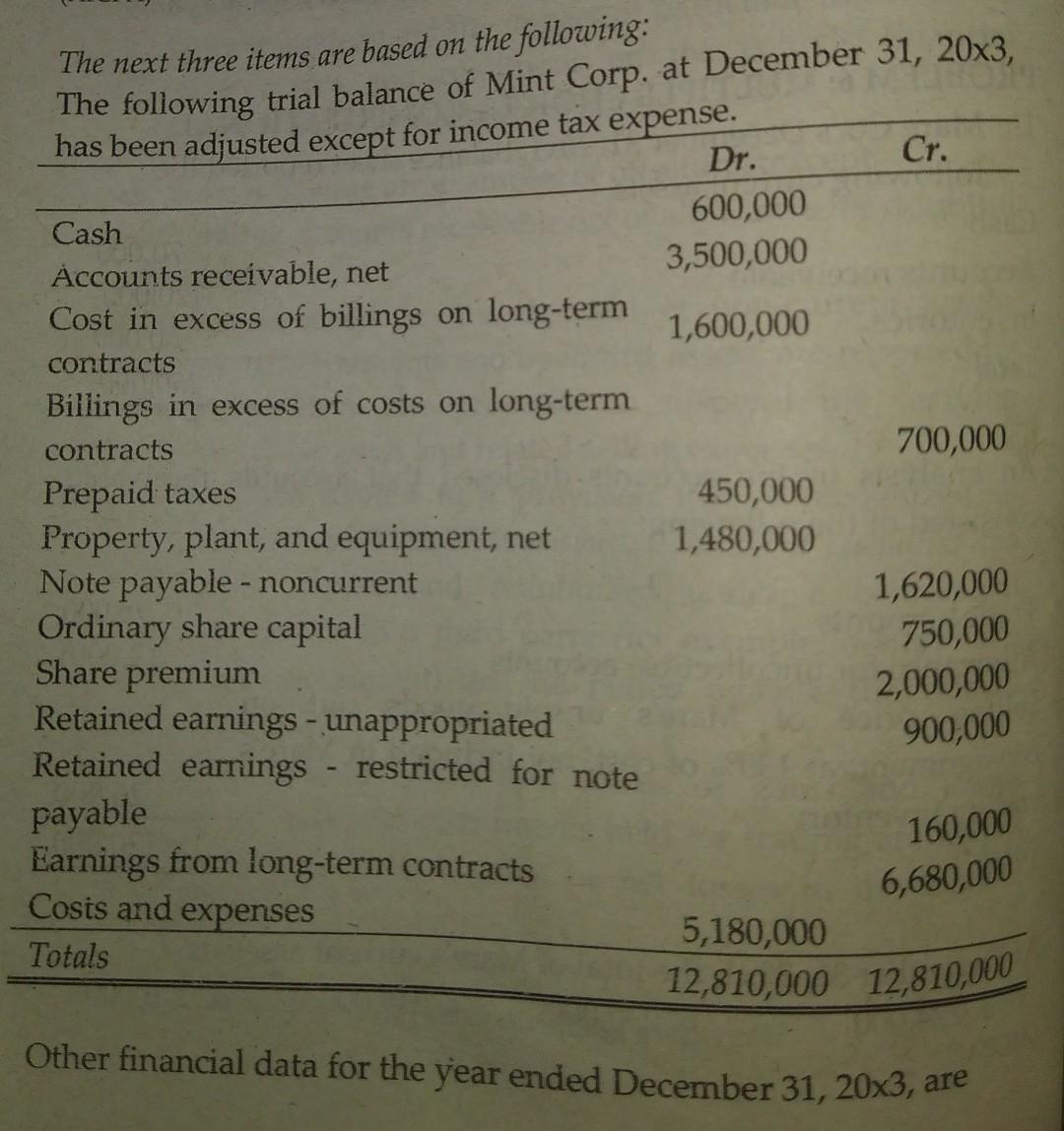

Question: The next three items are based on the following: The following trial balance of Mint Corp. at December 31, 20x3, has been adjusted except for

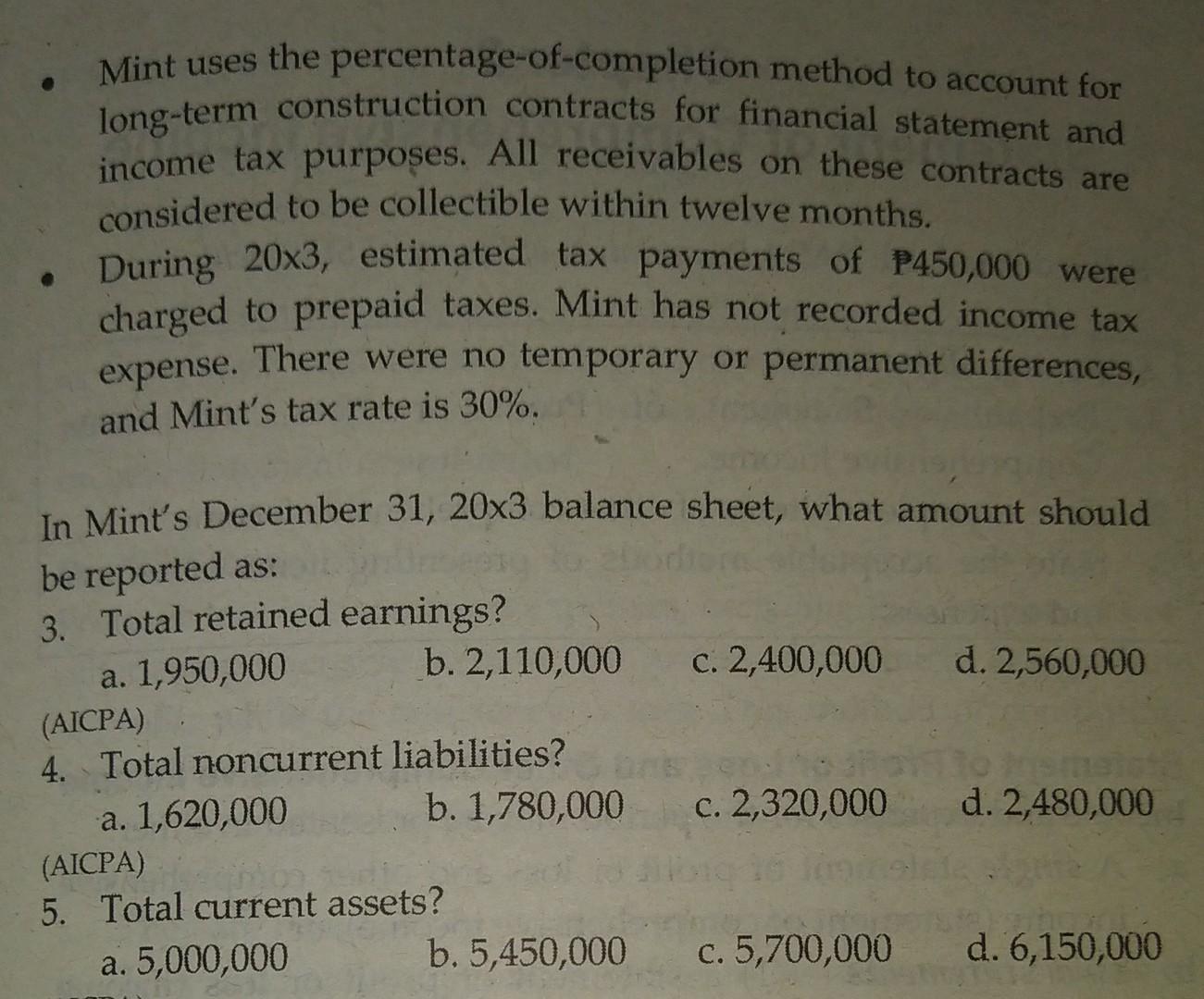

The next three items are based on the following: The following trial balance of Mint Corp. at December 31, 20x3, has been adjusted except for income tax expense. Dr. Cr. Cash 600,000 Accounts receivable, net 3,500,000 Cost in excess of billings on long-term 1,600,000 contracts Billings in excess of costs on long-term contracts 700,000 Prepaid taxes 450,000 Property, plant, and equipment, net 1,480,000 Note payable - noncurrent 1,620,000 Ordinary share capital 750,000 Share premium 2,000,000 Retained earnings - unappropriated Retained earnings 900,000 payable Earnings from long-term contracts 5,180,000 12,810,000 12,810,000 restricted for note 160,000 6,680,000 Cosis and expenses Totals Other financial data for the year ended December 31, 20x3, are Mint uses the percentage-of-completion method to account for long-term construction contracts for financial statement and income tax purposes. All receivables on these contracts are considered to be collectible within twelve months. During 20x3, estimated tax payments of P450,000 were charged to prepaid taxes. Mint has not recorded income tax expense. There were no temporary or permanent differences, and Mint's tax rate is 30%. In Mint's December 31, 20x3 balance sheet, what amount should be reported as: 3. Total retained earnings? a. 1,950,000 b. 2,110,000 c. 2,400,000 d. 2,560,000 (AICPA) 4. Total noncurrent liabilities? a. 1,620,000 b. 1,780,000 c. 2,320,000 d. 2,480,000 (AICPA) 5. Total current assets? a. 5,000,000 b. 5,450,000 c. 5,700,000 d. 6,150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts