Question: The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest

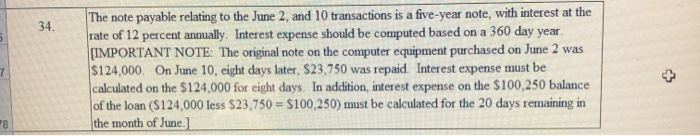

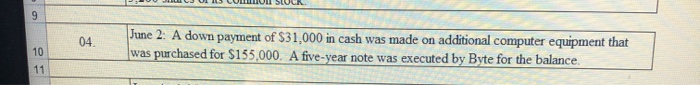

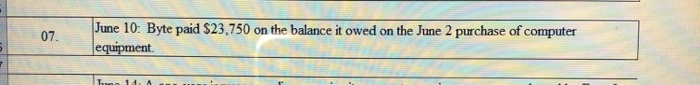

The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $124.000. On June 10, eight days later, $23.750 was repaid. Interest expense must be calculated on the $124,000 for eight days. In addition, interest expense on the $100,250 balance of the loan (S124,000 less $23.750 = $100,250) must be calculated for the 20 days remaining in the month of June. CO JA VIR June 2: A down payment of $31,000 in cash was made on additional computer equipment that was purchased for $155,000. A five-year note was executed by Byte for the balance. June 10: Byte paid $23.750 on the balance it owed on the June 2 purchase of computer equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts