Question: The options for the first drop down are 30.05 30.35 and 30.15 For the second drop down the options are 44.5% 43.1% 43.6 % Your

The options for the first drop down are 30.05 30.35 and 30.15

For the second drop down the options are 44.5% 43.1% 43.6 %

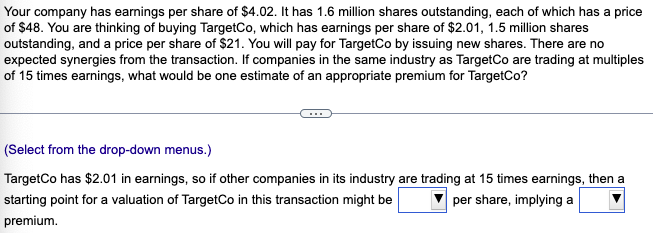

Your company has earnings per share of $4.02. It has 1.6 million shares outstanding, each of which has a price of $48. You are thinking of buying TargetCo, which has earnings per share of $2.01, 1.5 million shares outstanding, and a price per share of $21. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. If companies in the same industry as TargetCo are trading at multiples of 15 times earnings, what would be one estimate of an appropriate premium for TargetCo? (Select from the drop-down menus.) TargetCo has $2.01 in earnings, so if other companies in its industry are trading at 15 times earnings, then a starting point for a valuation of TargetCo in this transaction might be per share, implying a premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts