Question: The PE cash flow example excel file was posted on Canvas and referred to several times during the recent lectures. Students were asked to familiarize

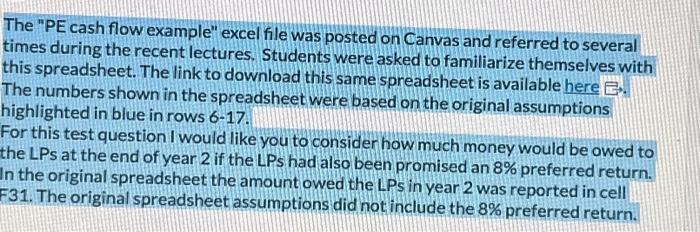

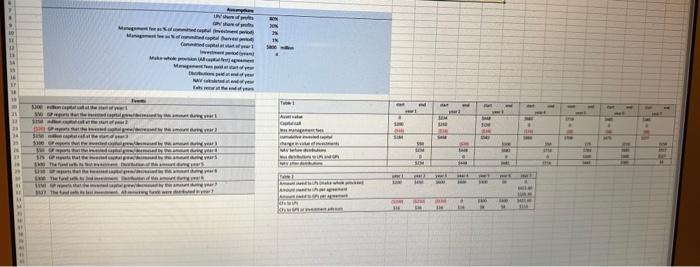

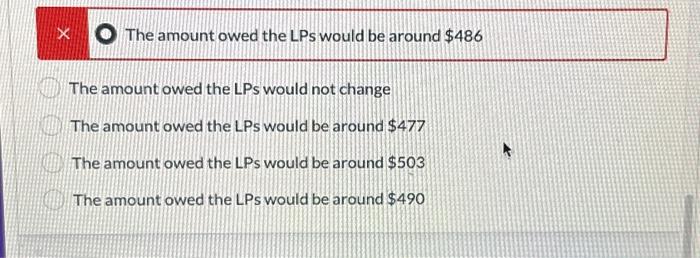

The "PE cash flow example" excel file was posted on Canvas and referred to several times during the recent lectures. Students were asked to familiarize themselves with this spreadsheet. The link to download this same spreadsheet is available here The numbers shown in the spreadsheet were based on the original assumptions highlighted in blue in rows 6-17. For this test question I would like you to consider how much money would be owed to he LPs at the end of year 2 if the LPs had also been promised an 8% preferred return. n the original spreadsheet the amount owed the LPs in year 2 was reported in cell 31. The original spreadsheet assumptions did not include the 8% preferred return. trem The "PE cash flow example" excel file was posted on Canvas and referred to several times during the recent lectures. Students were asked to familiarize themselves with this spreadsheet. The link to download this same spreadsheet is available here The numbers shown in the spreadsheet were based on the original assumptions highlighted in blue in rows 6-17. For this test question I would like you to consider how much money would be owed to he LPs at the end of year 2 if the LPs had also been promised an 8% preferred return. n the original spreadsheet the amount owed the LPs in year 2 was reported in cell 31. The original spreadsheet assumptions did not include the 8% preferred return. trem The amount owed the LPs would be around $486 The amount owed the LPs would not change The amount owed the LPs would be around $477 The amount owed the LPs would be around $503 The amount owed the LPs would be around $490

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts