Question: The objective is to create a class that will calculate tax paid based on salary and status code (S, MFJ, and HH) see code description

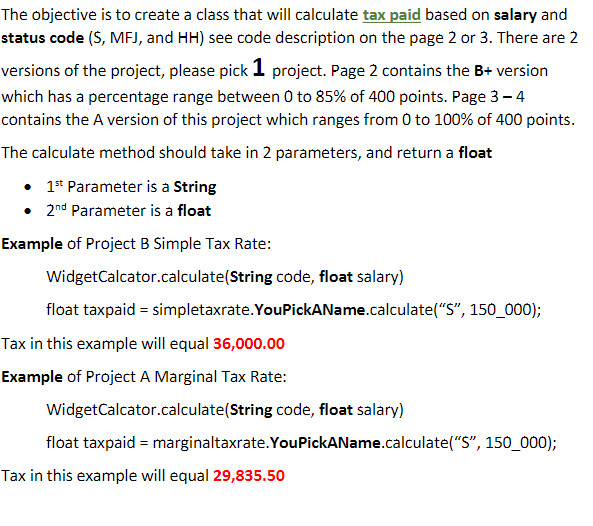

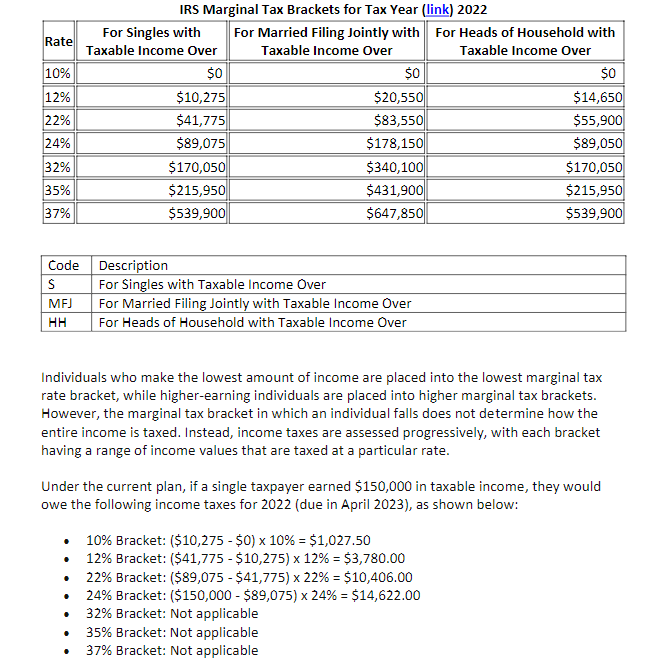

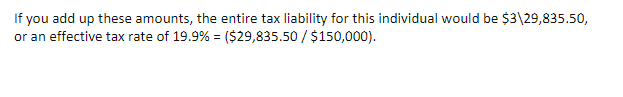

The objective is to create a class that will calculate tax paid based on salary and status code (S, MFJ, and HH) see code description on the page 2 or 3 . There are 2 versions of the project, please pick 1 project. Page 2 contains the B+ version which has a percentage range between 0 to 85% of 400 points. Page 34 contains the A version of this project which ranges from 0 to 100% of 400 points. The calculate method should take in 2 parameters, and return a float - 1st Parameter is a String - 2nd Parameter is a float Example of Project B Simple Tax Rate: WidgetCalcator.calculate(String code, float salary) float taxpaid = simpletaxrate.YouPickAName.calculate( "S", 150_000); Tax in this example will equal 36,000.00 Example of Project A Marginal Tax Rate: WidgetCalcator.calculate(String code, float salary) float taxpaid = marginaltaxrate.YouPickAName.calculate( "S", 150_000); Tax in this example will equal 29,835.50 Individuals who make the lowest amount of income are placed into the lowest marginal tax rate bracket, while higher-earning individuals are placed into higher marginal tax brackets. However, the marginal tax bracket in which an individual falls does not determine how the entire income is taxed. Instead, income taxes are assessed progressively, with each bracket having a range of income values that are taxed at a particular rate. Under the current plan, if a single taxpayer earned $150,000 in taxable income, they would owe the following income taxes for 2022 (due in April 2023), as shown below: - 10% Bracket: ($10,275$0)10%=$1,027.50 - 12% Bracket: ($41,775$10,275)12%=$3,780.00 - 22% Bracket: ($89,075$41,775)22%=$10,406.00 - 24% Bracket: ($150,000$89,075)24%=$14,622.00 - 32% Bracket: Not applicable - 35% Bracket: Not applicable - 37% Bracket: Not applicable If you add up these amounts, the entire tax liability for this individual would be $3\29,835.50, or an effective tax rate of 19.9%=($29,835.50/$150,000). Create a class that will calculate the tax paid by an individual. Example: WidgetCalcator.calculate(String code, float salary) float taxpaid = YouPickAName.calculate (S,150_000); Tax in this example will equal 29,835.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts