Question: the only rate given is the 5% discount rate which is need for the present values. Corporation VB was formed in 2019. Immediately prior to

the only rate given is the 5% discount rate which is need for the present values.

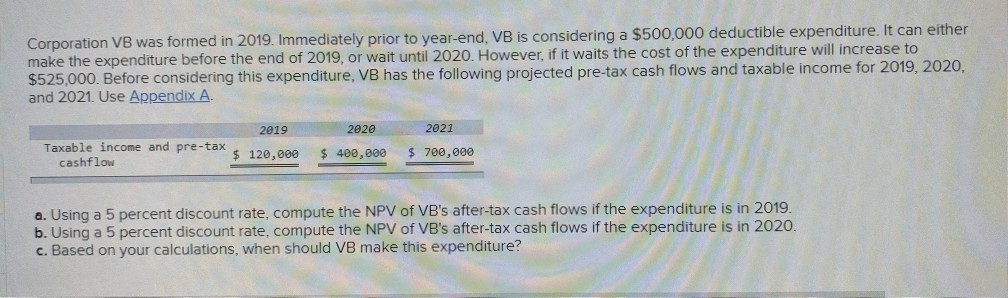

Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2019, or wait until 2020. However, if it waits the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pre-tax cash flows and taxable income for 2019, 2020, and 2021. Use Appendix A. 2021 2019 Taxable income and pre-tax s 120.000 cashflow 2020 $400,000 $700,000 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2019. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. C. Based on your calculations, when should VB make this expenditure? Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2019, or wait until 2020. However, if it waits the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pre-tax cash flows and taxable income for 2019, 2020, and 2021. Use Appendix A. 2021 2019 Taxable income and pre-tax s 120.000 cashflow 2020 $400,000 $700,000 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2019. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. C. Based on your calculations, when should VB make this expenditure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts