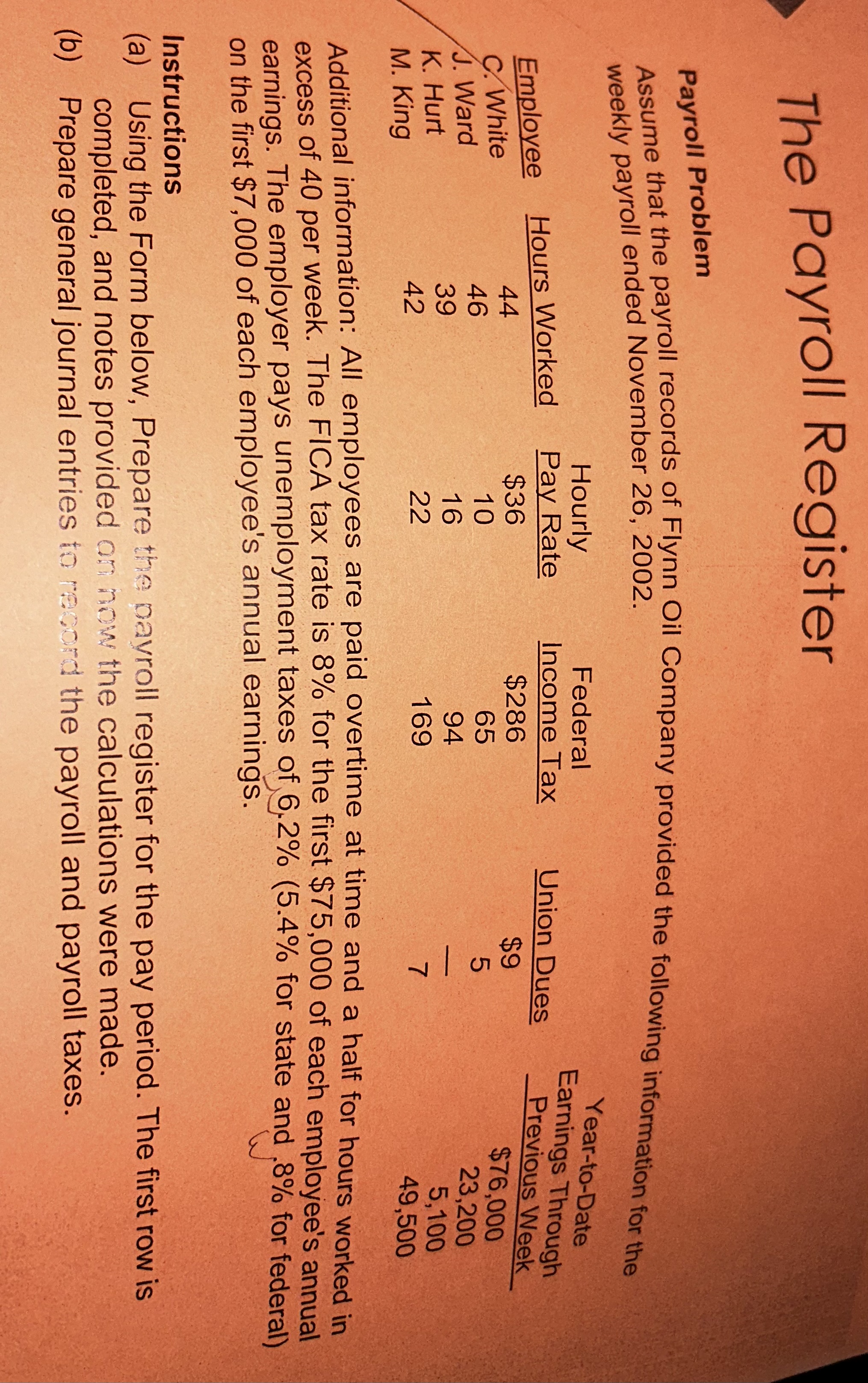

Question: The Payroll Register Payroll Problem Assume that the payroll records of Flynn Oil Company provided the following information for the weekly payroll ended November 26,

The Payroll Register Payroll Problem Assume that the payroll records of Flynn Oil Company provided the following information for the weekly payroll ended November 26, 2002. Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 8% for the first $75,000 of each employee's annual earnings. The employer pays unemployment taxes of 6.2%(5.4% for state and 8% for federal) on the first $7,000 of each employee's annual earnings. Instructions (a) Using the Form below, Prepare the payroll register for the pay period. The first row is completed, and notes provided an now the calculations were made. (b) Prepare general journal entries to moord the payroll and payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts