Question: The NPV using the present value of a single amount table is $908,140 X Points: 0/1 3. Calculate the NPV using discount factors from both

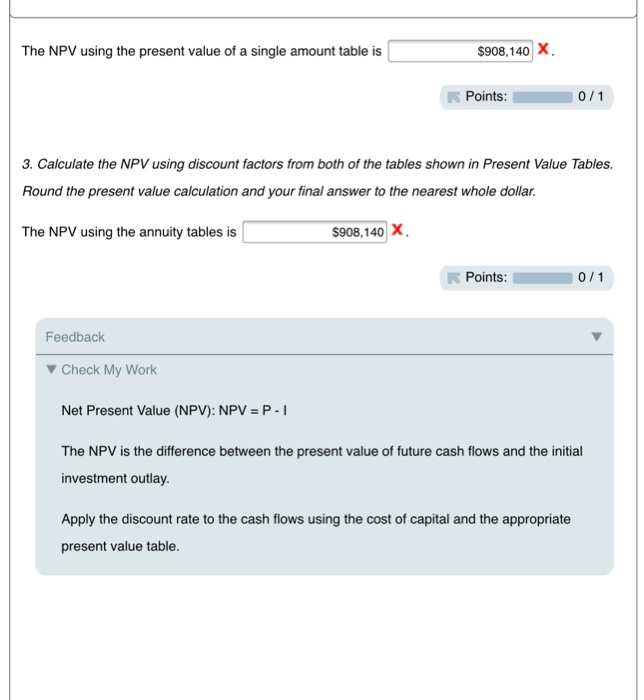

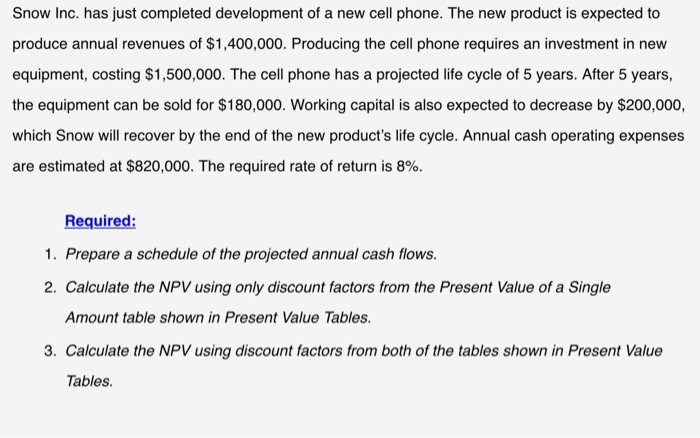

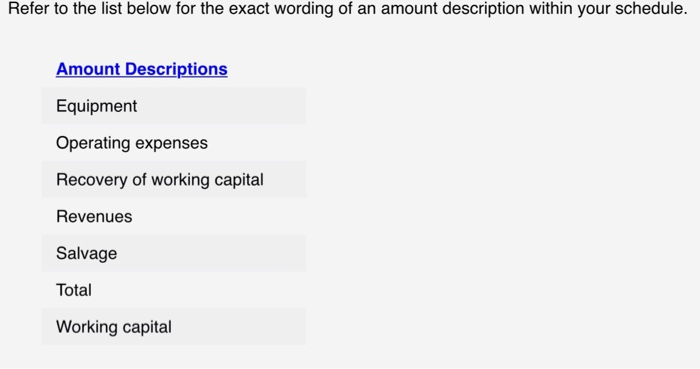

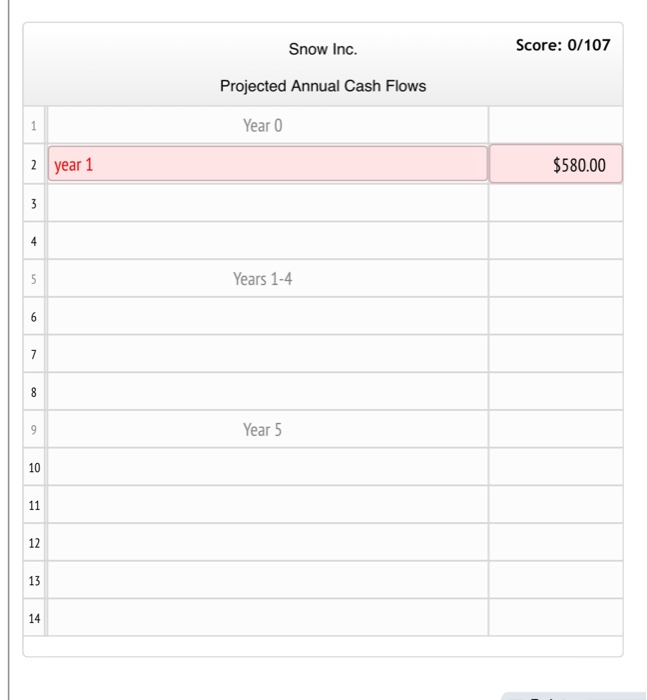

The NPV using the present value of a single amount table is $908,140 X Points: 0/1 3. Calculate the NPV using discount factors from both of the tables shown in Present Value Tables. Round the present value calculation and your final answer to the nearest whole dollar. The NPV using the annuity tables is $908,140 X Points: 0/1 Feedback Check My Work Net Present Value (NPV): NPV = P - The NPV is the difference between the present value of future cash flows and the initial investment outlay. Apply the discount rate to the cash flows using the cost of capital and the appropriate present value table. Snow Inc. has just completed development of a new cell phone. The new product is expected to produce annual revenues of $1,400,000. Producing the cell phone requires an investment in new equipment, costing $1,500,000. The cell phone has a projected life cycle of 5 years. After 5 years, the equipment can be sold for $180,000. Working capital is also expected to decrease by $200,000, which Snow will recover by the end of the new product's life cycle. Annual cash operating expenses are estimated at $820,000. The required rate of return is 8%. Required: 1. Prepare a schedule of the projected annual cash flows. 2. Calculate the NPV using only discount factors from the Present Value of a Single Amount table shown in Present Value Tables 3. Calculate the NPV using discount factors from both of the tables shown in Present Value Tables Refer to the list below for the exact wording of an amount description within your schedule. Amount Descriptions Equipment Operating expenses Recovery of working capital Revenues Salvage Total Working capital Snow Inc. Score: 0/107 Projected Annual Cash Flows Year 0 year 1 $580.00 Years 1-4 Year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts